Family Office Summit 2025

Overview

We are back for our 7th edition – this time including our ever-popular SFO-exclusive sessions on April 23 afternoon + more streams for SFO family members and professionals to meet and discuss topics important to them (all within a cone of silence without the inclusion of anyone who is not with an SFO).

Of course we have a great line-up of speakers (at least 50% from SFOs) to speak to issues and trends important to families & Table Talks coordinated by our sponsors for a truly exciting opt-in experience for all.

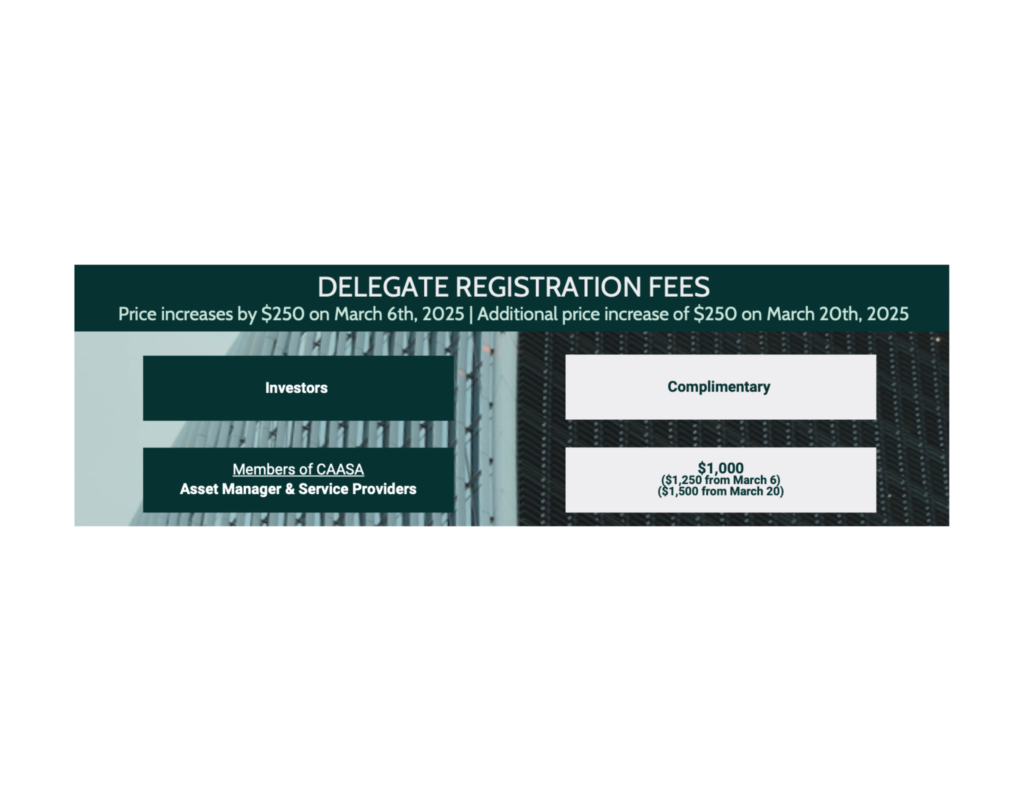

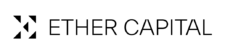

Registration

End Investor refers to pensions, foundations, endowments, sovereign wealth funds, and single-family offices. Intermediary Investor includes multi-family offices, investment advisors/dealers, wealth managers, and investment consulting firms. +1 indicates that the first delegate attends for free, with a nominal fee applied for each additional delegate. Managers and Service Provider Delegates must be CAASA members in good standing and are required to pay the applicable fee per person based on their respective sub-category. Core Service Providers include fund administrators, accounting firms, and legal firms.

MSC Cruises Get-away Give-away 2025

We are happy to partner with MSC Cruises for a super prize to be awarded to one of our event attendees (must attend and complete a ballot to be eligible).

Draw will occur at our Networking Night on October 7, 2025.

*Subject to travel restrictions, all details provided to the lucky winner upon receipt.

When

Please note the timings and agenda are subject to change.

- April 23, 2025

- 5:00 pm – 7:00 pm EST

- April 24, 2025

- 8:00 am – 7:00 pm EST

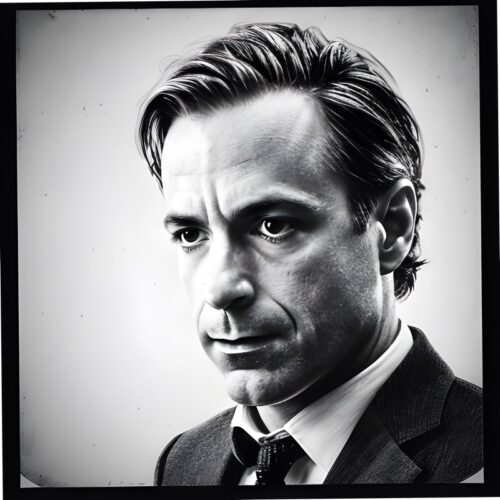

2025 Keynote Speaker

Martin Lueck

Co-Founder and Research Director

Aspect Capital Limited

Martin Lueck

Co-Founder and Research Director

Aspect Capital Limited

Mr. Lueck co-founded Aspect in September 1997. As Research Director, Mr. Lueck oversees the Research teams responsible for generating and analysing fundamental research hypotheses for development of all Aspect’s investment programmes. Mr Lueck is also a member of Aspect’s Investment Committee.

Prior to founding Aspect, Mr. Lueck was with Adam, Harding and Lueck Limited (AHL), which he co-founded in February 1987 with Michael Adam and David Harding. Man Group plc (a leading global provider of alternative investment products and solutions) completed the purchase of AHL in 1994 and Mr. Lueck left in 1996. At AHL, Mr. Lueck was instrumental in developing AHL’s trading systems and approach to research as well as the proprietary software language that provided the platform for all of AHL’s product engineering and implementation.

From May 1996 through August 1997, Mr. Lueck was on gardening leave from AHL during which time he helped establish his wife’s publishing business, Barefoot Books. Mr. Lueck was a Director of Research at Brockham Securities Limited, a London-based commodity trading advisor, from October 1984 to February 1987 and an executive in the Japanese Equity Sales department of Nomura International, a provider of financial services for individual, institutional, corporate, and government clients, from January to October 1984. Mr. Lueck serves on the Board of the National Futures Association. He holds an M.A. in Physics from Oxford University and currently serves as Chair of the Oxford Physics Development Board.

