Start-Up Round-Up – 2025

Overview

This annual event bringing together start-up founders, angel investors, single family offices, and venture capital fund managers for a day of meetings, panels, and networking.

Start-up founders are invited to submit their business plan, intro deck, video overview, and any other media for this afternoon event at the offices of Highline Beta.

Our process is we send the idea/company media to the angels/family offices & CAASA-member venture capital fund managers, along with a ranking form. On the day, we have two, 30-minute interview sessions where the matched start-ups and investors meet + 2 panel discussions and networking reception.

We invite all start-up founders to apply. Our investors each have unique requirements and preferences; pre-seed, seed, series A (and so on…); all industries including AgTech, RegTech, PropTech, Cryptoassets…all areas of endeavor; whether having an active raise or simply looking for exposure for the next raise.

We typically have 12 start-ups and all presentations are in person and capacity for this event is approximately that number. All start-ups are responsible for their travel expenses and must be CAASA members to be eligible ($200 fee to join; no cost to participate in the event).

Timeline:

April 18th – Deadline for Founders to send us their deck & other media.

April 20th – We send the presentations to all investors to review and rank by the end of the month.

April 30th – Deadline to have the matchings/pairings determined.

May 12th – We gather at the Highline Beta offices and have a great day!

MSC Cruises Get-away Give-away 2025

We are happy to partner with MSC Cruises for a super prize to be awarded to one of our event attendees (must attend and complete a ballot to be eligible).

Draw will occur at our Networking Night on October 7, 2025.

*Subject to travel restrictions, all details provided to the lucky winner upon receipt.

When

Monday, May 12th

- May 12, 2025

- 2:00 pm – 6:00 pm ET

2025 Founders & Angels/Investors

Jeffery Sun

Director, Multi-strategy Investments

OPTrust

Nikhil Nayar

Senior Associate

Rogue Insight Capital Ltd.

Claire Dixon

CEO, co-founder and Director

Neuraura Biotech Inc.

Stephen Bloom

Founder

Batl Capital LP

Michael Ashmore

CEO

Rondeivu

Greg Bedard

COO

XOSQE Media

Dave Lazar

Founder

XOSQE Media

Ashish Anand

Founder & CEO

Workforce Wellness

Oded Levi

President

Epstein Enterprises Inc.

Reza Khanahmadi

Chief Technology Officer & Co-Founder

Rondeivu Inc.

Adam Seanor

President & CFO

Blacktyde Capital

Lakhveer Singh Jajj

Founder and CEO

Moselle

Mukul Pal

Founder & CEO

AlphaBlock

Jeff Szeto

CFO

Avana Capital

Skyler Zhang

CEO & Founder

Skylean Capital

Marcus Daniels

Founding Partner & CEO

Highline Beta

Saad Hassan

Principal and North American Head

Hassan Family Office

Dan Rudanycz

Private Equity Analyst

Gestalt Capital

Yahya Mahmoud

President

BNQ Group

Ismael El-Samahy

Partner, Director of Acquisitions

BNQ Group

Connor Winters

Co-Founder and Managing Partner

Earl& Partners

Christopher Kruczynski

Chief Financial Officer

Picture Locke Inc.

Mary K. Hermant

Managing Director

Royce Holdings

Alexandra Kapelos-Peters

Founder, CEO, & Chief CANsultant

Cansulta

Aris Economopoulos

CEO

DentalForce

Nimar Bangash

Co-Founder & CEO

Obsiido Alternative Investments Inc.

Gonen Hollander

VP, Private Wealth

Obsiido Alternative Investments Inc.

Robert Klein

Senior Advisor

KNRS Group

Erik Eklund

CEO

TelemeTrak

Ankur Sethi

Founder Managing Partner

Winner Capital

Jack Lenchyshyn

Co-Founder & CEO

thisPantry Inc.

Jeffery Sun

Director, Multi-strategy Investments

OPTrust

Jeffery Sun leads the Technology and Innovation Portfolio at OPTrust, overseeing investments across a diverse range of strategies, including liquid technology investments and venture capital. He also has professional background in macro trading and software development. Jeffery holds a Master of Computer Science from Georgia Tech and a Master of Mathematical Finance from the University of Toronto. In his free time, he is active on GitHub and Substack.

Nikhil Nayar

Senior Associate

Rogue Insight Capital Ltd.

