Wealth Managers’ Forum 2025 – Toronto

Overview

Join us, dozens of speakers, and scores of fellow IAs and investors for this all-encompassing alts conference specifically designed for retail advisors and the client base they serve.

This forum will be held in person in Toronto, featuring award-winning investment advisors, well-known asset managers, and other distinguished speakers.

We have Advisor-only sessions from 9am – 10:30am on the day. This includes discussions exclusive to IAs and focuses on their interests and requirements. For clarity, asset managers and service providers will not be admitted to these earlier sessions.

General registration begins at 10:30am. Programming starts promptly at 10:45am and includes lunch and a 4:15pm reception for all.

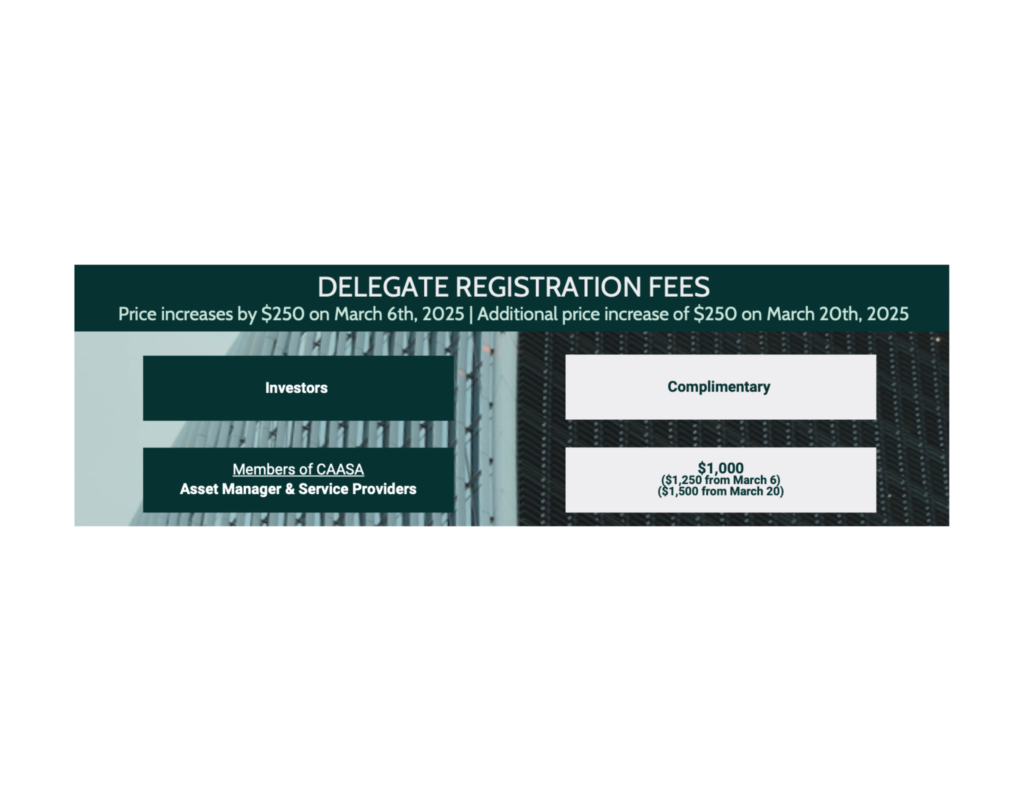

Registration

End Investor means Investment Advisors and those with Single Family Offices. Intermediary investors means Multi-Family Offices, and investment consulting companies and +1 means the first delegate is gratis but each additional delegate attracts a small charge. Manager and service provider delegates must be CAASA members in good standing and pay the requisite per person fee for their appropriate sub-category. Core service providers include prime brokers, fund administrators, and accounting and legal firms.

MSC Cruises Get-away Give-away 2025

We are happy to partner with MSC Cruises for a super prize to be awarded to one of our event attendees (must attend and complete a ballot to be eligible).