2025 Distinguished Speakers

Nancy Bertand

Managing Director Canada -Market Executive

Citi Private Bank, Canada

Jamie Biddle

Founding Partner and Chief Executive Officer

Verdis Investment Management

Lois Tullo

Executive in Residence

The Global Risk Institute

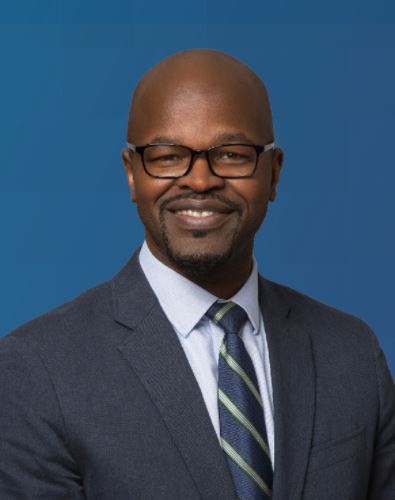

Shael Soberano

Chief Investment Officer

Sharno Group Inc.

Andrew Hamlin

Vide President and Portfolio Manager

Federated Capital

Drew Colaiezzi

Private Investments

McPike Global Family Office

Scott Morrison

Chief Investment Officer

Wealhouse Capital Management

Trevor Maunder

President & Chief Executive Officer

Peerage Capital

Andrew Garrett

Chief Investment Officer

Spotlight Development

Greg Nott

SVP, Chief Investment Officer

Northwood Family Office

Russell Deakin

CIO and Managing Partner

Aceana Group

Geraldine Hardy

Adrian Barber

President

Barber & Associates

Rohit Khuller

Vice President – Investment Management

Letko Brosseau

Stephen Bloom

Founder

Batl Capital LP

John Hynes

Chief Executive Officer

HedgeFacts

Tec Han

Sean Driscoll

Director & Co-Chief Executive Officer

FAX Capital

Jason Taylor

Founder & CEO

Climate Finance Advisors

François Ritchot

Investment Director

Sagana

Ralph Awrey

Director, Family Office, Canada

Stonehage Fleming

Nima Sanajian

Managing Director of Investments

Wealthsimple

Greg Valliere

Chief U.S. Policy Strategist

AGF Investments

Pascal St-Jean

President & CEO

3iQ

Loïc Julé

Head of Public Markets, Absolute Return and Direct Investment Transactions

Richter

Adam Vigna

Managing Partner and Chief Investment Officer

Sagard Holdings

Adriana Arrillaga

President & Portfolio Manager

One Summit Capital Wealth Management Inc.

Robert Wilson

Senior Vice President, Head of Portfolio Construction Consultation Service

Picton Mahoney Asset Management

Steven Novakovic

Managing Director, Educational Programs

CAIA Association

Jeff Noble

Director, Private Wealth Family Office

BDO Canada LLP

Robert S. Reichmann

President

Reichmann Rothschild

Jay Rosenfeld

Director of Business Development

Peerage Capital & Artemis

Félix Boyer

KPMG Canada

Executive Director, Wealth & Investment Strategy

Edwin Wong

VP Investments

Chandaria Family Holdings, Inc

Nancy Bertand

Managing Director Canada -Market Executive

Citi Private Bank, Canada

Nancy Hoi Bertrand is Managing Director and Head of Citi Private Bank, Canada. In this role, she is responsible for the growth of the business in Canada, which serves and advises ultra-high net worth families, foundations and single-family offices on wealth preservation and creation, with a particular focus on alternative and international investments.

Citi Private Bank is dedicated to serving the world’s wealthiest individuals and their families. From 60 locations across 20 countries, the Private Bank offers services to more than 14,000 ultra-high net worth clients from nearly 100 nations. Its Canadian offices are in Toronto, Montreal and Vancouver.

Having originally joined Citi Private Bank in 2006, Nancy has over 25 years of capital markets experience. Prior to Citi, she practiced U.S. securities law at the global law firm AOShearman, specializing in cross-border corporate finance and mergers and acquisitions.

Nancy sits on the board of the Golf Association of Ontario and is Past-President of the Toronto CFA Society and former Chair of its Governance and Nominations Committee. She was a member of the CFA I nstitute’s Capital Markets Policy Committee and a member of CFA lnstitute’s Global Corporate Governance Task Force and received her Chartered Financial Analyst designation in 2002.

Nancy is a graduate in Business Administration (Dean’s List) from the Richard Ivey School of Business at Western University and a Bachelor of Laws (great distinction) from McGill University. She has been called to the bars of the State of New York, the Commonwealth of Massachusetts and the Province of Ontario. She previously sat on the cabinet of the Royal Ontario Museum’s Young Patrons’ Circle, speaks Mandarin, Cantonese and French, is married and mentoring an adult daughter.

Jamie Biddle

Founding Partner and Chief Executive Officer

Verdis Investment Management

Jamie Biddle is the founding partner and CEO of Verdis Investment Management. He sets the strategic direction of the family office and oversees investment activities, operations and finance. Jamie is behind portfolio construction, manager sourcing and selection, due diligence and risk management. Jamie is an active member of the Investment Committee.

Jamie brings more than two decades of investing and operating experience, across asset classes and industries. Prior to forming Verdis Investment Management in 2004, Jamie was President and CEO of Orcom Solutions. Orcom was an outsourced customer care and billing service for electric, gas and water utilities across North America. The company was originally purchased by a group of private equity firms (including the Blackstone Group and Thomas H. Lee Partners) led by Jamie and was sold to Alliance Data Systems (NYSE:ADS) in December 2003. Jamie began his career as a VC at EnerTech Capital Partners, funding technologies in energy and power.

He earned his Masters in Business Administration from the Wharton School of the University of Pennsylvania and a bachelor’s degree from the University of Pennsylvania. Jamie is the President of Andalusia Foundation.

Lois Tullo

Executive in Residence

The Global Risk Institute

Lois Tullo is an expert in the area of risk, technology, finance, compliance and corporate governance.She has over 30 years of business experience spanning financial services, technology, cryptocurrency, telecommunications, strategy consulting, raising venture capital, M&A, and natural resources. In 2024 she was awarded Top 10 Women CFOs in Canada. She is a UN CEFACT Expert, and Global Blockchain Business Council Ambassador.