Global investor and entrepreneurial leader with a track record of building and backing high-growth ventures across technology, financial services, and global sports. At Rogue, a single-family office, I lead investments with a focus on sourcing, due diligence, and long-term portfolio strategy — partnering with founders and management teams to unlock scale and value.

Claire Dixon

CEO, co-founder and Director

Neuraura Biotech Inc.

Claire has 25+ years’ international leadership, strategy and operational experience, including 15 years as a strategic consultant to capital and technology-intensive businesses, 5 years in senior operational roles and 8 years as a deeptech founder.

She holds an MBA from Harvard Business School and a MEng/MA (Cantab.) in Mechanical Engineering from Cambridge University.

Claire was recently named one of the Top 200 Trailblazing Leaders in Women’s Health and FemTech by Women of Wearables.

Stephen Bloom

Founder

Batl Capital LP

A former senior partner of Goodmans LLP, one of Canada’s leading full service law firms who practiced corporate law for almost 30 years. Past CEO of Shiplake Properties Ltd., a third-generation family-owned private business. Co-founded Collecdev, Shiplake’s development and construction management business. Currently, President and Managing Partner of Batl Capital, founded by Stephen as a family office and manager of capital.

In his previous role as CEO of Shiplake, Stephen provided critical support and guidance to the day-to-day management of a billion-dollar business that included the ownership and operation of an apartment portfolio and retirement residence, high-rise development and construction management, as well as investment in commercial real estate, private equity and public securities.

Stephen is a value-added investor who has negotiated and completed dozens of transactions, including land and business acquisitions, dispositions, financings, joint ventures, partnerships and shareholder agreements, while providing wise counsel throughout the life cycle of the investment.

Stephen has served on the boards of various charitable organizations including the Israel Cancer Research Fund, Tanenbaum CHAT and Trustees of the Jewish Foundation of Toronto.

Michael Ashmore

CEO

Rondeivu

Michael Ashmore is CEO of Rondeivu, an end-to-end InvestTech platform reimagining how institutional investors source, diligence, transact, and monitor investments across private markets. Michael is also Chair, Finance & Investment Committee at the University of Waterloo, leading the committee overseeing C$600 million in endowment assets since 2022. Michael has been a member of the Board of Governors of the University of Waterloo since 2019.

Michael was previously Director, External Managers Program at OMERS, the C$134 billion Canadian pension plan, from 2015 to 2020 in the New York office. While at OMERS, Michael was selected as a member of OMERS Future Leaders program. Prior to OMERS, Michael was a Vice President at The Carlyle Group – DGAM from 2013 to 2015, where he led research on investments in various strategies across alternatives. From 2010 to 2012, Michael was an Investment Analyst at PGGM, the €240 billion Dutch pension plan.

Michael graduated with a Bachelor of Arts, Economics with Honours, from the University of Waterloo, and is a CFA® Charterholder. Michael’s industry accolades include selection as one of Chief Investment Officer magazine’s “2016 Forty Under Forty” and finalist for Institutional Investor magazine’s 2017 “Next CIO” award. Michael is an avid athlete, and is actively involved in a number of charitable efforts, mainly focused on youth education and opportunity.

Greg Bedard

COO

XOSQE Media

Greg Bedard is a seasoned strategic business development leader with 20+ years of success. He is a versatile leader with experience in turning startups into revenue generators.

He specializes in strategic implementation in retail, media, and telecommunications where he has held impactful roles at industry giants like Rogers Communications, Canada’s leading wireless, cable and media companyand TELUS, a world-leading technology company.

Career Highlights:

- Startup Scale & Exit: Grew Mobile Klinik from 6 to 150+ stores (2017–2023) with 2,325% revenue growth; led 4 competitor integrations and the successful sale to TELUS.

- Operational Impact: Directed post-acquisition integration and rebranding across 80 stores — awarded by the Retail Council of Canada for best in-store design and experience.

- Strategic Partnerships: Built OEM, B2B, and insurance partnerships driving ~20% of revenues and exceeding growth targets 2X.

- Executive Leadership at Rogers: Led long-term strategy, product development, and governance initiatives; managed a $33M portfolio and launched 34 products while cutting time to market by up to 25%.

Dave Lazar

Founder

XOSQE Media

Buy Canadian Group founder Dave Lazar has been a startup CEO for 10 years, has raised more than $15 million in private and public financing, holds 5 patents, and has generated more than $25M in revenue from his live stream shopping platform, Stage TEN.

Notable Stage TEN investors include Mark Cuban, Netflix Founder Marc Randolph and TikTok Stars Josh Richards and Griffin Johnson.

Stage TEN has powered live streams for MrBeast, Tommy Hilfiger, John Krasinski, Cardi B, Justin Bieber, Target, YouTube, Walmart, Atlantic Records, and Just For Laughs.

Ashish Anand

Founder & CEO

Workforce Wellness

Ashish Anand, Founder & CEO of Workforce Wellness, is an AI innovator and entrepreneur directly addressing critical healthcare workforce challenges like clinician burnout and administrative inefficiency. He has over 20 years of executive leadership experience scaling high-growth SaaS startups. His proven ability to drive rapid market expansion and operational excellence was honed through pivotal C-suite roles including CMO at Phemi, COO at Tribe, CMO at Wishpond, and CDO at Terramera. Ashish represented Canada’s AI sector on an international trade mission to France and has contributed to British Columbia’s provincial AI strategy. Ashish is an AI thought leader who regularly speaks at industry events, including CPHR, BCTECH, Vivatech, and SONSIEL. He is a driving force shaping the future of work, particularly within AI-driven healthcare transformation.

Oded Levi

President

Epstein Enterprises Inc.

Oded Levi is the President of Epstein Enterprises Inc., a single family office based in Toronto.

A tenacious problem-solver and insightful leader, he has played executive management and CFO roles at a number of EEI’s operating subsidiaries. He works closely with leaders of those enterprises into which EEI has invested, bringing his entrepreneurial, finance and tax-related problem-solving skills to bear when needed. EEI invests across the investment spectrum including venture, for which he has a soft spot. Oded is a CPA, CA, and earned a BBA in Accounting and an MBA in Finance from the Schulich School of Business at York University. Oded spent the first part of his career working with one of the major accounting firms before working in corporate finance for several years before joining EEI. He has served on the boards of private, public, and not for profit organizations.

Reza Khanahmadi

Chief Technology Officer & Co-Founder

Rondeivu Inc.

Reza’s background is a marriage of engineering and finance. After graduating Honours Electrical Engineering from University of Waterloo, he achieved his CFA charter.

With over a decade of experience as fractional CTO and solutions architect, he has developed and deployed over 7 different products from idea to full-scale launch, focusing on security, robustness, usability, and sleek design. Before joining Rondeivu, he worked on algorithmic trading, market making, and analytics systems for futures and derivative products.

Adam Seanor

President & CFO

Blacktyde Capital

Adam Seanor, CFA, is a seasoned finance and corporate strategy executive with deep expertise in mergers & acquisitions, business development, and investment banking. With a proven track record in sourcing and executing complex transactions across financial services, real estate, fintech, automotive and technology sectors, Adam has successfully led strategic initiatives that drive business growth and investor value. His ability to identify opportunities, negotiate high-value deals, and build long-term partnerships has been instrumental in structuring transactions exceeding $10 billion.

Adam holds an MBA in Finance and Financial Services Management from the Schulich School of Business at York University and a BA in Finance and Economics from the University of Western Ontario. As a CFA charterholder, he combines technical financial expertise with strategic vision, helping clients navigate complex investment landscapes. Outside of work, Adam is a volunteer rep baseball coach and an accomplished endurance athlete, having competed in Ironman triathlons and international swimming championships.

Lakhveer Singh Jajj

Founder and CEO

Moselle

Lakhveer is the Founder and CEO of Moselle, an inventory and operations automation platform designed to help rapidly growing e-commerce and retail brands automate their supply chain processes. Before founding Moselle, Lakhveer served as the Director of Engineering at Highline Beta’s venture studio, where he collaborated with corporate partners to launch new ventures.

Mukul Pal

Founder & CEO

AlphaBlock

Born in New Delhi, Mukul has spent the past 25 years creating quantitative investment strategies for active managers around the globe. Early in his career, he worked at the Bombay Stock Exchange, assisting prominent Indian financial institutions before expanding his business to Europe, where he consulted for asset managers and securities divisions of global banks. A double major in finance and statistics, he has also earned both the Chartered Market Technician (CMT) and Chartered Alternative Investment Analyst (CAIA) designations. His extensive contributions to fintech have garnered him recognition from MIT, and he has been invited to speak at leading conferences worldwide, including the Princeton–Chicago quant conference. Mukul has also played a key role in listing financial innovations on Nasdaq. Today, he runs a deep tech company in Toronto, offering advanced solutions that empower active managers worldwide to outperform the market.