As CFRO/CCO she is responsible for financial oversight for KuberMIC a Mortgage Investment Corporation and Advisor for YAMS LLP a Crypto system company. She has over 20 years of Board experience as Chair, Treasurer, and Risk and HR Committee Chair, for a tier 1 bank, private sector and not-for-profit organizations. As an Executive-in-Residence for the Global Risk Institute she spoken on and published the Global Risks and Trends Framework (GRAFT), the linkage of risk management and business strategy, Polycrisis, and the Future of Digital Assets. She has publications for the Banking, Government, and Pension/Asset Management sectors. She is an conference speaker at the United Nations, IACPM, Risk.net, etc, author, and faculty of risk mgt; cyber security, data and IT risk; and financial services at the Schulich School of Business, York University. She teaches in the Master of Risk Management Certificate program, executive programs, MBA, and undergraduate program. She is the author of the whitepaper Enterprise Risk Management – Canadian Best Practices, and Nonfinancial Risk Best Practices in Canada.

She was previously CFO for CIBC Finance Inc. where she was responsible for a $6 Billion credit portfolio, Human Resources, and $1.5 securitization. She held senior positions with a large telecommunication company in the area of Finance, HR, and Business Process Redesign. She provided strategy and technology advice for a Boston consulting firm in the financial, oil and gas mining, and government sectors. She has done international relief and development work in Ethiopia. She was in data management for a gas transmission company. Previously she was a C.P.A./C.A. with Clarkson Gordon/E&Y, and PWC. Ms. Tullo is a CPA, CA, ICD.D, CCO. She has a Bachelor of Commerce from the University of Saskatchewan, and an EMBA from the Ivy School of Business, University of Western.

Shael Soberano

Chief Investment Officer

Sharno Group Inc.

Shael Soberano, CFA, is the Chief Investment Officer of Sharno Group, a privately owned independent principal investment group and family office focused on identifying strategic, value-add investment opportunities across a wide range of traditional and alternative asset classes and strategies.

Shael is also the President & CEO, Portfolio Manager & Chief Compliance Officer of Sharno Capital Corporation, a registered Exempt Market Dealer and Portfolio Manager with the Ontario Securities Commission, and distributes securities in Ontario to eligible Accredited Investors.

Prior to Sharno Group, Shael Soberano was Vice President, Senior Analyst at Vision Capital Corporation, a leading Toronto-based Hedge Fund manager focused on publicly traded real estate related securities. Shael first joined Vision Capital as an Analyst in 2009, shortly after its inception. He was promoted to Vice President, Senior Analyst in 2014, and was registered as an Advising Representative with the Ontario Securities Commission in 2017. With a wide range of roles spanning both business development and investment management initiatives, Shael’s contributions were integral in growing Vision Capital’s assets under management and contributed to its award-winning risk-adjusted performance over that period.

Shael is a CFA Charterholder and completed the Bachelor of Management and Organizational Studies Honours Degree with a Specialization in Finance at the University of Western Ontario. Shael completed the Partners, Directors, and Senior Officers (PDO) Course in 2019 and the Canadian Securities Course (CSC) in 2010, provided by the Canadian Securities Institute (CSI).

Andrew Hamlin

Vide President and Portfolio Manager

Federated Capital

Andrew leads the investment team at Federated Capital, a private single family office. He is responsible for overseeing the whole investment process from identifying, investing, and monitoring investments. He has extensive experience allocating capital in both public and private markets. Andrew has a strong track record of performance having worked in the industry for over 25 years. Previous experience includes spending 10 years building an independent asset manager, working with high net worth families, and sitting on the board of a private air logistic company. He started his career in the capital markets division of Canada’s largest banks. Andrew has an MBA from the Schulich School of Business and a Master degree in International Politics from Sussex University (UK).

Drew Colaiezzi

Private Investments

McPike Global Family Office

Drew Colaiezzi is a private equity/venture capital specialist & investment manager with a background in capital markets focused on securitizations, specialty credit products, fixed income asset-back warehouses, financing consultancy, investment strategies & management, investment relationship structures, and early-stage venture.

After working in NYC and Miami for various private equity firms, he moved internationally and currently sits on the investment committee for MGFO, a single-family office based out of the Bahamas with a large venture portfolio containing exposure to various industries with a strong focus on early stage opportunities in financials, tech, fintech, life sciences, the carbon economy, venture funds, co investment opportunities, and web3/crypto based assets.

Scott Morrison

Chief Investment Officer

Wealhouse Capital Management

Scott Morrison is the Chief Investment Officer of Wealhouse Capital Management, a privately-owned investment firm and family office. As the firm’s founder, Scott is responsible for overseeing Wealhouse’s various strategies across asset classes, as well as the firm’s private equity portfolio and real estate holdings.

Outside of Wealhouse, Scott serves on the investment committee of the Centre for International Governance Innovation (CIGI), where he advises on investment decisions for CIGI’s endowment fund. Scott has over 25 years of asset management experience. Prior to Wealhouse, Scott spearheaded the portfolio management for notable firms such as Mackenzie Investments, CI Funds, and Investors Group. Scott holds a Bachelor of Finance from Concordia University and is a CFA Charterholder.

Trevor Maunder

President & Chief Executive Officer

Peerage Capital

Trevor is President and Chief Executive Officer at Peerage Capital. With a Commerce degree from Queen’s University, Trevor began his professional career at PricewaterhouseCoopers as a CPA. There, he focused on transaction support for the telecom and media sectors before moving to MDC Partners Inc. At MDC, Trevor worked in the corporate development group where he led two restructurings, acted as a partner company CFO, oversaw the successful bidding and implementation of the Multi-Print III stamp contract awarded by the United States Postal Service, and assisted with acquisitions and due diligence. As CEO, Trevor oversees development and execution of the broad corporate strategy for Peerage, including the ongoing growth of all operating platforms including real estate services, asset management and self-storage.

Andrew Garrett

Chief Investment Officer

Spotlight Development

After more than 20 years in institutional investing—as both a pension-backed GP and LP—Andrew Garrett brings a fresh perspective to family office investing in his dual roles as Chief Investment Officer at Spotlight Development and Board Advisor at Ruck Lane.

Andrew leads Spotlight’s investment strategy and capital partnerships, drawing on his extensive experience in commercial real estate across Canada, the U.S., and Mexico. Over the course of his career, he has managed more than $8 billion in new-build developments and held leadership roles at Cadillac Fairview and IMCO, where he cultivated deep industry relationships and consistently delivered high-performing projects.