Jeff Szeto

CFO

Avana Capital

Jeff is the CFO of Avana Capital, a family office, and leads VC and PE investments for Alder Sustainable Ventures, its private capital arm. He also provides CFO support to many portfolio companies, playing a key role in top grading, scaling, and growing these businesses by leveraging his 15 years of experience in leading finance functions for high-growth entrepreneurial companies. His career spans roles in M&A and corporate finance at top-tier institutions and as CFO for fast-growing private companies, guiding several from scale-up to exit. Previously, he served as the finance lead for a high-growth SaaS company, where he built a scalable finance team, secured growth capital, and facilitated a successful exit to a $1 billion private equity firm.

Skyler Zhang

CEO & Founder

Skylean Capital

Skyler Zhang is the Founder and CEO of Skylean Capital, a boutique family office venture capital firm based in Toronto. Established in 2022, Skylean Capital maintains a strategic focus on Fintech, Blockchain, and Artificial Intelligence, investing from the early stage through to Series D. The firm also considers select opportunities in other sectors. Skylean Capital is dedicated to supporting exceptional founders by investing in their story, ambition, and future.

Skyler holds a Bachelor’s degree in Mathematics, East Asian Studies, and Spanish from the University of Toronto. In 2024, she has completed the Foundations of Private Equity and Venture Capital program at Harvard Business School Executive Education in Boston.

Marcus Daniels

Founding Partner & CEO

Highline Beta

Marcus Daniels is a Founding Partner & CEO of Highline Beta where he leads visionary execution, strategic deals, corporate venture co-investment and startup funding. He has 21+ years as a serial tech entrepreneur & operating executive with a top decile pre-seed investing (34 startups) track record. 12+ years working with Fortune 1000 companies advising on corporate innovation models & building a pipeline of new corporate ventures beyond the core business. Formerly the Co-Founder & CEO of HIGHLINE.vc and Managing Director of Extreme Startups, Marcus continues to help evolve accelerator models to make corporate-startup collaboration work.

Saad Hassan

Principal and North American Head

Hassan Family Office

Saad Hassan is Principal and North American Head of Hassan Family Office, a Abu Dhabi–based single‑family office dedicated to private alternative investments. As a member of the firm’s Investment Committee, he collaborates with fellow principals and family members to shape strategic asset allocations across private equity, venture capital, real estate and private credit.

In his North American role, Saad leads deal sourcing and due diligence for co‑investment opportunities throughout the region, leveraging an extensive network of sovereign wealth funds, institutional allocators and top‑tier general partners. He applies a data‑driven investment framework combined with hands‑on value‑creation initiatives—focusing on operational improvement, risk management and ESG integration—to optimize long‑term risk‑adjusted returns.

A University of Waterloo alumnus with a Bachelor of Business Administration, Saad began his career in financial services and consulting, where he honed the analytical rigor that informs his investment philosophy today. He regularly serves as a judge at startup competitions and mentors emerging entrepreneurs on fundraising, business models and scaling high‑growth ventures.

Connect with Saad on LinkedIn: linkedin.com/in/saadhassan90.

Dan Rudanycz

Private Equity Analyst

Gestalt Capital

Daniel (Dan) Rudanycz is a Wilfrid Laurier University student pursuing an Honours Bachelor of Business Administration (BBA) with a concentration in Finance and an Environmental Studies minor. In May 2025, he began working as a Private Equity Analyst at Gestalt Capital.

Before joining Gestalt, Dan worked in the M&A practice at BFL Canada, where he reviewed deal information from top private equity firms, investment banks, and strategic buyers while supporting the underwriting of Representation and Warranties Insurance for more than 30 transactions. He also led the creation of an internal strategic pricing model. Dan started his career with Sapling Financial Consultants, where he co-authored whitepapers on data analytics and financial modeling, developed training materials, and pioneered certain business development initiatives.

Yahya Mahmoud

President

BNQ Group

Yahya Mahmoud is a seasoned real estate investor with over 25 years of investment experience. He leads a Single Family Office focused on strategic and value add real estate investments, actively engaging in equity and debt placements. Yahya founded and exited his business from 2017 to 2023, after a two decade corporate career with Fortune 500 firms and is a proud family man with two young adults. We primarily look for co-investment / co-lending opportunities.

Ismael El-Samahy

Partner, Director of Acquisitions

BNQ Group

Ismael El-Samahy combines entrepreneurial drive with deep technical expertise to build innovative ventures across industries. He leads acquisitions at BNQ Group, a single-family office focused on strategic real estate investments.

With a Ph.D. in Electrical and Computer Engineering from the University of Waterloo and two decades of experience in the electricity sector, he plays an active role in shaping Ontario’s energy future.

Ismael also co-founded Tut’s, a modern brand introducing Egyptian street food to Canadian foodies.

Connor Winters

Co-Founder and Managing Partner

Earl& Partners

Connor Winters is a Co-Founder and Managing Partner at Earl& Partners, an entrepreneurial investment firm that acquires and invests in businesses overlooked by traditional investors due to size or circumstance. At Earl&, Connor focuses on partnering with technology companies seeking an off-ramp from the traditional venture capital path, helping them transition toward sustainable and profitable growth. Prior to founding Earl&, Connor was a member of the investment team at Fulcrum, where he focused on capital raising and acquiring businesses in the AI, cybersecurity, and IT sectors. Connor holds a Commerce degree from the Smith School of Business and a Computer Science degree from Queen’s University.

Christopher Kruczynski

Chief Financial Officer

Picture Locke Inc.

Christopher began his career at Scotia Capital in 1999 as a trading assistant and later managed over $1 billion in assets as a portfolio manager at a competitor. After his departure from asset management, he has since structured businesses across industries—from manufacturing and real estate to entertainment—helping Canadian firms expand globally. At Picture Locke Inc., since 2021, he drives strategic growth, diversifies revenue, and builds partnerships. He is the co-founder of XCE Inc, and ONE-SHOT GP Inc., both Picture Locke Inc., joint venture companies.

Mary K. Hermant

Managing Director

Royce Holdings

Mary is the Managing Director at Royce Holdings (division of Single Family Office). With over 20 years in Tech and Finance, she’s been a Head of Finance at 2K Media AG and managed early-stage investments for over 20 startups, firms and government bodies. She’s launched tech products like Frsh Beacons, CoSync Auth, Ursa Live, House Codes, AppKey and social data marketing platforms Social Extract and Hello Media, and has worked globally in cities like London, Zurich, and Toronto. In Toronto, she was honoured with the Queen’s Jubilee award in 2022 and mentors for The King’s Trust.

Alexandra Kapelos-Peters

Founder, CEO, & Chief CANsultant

Cansulta

Alexandra Kapelos-Peters is a serial founder, award-winning entrepreneur, consultant, and business strategist with 20+ years leading ventures & agencies across consulting, marketing, technology, healthcare, and education. She’s launched and scaled more than 10 brands and holds dual Master business degrees (MBA and MSIE), plus PMP® and CSM® certifications.

A self-professed geek and people-person, she builds high-performing teams, streamlines operations, and energizes organizations with vision & infectious momentum.

As the Founder & CEO of Cansulta — a global expert consulting platform — Alexandra was recently recognized among WXN’s 2024 Top 100 Most Powerful Women. Known for blending innovation with bold execution, she specializes in helping businesses grow smarter and stronger — creating the people, processes, and excitement needed to scale with purpose.

Aris Economopoulos

CEO

DentalForce

A three-time VC-backed entrepreneur, Aris has secured venture capital again to tackle the talent shortage in the dental industry.

He has taken three companies from 0-to-1, driving product development, enterprise revenue streams and partnerships on the journey from <$10k MRR to ~$100k MRR.

Completed the first crowdfunded commercial real estate investment in Canada as a founding member of NexusCrowd, and as CEO of SeasonedPros.ca, a two-sided talent marketplace matching 50+ talent to companies, led expansion to 10k+ users and 300+ clients nationwide, resulting in acquisition offer.

Aris has raised $11m to create $75m+ of enterprise value, building enduring products/companies with teams up to 30.

Nimar Bangash

Co-Founder & CEO

Obsiido Alternative Investments Inc.