A committed community advocate, Andrew served on Ontario’s Housing Affordability Task Force and continues to champion projects that align financial performance with social impact.

He holds an MBA from the Kellogg School of Management, a Bachelor of Commerce from the University of Guelph, a certificate in Crown Corporation Board Director Effectiveness from the ICD, and advanced training in Real Estate Development from MIT.

Greg Nott

SVP, Chief Investment Officer

Northwood Family Office

As a member of the firm’s management team, Greg leads Northwood’s investment activities, and provides overall thought leadership on all investment matters for the firm. Working in conjunction with other members of the investment team, Greg draws on his extensive experience in asset allocation and conducting due diligence on investment managers, with an aim to select and monitor best-in-class investment managers across all asset classes. Greg also participates in building client relationships and business development. Prior to joining Northwood, he was a member of Russell Investments Canada’s Leadership Team, and regularly met with the firm’s institutional and individual clients to discuss investment strategies and outlook. He was responsible for management of the firm’s Canadian fixed income and multi-asset portfolios, while also overseeing the Canadian investment team.

Greg attained his Chartered Financial Analyst (CFA) designation in 1999. He has a Bachelor of Commerce degree from Queen’s University. Greg is an active member of his community, volunteering his time to support a number of his children’s activities.

Russell Deakin

CIO and Managing Partner

Aceana Group

Russell Deakin serves as the Chief Investment Officer (CIO) and Managing Partner at Aceana Group, bringing over 25 years of experience in alternative assets, including private equity, venture capital, real estate, infrastructure, and renewable energy. His career spans North America, Europe, South America, India, and China, underscoring his extensive global expertise.

His specialties encompass entrepreneurial ventures, blockchain, crypto, growth capital, private equity, real estate development, infrastructure, renewable energy, and international capital markets.

Russell holds an MBA from the Anderson Graduate School of Management at UCLA, with undergraduate studies completed at Oxford University (Honors Exchange Program in PPE) and Tufts University (BA in Economics and History).

Geraldine Hardy

Geraldine is a Director and coach of Family Hippocampus, a peer -to-peer driven Think & Do Tank focusing on family dynamics in business families. She was born in Indonesia to a Chinese father, to an 8th-generation Peranakan business family and descendant of Hong Kiam Lauw, and a German mother. She grew up across Indonesia, Germany, and the United States, gaining valuable experience in connecting with stakeholders from diverse cultural backgrounds.

With over 27 years of professional experience in marketing, business development, and communications, Geraldine has a strong background in investor relations and stakeholder engagement across private and public equity.

Geraldine has worked and lived in nine countries in various industries that involved adapting and gaining knowledge in sectors such as oil & gas, bio pharmaceutical, clean tech, information technology, luxury: yachting, private aviation property, family office and finance in Europe (Germany, Portugal & France), UK (London & Brighton), ME (Dubai), Africa (Tanzania & Cameroun), SEA (Singapore & Indonesia), Australia (Brisbane) and USA (New York).

She blends business acumen with a focus on well-being to enhance productivity, creativity, and integrity in my decision-making process—qualities I see as essential for adapting to today’s uncertain landscape.

Trauma & Energy Coach, Shaolin Temple Europe Taiji Martial Artist, Alchemy Healer, NLP Master Coach and Meditation Guide

Adrian Barber

President

Barber & Associates

Rohit Khuller

Vice President – Investment Management

Letko Brosseau

Rohit Khuller is a McGill University graduate (MBA) with a bachelor’s in engineering from Delhi College (B. Eng). A CFA® charter holder, he has also completed the Harvard Business School General Management Program (GMP).

Prior to joining Letko Brosseau in 1998, he held a senior sales engineering position at Carrier Aircon Ltd, after completing internships with major companies such as Suzuki India, Indian Airlines and Bank of America.

Mr. Khuller’s career in various industries such as automotive, aerospace and banking in several countries has enabled him to deepen his knowledge in different fields. After 25 years with Letko Brosseau, in addition to his role as Portfolio Manager, he is now Vice President, Investment Management and member of the Investment Council, overseeing portfolio strategy and risk management for all the company’s assets, and is responsible for the firm’s emerging markets equity investments.

Mr. Khuller is recognized for his talent as an investor, his strong analytical skills, and his diligence in his work.

Stephen Bloom

Founder

Batl Capital LP

A former senior partner of Goodmans LLP, one of Canada’s leading full service law firms who practiced corporate law for almost 30 years. Past CEO of Shiplake Properties Ltd., a third-generation family-owned private business. Co-founded Collecdev, Shiplake’s development and construction management business. Currently, President and Managing Partner of Batl Capital, founded by Stephen as a family office and manager of capital.

In his previous role as CEO of Shiplake, Stephen provided critical support and guidance to the day-to-day management of a billion-dollar business that included the ownership and operation of an apartment portfolio and retirement residence, high-rise development and construction management, as well as investment in commercial real estate, private equity and public securities.

Stephen is a value-added investor who has negotiated and completed dozens of transactions, including land and business acquisitions, dispositions, financings, joint ventures, partnerships and shareholder agreements, while providing wise counsel throughout the life cycle of the investment.

Stephen has served on the boards of various charitable organizations including the Israel Cancer Research Fund, Tanenbaum CHAT and Trustees of the Jewish Foundation of Toronto.

John Hynes

Chief Executive Officer

HedgeFacts

John Hynes is the Chief Executive Officer at HedgeFacts, a leading provider of cloud hosted middle & back office outsourced solutions to Family Offices, Allocators and Investment Managers.

HedgeFacts is a family owned business which has provided John with experiences and insight which enables his to relate to many clients.

John previously held various at Barcalys Bank and Allied Irish Banks after starting his career with PwC. John is a graduate of Trinity College Dublin and is a Fellow of the Chartered Accountants in Ireland.

Tec Han

Tec Han, MBA is a senior investment allocator with over 20 years of experience in asset allocation, manager research, and portfolio strategy, Tec was the founding Chief Investment Officer of Vibrato Capital, a Portland-based family office, and has held investment roles at Clark Enterprises and the National Railroad Retirement Investment Trust. He serves on the board of CareOregon, guiding strategic financial sustainability for Oregon’s largest Medicaid and Medicare provider.