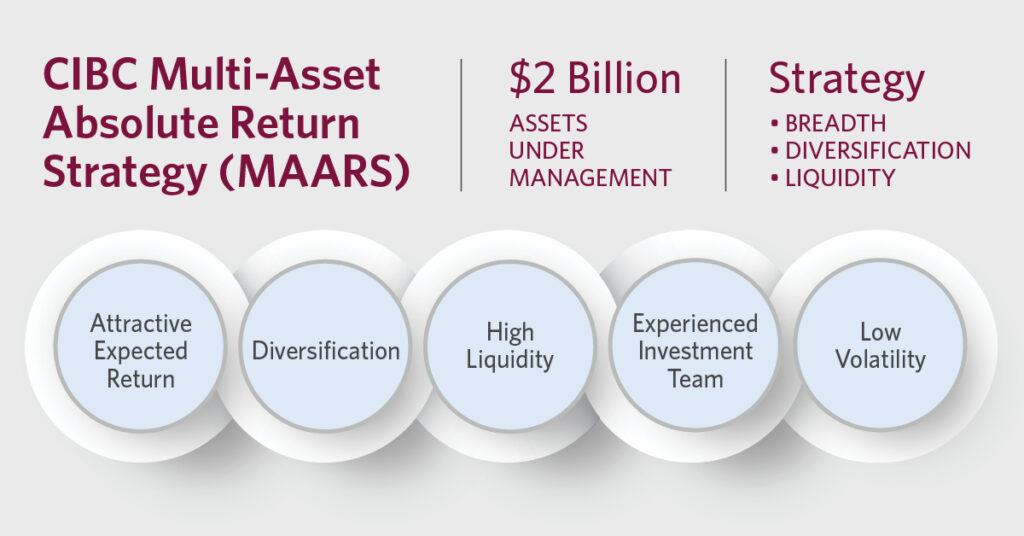

Nimar has over 10 years of investment industry experience in progressively senior product and strategy related roles. Prior to founding Obsiido, Mr. Nimar was head of investment products at AGF Investments Inc. where he was responsible for AGF’s multi-billion-dollar suite of pooled investment solutions, chaired AGF’s Product Committee and was a member of AGF’s Employee Retirement Plan Investment Committee as well as the AGF SAF Investment Committee. Over the course of his career, Nimar has led over 30 new pooled investment fund launches including building out AGF’s ETF product suite, leading AGF’s entry into the liquid alternative fund market and the ground up build of AGF’s private market investing platform. Prior to AGF, Nimar was the business lead for CIBC’s multi-billion dollar separately managed account program, Investment Consulting Service.

Nimar was previously Co-Chair of the AIMA Canada Community Engagement Committee and was recognized by Wealth Professional Magazine as an Industry Rising Star in 2021.

Nimar holds the Chartered Investment Manager designation, the Chartered Alternative Investment Analyst designation, an Honors Bachelor of Arts in Economics from Wilfrid Laurier University, and a Master of Finance from Queen’s University. He has also completed the IFSE Exempt Market Proficiency course and studied cryptocurrency and blockchain technology via MIT’s Media Lab.

Gonen Hollander

VP, Private Wealth

Obsiido Alternative Investments Inc.

Gonen leads Obsiido’s business development and investor relations within the Canadian wealth management channel with a specific focus on partnering with independent wealth management firms and multi-family office & family office practices.

Gonen is a proven strategic leader who has held high impact roles across investment wholesaling, venture capital, startup operations, and military service. He is passionate about democratizing access to alternative investments and the role of technology in the betterment of society.

Prior to joining Obsiido, Gonen led the Canadian wealth management business of OurCrowd, a multi-billion-dollar global venture capital platform, where he spearheaded the formation and launch of one of the first of its-kind evergreen open-ended venture capital funds for private wealth. Prior to OurCrowd, Gonen was a venture capital investor at Amplify Capital, where he developed investment theses, sourced deals, conducted due diligence, and advised portfolio companies on sales, operations, fundraising, and impact measurement. During his tenure, Gonen led due diligence in four new investments, two of which were acquired.

Gonen also served as Chief Operating Officer at Acerta Analytics Solutions, a software company that delivers AI solutions for autonomous and connected cars and industry. He led and closed deals with global-leading OEMs and Tier 1s.

Before embarking on a business career, Gonen served for eight years as a Naval Officer. Gonen holds an undergraduate degree from the University of Haifa and an MBA from the Rotman School of Management at the University of Toronto.

Robert Klein

Senior Advisor

KNRS Group

Robert is a senior advisor to a prominent Toronto-based family office, where he leads the sourcing, evaluation, and structuring of co-investments and direct deals globally. His role spans multiple sectors, guiding capital deployment in both growth-stage businesses and income-generating assets.

He is also the founder of Convoy Capital Corporation, an alternative investment consulting firm specializing in hedge fund due diligence, strategic fundraising, and investment advisory services for institutional investors and family offices. Through Convoy, Robert has helped global managers sharpen their value proposition, raise capital, and expand into new markets.

Earlier in his career, Robert founded Budding Equity Inc., an early entrant in the legal cannabis industry. While no longer the focus of his current work, the company’s success under his leadership exemplifies his strength in building scalable ventures and forging high-impact partnerships.

Robert’s career is defined by a deep understanding of capital markets, an entrepreneurial mindset, and a consistent ability to drive investment performance across sectors.

Erik Eklund

CEO

TelemeTrak

29 years experience in Silicon Valley – two engineering degrees (RMC, Canada and UTC, France) and an MBA (Harvard). Previously:

-

- Bain & Co.

- Net Insight (IPO)

- Nextag (acquired by Providence Equity for $1.1B)

- Adchemy (acquired by Walmart Labs)

- Nanigans (acquired by Sprinklr)

- Fiksu (acquired by Noosphere)

- Haven (container logistics)

Jack Lenchyshyn

Co-Founder & CEO

thisPantry Inc.

Jack Lenchyshyn leads product and strategy at thisPantry, a kitchen platform designed for people who actually cook. While studying business and playing hockey at Simon Fraser University, he worked in hospitality and startups, where he experienced firsthand the disconnect between food tech and real home cooking.

Driven by a passion for tasteful, user-first tools, Jack co-founded thisPantry to combine smart design with practical kitchen management. The company was bootstrapped from the ground up and is now gaining traction with chefs, creators, and home cooks across North America”

Start-Ups – Apply to Participate!

Members – Submit your presentation below. CAASA team will reach out to confirm after reviewing the pitch decks.

Non-members – To be able to register to Start-Up Round-Up Pitch Competition 2025, you need to be a member of CAASA – click the link below to register for CAASA Membership for $200 CAD.

Deadline to submit your deck/propaganda is April 18.

Agenda 2025

Day 1

- May 12, 2025

- 2:00 pm – 7:00 pm

- May 12, 2025

- 2:00 pm – 7:00 pm

Day 1

2:00 pm

Registration & coffee

All Founders, Angels, and VCs are asked to be at the venue by 2pm to register for the day.

2:20 pm

Introduction

Briefing to all on the upcoming sessions, room/area assignments, and expectations of and for all throughout the event.

2:30 pm

First Pitch

Curated pairings (Founder presenting to Angel and/or VC) will provide opportunity to pitch and answer questions. Each of the Founder decks’ will have been read already by the investors so an abridged pitch can be made.

3:00 pm

Second Pitch

Curated pairings (Founder presenting to Angel and/or VC) will provide opportunity to pitch and answer questions. Each of the Founder decks’ will have been read already by the investors so an abridged pitch can be made.

3:30 pm

Coffee break

Quick refresher.

3:45 pm

Surviving, Striving, and Thriving as a Start-Up

Step one: survive. Step two: strive. Step three: thrive. Start-ups sometimes get ahead of their skis with far-reaching ideas of what they will do once they ‘make it’. The reality is not all will make it and energy, perhaps, should be put toward step one and two. This panel will feature start-ups from all three stages – an excellent opportunity to hear how they make it happen.

Moderator: Mary Hermant, Royce Holdings

Jack Lenchyshyn, thisPantry

Michael Ashmore, Rondeivu

Lakhveer Jajj, Moselle

4:30 pm

Taking First in the Beauty Pageant

Start-ups spend a great deal of time dreaming up, planning, and tweaking their product offering as well as their pitch (deck). This panel will discuss the main areas that founders should focus on to appeal to investors who will take their company to the next level. Practicable advice for all!

Moderator: Marcus Daniels, Highline Beta

Connor Winters, Earl& Partners

Yahya Mahmood, BNQ Group

Saad Hassan, Nvestiv

5:00 pm

Reception

6:00 pm

End of Start-Up Round-Up

See you next year!

Member – Investor

End Investors: Pensions, Endowments, Foundations, Sovereign Wealth Funds, or Single Family Offices

Event Registration Closed

Non-member – Investor

End Investors: Pensions, Endowments, Foundations, Sovereign Wealth Funds, or Single Family Offices

Event Registration Closed