Sean Driscoll

Director & Co-Chief Executive Officer

FAX Capital

Sean Driscoll is the Co-Founder, Co-Chief Executive Officer and Director of FAX Capital, an investment company focused on high quality investment opportunities in equity, credit and real estate across both public and private markets. He is also the Co-Chief Executive Officer and Director of Federated Capital, a single-family office.

Before establishing FAX, Mr. Driscoll spent 10 years at Sentry Investments, a Canadian mutual fund company, where he was the Chief Executive Officer and a member of the board of directors and led a multi-year strategic repositioning of the company as it grew organically from $3 billion to $20 billion in assets under management becoming one of Canada’s largest independent asset management firms. Sentry was acquired in late 2017, laying the foundation for the capitalization of FAX and Federated. Mr. Driscoll was also President and CEO of NCE Diversified Management, a company that raised over $350 million across 5 partnerships during his tenure, for investment in resource exploration and development companies on a tax advantaged basis. Prior to joining Sentry, Mr. Driscoll worked at a leading Canadian investment bank where he worked on a broad range of financing transactions and merger and acquisition assignments.

Mr. Driscoll currently serves as a director of the UHN Foundation where he is a member of the Finance and Investment Committees. He holds a Masters of Business Administration from the Schulich School of Business, York University and received a Bachelor of Arts degree (Economics) from McGill University. He is a graduate of the Directors Education Program, jointly developed by the Institute of Corporate Directors and the University of Toronto’s Rotman School of Management and has obtained the ICD.D designation.

Jason Taylor

Founder & CEO

Climate Finance Advisors

Jason Taylor is a capital markets professional with over 20 years of experience and founder of Climate Finance Advisors a boutique sustainable investing firm. In recent years he led the teams and development of the sustainable finance strategy for two Canadian banks working in close collaboration with groups across the bank and capital markets. A frequent conference panelist and speaker covering a wide range of sustainable finance topics (impact investing, transition & environmental finance), Jason has also participated in a number industry workstreams to accelerate the mainstreaming of sustainable finance.

He is an advocate for using the power of capital to influence systemic change and contribute to building just, faire, and resilient communities. His work focuses on crowding-in capital to shrink various funding gaps (nature, climate, transition, social) in a financially efficient manner. He completed an MBA focused in sustainability, strategy, and innovation management at McGill/HEC Montreal, where he was named to the Poets & Quants 2019 100 best & Brightest list. He co-instructs the sustainable investing course in Concordia University’s MBA program and is a CFA and CAIA charter holder. His volunteering commitments are focused on his role on the board and investment & Impact committee of the Foundation of Greater Montreal, and as president of West Island Lacrosse.

François Ritchot

Investment Director

Sagana

François is an impact investing transaction and strategy professional. He is an Investment Director at Sagana, advising UNWHI and family offices investing in companies and funds with attractive financial returns and significant human and planetary impact. At Sagana, Francois leads investment activities in the Food and Agriculture sector globally. He was previously an Associate Director at Palladium Impact Capital (formerly Enclude) where he provided capital raising services to impact enterprises (pre-revenue to growth-stage) and mission-driven financial institutions as well as impact fund placement.

Ralph Awrey

Director, Family Office, Canada

Stonehage Fleming

Ralph is Director, Family Office for Stonehage Fleming, based in Toronto. He has more than 20 years’ experience working with families and their advisors across the Americas providing strategic counsel, management and implementation covering the full spectrum of a family’s wealth requirements. His experience in both living and working internationally allows him to bring the right resources and practical wisdom to help international families manage their wealth and protect their legacy for this generation and those to come.

Stonehage Fleming are valued advisors to the world’s leading families and wealth creators. We manage and protect their wealth, across multiple geographies and generations. We work with families to help determine a purpose and strategy for their wealth, providing the platform to protect and manage their assets. This support can vary from a single standalone service to operating as a fully outsourced Family Office. With a seventh generation family at our core, we bring the families we support the benefit of shared experience; the challenges and opportunities they face will often be unique to them, but not to us. We give them the peace of mind and the time to focus on what’s most important to them.

Prior to joining Stonehage Fleming, Ralph held a variety of senior leadership roles in wealth management across the Americas with Canadian banks and a Single Family Office. This included a 20-year career with postings in Canada, Barbados, and the Cayman Islands where he also served on the Boards of Delaware and Caribbean Trust companies. Ralph is a Chartered Accountant (Canada), and has a Masters in Business Administration from The Rotman School of Management, University of Toronto, and Honours Bachelor of Arts from Western University.

Nima Sanajian

Managing Director of Investments

Wealthsimple

Nima Sanajian is the Managing Director of Investments at Wealthsimple, with over 15 years of experience in investment management. He leads the firm’s alternative investment offerings, asset allocation, and portfolio construction strategies. Prior to Wealthsimple, Nima spent nearly seven years at CPP Investments, where he specialized in strategic asset allocation, portfolio construction, and the development and management of systematic macro strategies. Earlier, he served as a senior quantitative analyst at RBC. Nima holds a Ph.D. in Operations Research from the Rotman School of Management (University of Toronto).

Greg Valliere

Chief U.S. Policy Strategist

AGF Investments

Greg Valliere joined AGF Investments (AGF) in February 2019 as Chief U.S. Policy Strategist. In this role, he is responsible for providing insight into how U.S. politics are shaping global markets.

He brings a unique perspective to AGF with more than four decades of experience analyzing policy and politics providing regular commentary and insight into Washington for financial services and investment management clients globally, including specialized coverage of the Federal Reserve, economic policy and politics. Greg began partnering with AGF in 2017 advising investment management teams on policy and the impact on global markets, providing daily market commentary for financial advisors and participating in numerous client events and roadshows.

Greg has more than 40 years of experience following Washington issues for institutional and retail investors. He is widely quoted in U.S. media and specializes in coverage of the Federal Reserve, tax and spending issues, and politics. Greg is based in Washington, D.C.

Pascal St-Jean

President & CEO

3iQ

Throughout his career, Pascal has focused on the transformation and disruption of industries via rapid scaling of businesses under his leadership. Having successfully created and grown multiple business ventures, Pascal was recognized as one of the youngest recipients of the Forty Under 40 award.

Before joining 3iQ, Pascal was an active angel investor and served as Strategic Advisor and Fractional Executive to over 5% of the Globe and Mail’s 500 fastest growing companies in Canada.

Pascal’s experience in open-source technologies and distributed systems led him to invest in cryptocurrency in 2016, and act as an educational resource on digital asset investments to several organizations. As President & CEO of 3iQ, Pascal is focused on overseeing the growth and global expansion of the company as it continued to pave the way as a global leader in Digital Asset Management.

Adam Vigna

Managing Partner and Chief Investment Officer

Sagard Holdings

Adam Vigna has served as Managing Partner and Chief Investment Officer of Sagard since 2016. As the firm’s Chief Investment Officer, Adam is actively involved in all investment decisions made across the platform and is responsible for Sagard’s overall investment activities, including investment strategy, governance, and portfolio construction. Adam also serves as Chief Investment Officer of Sagard Credit Partners. Adam is a member of the Management Committee and is currently a director of Peak Achievement Athletics. He is based in Toronto, Canada.

Prior to Sagard, Adam spent nearly a decade at the Canada Pension Plan Investment Board (“CPPIB”) where he was Managing Director and Global Head of CPPIB’s Principal Credit Investments Group (“PCI”) with approximately CA$20B of AUM. While at CPPIB, Adam was one of the founding members of CPPIB’s Principal Credit Investment Group and led CPPIB’s acquisition of Antares Capital in 2015. Prior to CPPIB, Adam was Vice-President at Goldman Sachs in the Special Situations Group (“SSG”) in New York, US and Toronto, Canada. In 2006, he moved to Toronto from New York to become one of the three founding members of the Canadian Special Situations Group (“CSSG”). Before joining SSG, Adam worked in Goldman’s Investment Banking Division in New York where he was a part of their Financial Institutions Group (“FIG”).

Adam holds a B.Comm. (Honours) degree from Queen’s University in Kingston, Ontario. He served on the boards of Antares Holding (Chair), Antares Capital, Teine Energy, Laricina Energy, and Long Point Energy.

Adriana Arrillaga

President & Portfolio Manager

One Summit Capital Wealth Management Inc.

Adriana is President and Portfolio Manager of One Summit Capital.

Adriana’s extensive career in the investment management industry, includes 15 years as Senior Portfolio Manager with Fleming Asset Management, where she oversaw North American mandates for foreign pension funds.

During her career, Adriana worked with institutional asset managers as well as major Canadian Financial Institutions.

Adriana is an alumnus of John Molson School of Business, where she graduated with a B. Comm. Finance Major.

Adriana is a CFA charter holder and was conferred the FCSI designation (Fellow of the Canadian Securities Institute).

Adriana is a member of CFA Montreal, Women in Investment Management Committee, where she leads the Scholarships Selection Committee.

Adriana volunteers as a guest speaker at the Goodman Mentor Circle and as guest lecturer at JMSB.

Adriana values the importance of women’s financial education. In 2018, she established an annual scholarship with Concordia University to help encourage female finance students to pursue their CFA designation.

Adriana is a founding member donor of Women Impact Montreal fund. She is voting member of Conservation Manitou. She was a member of Tiger 21 till February 2025.

Adriana came to Montreal as foreign student and is a first-generation immigrant to Canada.

Robert Wilson

Senior Vice President, Head of Portfolio Construction Consultation Service

Picton Mahoney Asset Management

Robert Wilson, Senior Vice President, is the Head of Picton Mahoney’s Portfolio Construction Consultation Service (PCCS). He is responsible for leading a multi-disciplinary team of experts in asset allocation, risk management, quantitative research and portfolio management. Robert and his team partner with investment advisors and institutional investors to help them construct more resilient and efficient investment portfolios. Robert is often invited to share his insights on alternative investments, asset allocation and portfolio construction with industry groups and media outlets.

Prior to joining Picton Mahoney in 2019, Robert spent 10 years working in financial services in progressively senior roles. Most recently, Robert was vice president at BlackRock Asset Management Canada Limited where he distributed iShares ETFs to Canadian investment advisors. Prior to that, Robert was an associate at PIMCO where he distributed PIMCO funds to Canadian investment advisors.

Robert holds an MBA from the Rotman School of Management at the University of Toronto. He is a CFA charterholder, and he holds the Chartered Alternative Investment Analyst designation. He is also a member of the Responsible Investment Association of Canada and holds the Responsible Investment Professional Certification designation.

Steven Novakovic

Managing Director, Educational Programs

CAIA Association

Steve Novakovic, CAIA, CFA is the Managing Director, CAIA Curriculum for CAIA Association. In this role, he is responsible for managing the CAIA Charter curriculum, ensuring the content remains relevant and reflects current trends in the institutional asset allocator space. He joined CAIA Association in 2022 and has been a Charterholder since 2011. Prior to CAIA Association, Steve was a faculty member at Ithaca College in Ithaca, NY, where he taught a variety of finance courses including: Cryptocurrencies, Alternative Asset Management, and Wealth Management, among others. Before entering academia, he worked at his alma mater, Cornell University, (B.S. 2004, MPS 2006) in the Office of University Investments. In his time at Cornell University, Steve invested across a variety of asset classes for the $6 billion endowment. His twelve years at Cornell generated substantial insight into endowment management and fund investing across the alternatives and traditional landscape.

Jeff Noble

Director, Private Wealth Family Office

BDO Canada LLP

Jeff is a senior consultant in the BDO Wealth Advisory & Tax Services Practice. With 25+ years of family facilitation and financial experience, Jeff helps family enterprises, private companies and not-for-profits effectively deal with the transition from one stage of their lifecycle to the next. The fourth generation to spend several years working in his family’s firm, Jeff thoroughly understands the challenges facing privately-owned businesses, their key stakeholders and the high net worth families they support.

For over two decades, Jeff continues to grow and apply his knowledge and experience to help private company owners and their families adapt a truly holistic approach to planning for the future. He is renowned for expertise in strategic wealth preservation, stewardwhip & growth, family enterprise risk management, succession & family wealth continuity planning, wealth transition and family governance. In 2003, he earned the Certified Management Consultant designation, globally-recognized as the highest standard of consulting and adherence to a code of professional conduct. More recently, Jeff earned the designation of FAMILY ENTERPRISE ADVISORTM representing the pinnacle of professional expertise in the field of family enterprise advising.

Robert S. Reichmann

President

Reichmann Rothschild

Robert S. Reichmann is the President of ReRo, a third-generation family office and investment firm focused on North American real estate and private opportunities. He is particularly passionate about purpose and spirituality.

Jay Rosenfeld

Director of Business Development

Peerage Capital & Artemis

Jay is Peerage Capital & Artemis’ Director of Business Development. Jay brings more than 30 years of experience in the Financial, Advertising and Marketing industries. Responsible for building business for the groups, Jay has exposure to all asset classes and a deep understanding of Asset Allocation & Asset management.

Prior to Artemis, he worked as Regional Director for Smart Circle International overseeing operations in the North Eastern United States. He hired, trained, and managed over 200 sales representatives. Jay earned a Bachelor of Arts and an Economics degree from Bishop’s University.

Félix Boyer

KPMG Canada

Executive Director, Wealth & Investment Strategy

Félix Boyer oversees the delivery of KPMG Family Office’s National Wealth and Investment Strategy engagements. KPMG Family Office is an independent, open architecture and institutional investment platform tailored to support families and private foundations with a wide-ranging suite of tailormade investment solutions. It adopts a multi-disciplinary, independent and customized approach to family investment solutions. Félix leads projects that encompass portfolio reviews, investment approach structuring, asset allocation, manager selection and ongoing investment monitoring.

Prior to his current role, Félix held various positions, including roles in asset management front office, serving as an institutional investment principal, and as a leading consultant in sustainable investment. Throughout his career, Félix has consistently designed and implemented bespoke solutions for his high AUM clients, including family offices, ultra-high-net-worth (UHNW) families, pension plans, foundations/endowments, banks, insurers and other institutions.

Félix is well-versed in all asset classes and is particularly recognized for his deep expertise in manager selection and private markets. He excels at creating personalized solutions in strategic investment structuring, ESG assessment, investment policy statements, asset allocation (both long-term and tactical), manager selection, impact investing, and performance/risk/ESG monitoring, all through a client-centric approach. He understands each client’s unique situation and objectives while leveraging his extensive investment industry knowledge to serve them effectively.

Edwin Wong

VP Investments

Chandaria Family Holdings, Inc

Edwin is the VP Investments at Chandaria Family Holdings, Inc, a single-family office in Toronto, Ontario where he leads and is responsible for all aspects of portfolio management and oversight.

Edwin has extensive experience building and managing multi-asset portfolios for institutional and private clients, creating processes and frameworks for enhanced investment governance, and conducting thoughtful due diligence, selection, and oversight of investment managers and strategies.

Edwin holds the CFA and CAIA charters and the CFP and FRM certifications/designations.

2025 Agenda

Please note the timings and agenda are subject to change.

Day 1

- April 23, 2025

- 5:00 pm – 7:00 pm

Day 2

- April 24, 2025

- 8:00 am – 7:00 pm

- April 23, 2025

- 5:00 pm – 7:00 pm

Pre-day – PLEASE NOTE ATTENDEE TYPES

2:00 pm

Single Family Office Roundtable (Relatives Only)

Life as the principal of a family office can be exciting, inspirational, and busy, while at the same time worrisome, stressful, and draining. We provide this (strictly!) family members only dinner as an opportunity to meet with your peers and share questions, concerns, solutions, and insights across the table. We have nominated three leaders/instigators to get things going and guarantee that all will find the evening illuminating and fun.

SFO Relatives Instigators (3 total):

Jamie Biddle, Verdis Investment Management

John Hynes, HedgeFacts

2:00 pm

Single Family Office Roundtables (Professionals Only)

Working in a single family office is not your typical investment management job – you gain the benefit of a sometimes extremely flat organizational structure and many find the spectrum of duties and tasks to be (very) intellectually stimulating. On the other hand, it can be isolating and difficult to keep up with the pace of work: each family has its own dynamic and cadence so we created this dinner where (strictly!) full time employees (not relatives) of SFOs can interact with their peers to get the most out of their roles.

SFO Professionals Instigators (3 per room)

3:30 pm

SFO Break Out – Portfolio Diversification in Challenging Markets

This discussion will cover investment strategies, alternative asset classes, and how to balance risk and return in today’s volatile market.

Jay Rosenfeld, Peerage Capital & Artemis

Edwin Wong, Chandaria Family Holdings

3:30 pm

SFO Break Out – Multi-Generational Plan for Multi-Generational Wealth (Family Members Only)

This session will focus on purpose and accountability and explore strategies to ensure smooth leadership transitions, the role of next-gen family members, harmonious family relations, and maintaining the family’s values and vision across generations. Special treat: one of the families will describe how their (long-awaited) transition is progressing; all are encouraged to add their thoughts as well!

Shael Soberano, Sharno Group

Robert Reichmann, ReRo

John Hynes, Hedgefacts

3:30 pm

SFO Break Out – Family Office Operations: Best Practices

4:15 pm

SFO Break Out – Investing in Private Markets & Venture Capital

This discussion will explore family office investments in private companies, including deal sourcing, due diligence, and the role of venture capital in a diversified portfolio.

Russell Deakin, Aceana Group

Drew Colaiezzi, McPike Global Family Office

4:15 pm

SFO Break Out – Due Diligence for Families

How can families conduct thorough due diligence on funds and managers? This session will highlight frameworks for avoiding pitfalls and selecting quality partners.

Tec Han, SFO Professional

Adrian Barber, Barber and Associates

4:15 pm

SFO Break Out – Tax Planning & Cross-Border Issues

With families often spread across jurisdictions, this session will focus on managing tax exposure, estate planning, and navigating complex global tax issues.

Jay Rosenfeld, Peerage Capital & Artemis

5:00 pm

All Delegates – General Welcome Reception

Everyone welcome to this time to meet. Generally, sponsors and managers arrange private dinners after this time with select conference delegates – either via the messaging & meeting app or off-line.

7:00 pm

End of Pre-day

- April 24, 2025

- 8:00 am – 7:00 pm

Main Day

8:00 am

Registration & Breakfast

8:30 am

Wheat From the Chaff: Manager due diligence

There are thousands of managers in the alts landsacpe – some might even think that they have seen them all…until they find dozens more at a new event or database. This session will show new and veteran family office professionals and their families a framework of categorizing, diligencing, and choosing managers which have the best probability to perform according to the needs of the families’ beneficiaries.

Tec Han, SFO Professional

Adriana Arrillaga, One Summit Capital Wealth Management Inc.

Moderated by: Felix Boyer, KPMG Family Office

9:00 am

Private Markets in Transition

Private markets have been all the rage for many years with PE and then venture coming to the fore in retail-friendly wrappers and terms (even if they are at odds with how the industry would traditionally package them). Secondaries have evolved from PE to real estate and now infrastructure secondary funds (designed with the feature/bug that they buy more mature positions and are able to offer better liquidity terms to investors) in very quick succession (the latter of the three offered seemingly just after people started musing about it. Platform proliferation has made accessing these funds easier than ever and allowed capital to flow virtually unhindered into this space. What’s next? This panel will discuss just that.

Drew Colaiezzi, McPike Global Family Office

Nima Sanajian, Wealthsimple

9:30 am

Non-correlated Ideas

Diversification is touted as the Holy Grail of investing – but one must choose their portfolio constituents wisely. 79 of the NASDAQ 100 constituents are in the S&P 500. Equity and bond indices generally correlate – especially in crisis situations. Even hedge funds and other sectors like real estate can correlate when crowded trades or macro factors align to take them down. Where can an investor find solace? Possibly in the offerings of these three panelists: one’s employer has a plethora of non-correlated products on offer (Sagard), one has a fund that is correlated to the EM index which is, itself, a diversifier to other assets and strategies (Letko Brosseau), and the third has digital assets at its core (3iQ Corp).

Rohit Khuller, Letko Brosseau

Adam Vigna, Sagard Holdings

Pascal St-Jean, 3iQ

Moderated by: Loïc Julé, Richter

10:15 am

Table Talks

11:00 am

1:1 meetings / Morning Refresher

This is everyone’s opportunity to meet – either as established via our conference meeting & messaging app or ad hoc

11:30 am

Getting to G10

We have hosted numerous sessions where families and their professionals blue sky ideas on how to make their family office run better – but, as with most things, it comes down to people (this is the good and bad news). At the end of the day, G+1 or 2 or 3 will pass on and their legacy will be in the hands of the next generations. Now, one can live a lifestyle exclusive of worry about the next generation, but many believe that they’d like their progeny to do at least as well as they did. The math is difficult, though…exponential beneficiary growth meets arithmetic portfolio growth; and add to that missteps that the guardians of the hoard might make and ‘getting to G10’ can seem a gargantuan task. This panel will show you all sides of this conundrum and give you actionable tasks to make your heirs better off.

Geraldine Hardy, SFO

Jamie Biddle, Verdis Investment Management

Sean Driscoll, Fax Capital

Moderated by: James Burron, CAASA

12:15 pm

Lunch & Keynote

12:45 pm

Martin Lueck: Delivering non-correlated, liquid alpha for decades

Mr. Lueck may not be known to all – his forte is discovering and exploiting trading opportunities and longer-term price trends that can create value for his many investors. His experience stretches about 40 years and his namesake first big win (AHL Fund, wherein he is the ‘L’) along with his current company (Aspect Capital) continue to be beacons of performance and innovation for the industry. Plase join us in this perhaps once-in-a-lifetime opportunity to hear his story and how he has managed to provide returns for investors in all markets as well as create and build relatinonships with investors over the years.

Martin Lueck, Aspect Capital Limited

Nancy Bertand, Citi Private Bank, Canada

1:30 pm

How much Alpha is enough? How many yachts?

Family offices are unique: they are a compilation of the family members (usually the founder/G1 is the main driving force behind this, but more mature families have successive generations represented in the Investment Committee) and their professional (non-related) staff. Unlike more institutionalised roles, that of an SFO professional is usually more dependent on the preferences of the beneficiaries involved in the process vs the process itself. This can be liberating (only one politic to worry about) or not (overbearance). Then there are the expectations, which this panel will focus on. Both of our speakers work for an involved G1 and their progeny (to an extent) and other advisors/professionals – but the expectations of them are very different. This will be an interesting illustration of how families of the same vintage can differ!

Scott Morrison, Wealhouse Capital Management

Trevor Maunder, Peerage Capital

Moderated by: Jason Campbell, Eckler

2:00 pm

Total Portfolio Allocation

Every once in a while there is an epochal change in how things are done. One can observe an industry for years, piecing together many participants’ actions, before stepping back to see what the mosaic illustrates. The Total Portfolio Approach is one of those paradigm-changing (or shifting) mindsets. Institutional investors always seek additional alpha or risk-adjusted return, or (to be simple) ways to deliver value (e.g., retirement income) to their beneficiaries. The Maple Model is another example of this – but it is almost impossible to implement for smaller (<$10 billion) investors. The panel will explain the TPA and how it can be implemented by other investors to help them reach their lone-term goals.

Attendees are encouraged to read ahead prior to the event by perusing (or at least scanning) this CAIA paper on the topic [link].

Robert Wilson, Picton Mahoney Asset Management

Steven Novakovic, CAIA Association

Moderated by: Jeff Noble, BDO

2:30 pm

Table Talks

3:15 pm

Tete-a-Tete / Afternoon Refresher

This is everyone’s opportunity to meet – either as established via our conference meeting & messaging app or ad hoc

3:45 pm

Cross-Border Currents: The Evolving Canada-U.S. Relationship

In an increasingly interconnected and politically dynamic world, the relationship between Canada and the United States remains critical for families, businesses, and investors on both sides of the border. Greg Valliere, Chief U.S. Policy Strategist at AGF Investments, will provide a timely and insightful overview of the current state of Canada-U.S. relations, highlighting key political, economic, and policy developments. From trade agreements and energy policy to regulatory shifts and election cycles, Greg will decode what’s happening now — and what’s likely ahead — offering actionable intelligence for those navigating cross-border opportunities and risks.

Greg Valliere, AGF Investments

4:15 pm

MFO Round-Up

A popular panel each year, this year’s crop of MFO leaders will discuss their views on the global multi-family office scene; describe, compare, and contrast their client service offerings; and give prescient outlooks on investments and family governance trends. Enjoy!

Greg Nott, Northwood Family Office

François Ritchot, Sagana

Ralph Awrey, Stonehage Fleming

Moderated by: Jason Taylor, Climate Finance Advisors

5:00 pm

Reception

Open to all delegates.

7:00 pm

End of Family Office Summit 2025

Thank you!

Manager

Members of CAASA

Event Registration Closed

Service Provider

Members of CAASA

Event Registration Closed

Investor

Members of CAASA

Event Registration Closed

Investor

Non-members of CAASA

Event Registration Closed

Thank You to Our 2025 Gold Sponsors

Thank You to Our 2025 Silver Sponsors

Thank You to Our 2025 Bronze Sponsor