Draw will occur at our Networking Night on October 7, 2025.

*Subject to travel restrictions, all details provided to the lucky winner upon receipt.

2025 Distinguished Speakers

Guy Côté

Senior Wealth Advisor & Portfolio Manager

Guy Côté Integrated Wealth Management – National Bank Financial

Cam Richards

Chief Investment Officer

Guardian Partners

Theresa Shutt

Chief Investment Officer

Harbourfront Wealth Management

Ida Khajadourian

Senior Portfolio Manager, Senior Investment Advisor

Richardson Wealth

Martin Pelletier

Senior Portfolio Manager

Wellington-Altus Private Counsel

Rafa Silveira

Portfolio Manager

LGT Capital Partners

Ash Lawrence

Head of AGF Capital Partners

AGF Capital Partners

Brianne Gardner

Senior Wealth Manager

Velocity Investment Partners – Raymond James

Ted Karon

Portfolio Manager

RBC Dominion Securities

Aled ab Iorwerth

Deputy Chief Economist

CMHC – SCHL

Colleen Redmond

Vice President, Investment Product Research

Morgan Stanley Wealth Management Canada Inc.

Robert Wilson

Senior Vice President, Head of Portfolio Construction Consultation Service

Picton Mahoney Asset Management

Josh Benchetrit

Principal and Portfolio Manager

Westcourt Capital

Paul Patterson

National Sales

Spartan Fund Management

James Burron

Founding Partner

CAASA

Guy Côté

Senior Wealth Advisor & Portfolio Manager

Guy Côté Integrated Wealth Management – National Bank Financial

Guy Côté, CFA has 30 years of experience in finance and asset management. He holds a BAA in Finance, he is a Chartered Financial Analyst (CFA),has taken courses on derivatives (options) and financial planning offered by the investment Industry Regulatory Organization of Canada.

Guy can count on the complete range of National Bank Financial products, services and specialists as well as on his extensive network of experienced professionals, in meeting all the specific needs of his clients.

He is a director of the Lise Watier Foundation and La Pietà musical ensemble. He is also actively involved with other foundations.

Cam Richards

Chief Investment Officer

Guardian Partners

As Chief Investment Officer at Guardian Partners, Cameron’s mission is to combine the investment strategies and disciplined portfolio construction and risk management utilized by pension funds and endowments, with the customization and client responsiveness required by private clients, to increase the robustness of investment solutions and to enhance the experience of Guardian Partners’ clients. Previously, he served as CIO of the Nova Scotia Health Employees’ Pension Plan, and was the Head of Real Assets at Albourne Partners in London, England. He also served as the Co-Chief Investment Officer of University of Toronto Asset Management (UTAM), and Chair of the Investment Committee for the entirety of the university’s investment assets. Before joining Guardian Partners, he founded Isengard Capital Management, which provided capital markets research to Albourne Partners and also designed a research platform which applied global macro, stock selection and quantitative strategies to generate long and short exposures in stocks.

Cameron is a graduate of Osgoode Hall Law School in Toronto, holds a Bachelor’s Degree in Mathematics from Queen’s University, earned an MBA from the Schulich School of Business and is a CFA® Charterholder. He has been called to the Bar in Ontario.

Theresa Shutt

Chief Investment Officer

Harbourfront Wealth Management

In her role as Chief Investment Officer with responsibility over the Portfolio Management Department and overall investment platform, Theresa Shutt is a key member of Harbourfront’s executive team, contributing to the leadership and strategic vision of the firm with a focus on increasing AUM and developing innovative investment strategies.

Theresa brings over 20 years of experience in private and public markets with demonstrated success in leading asset management teams. Prior to joining Harbourfront, Theresa was the Head of Corporate Debt for Fiera Capital, where she was responsible for the overall strategic direction of Fiera’s corporate private debt strategies. In this role, she provided leadership in support of business development, investment approval, fund strategy and portfolio management. Theresa joined Fiera from Integrated Asset Management where she was Chief Investment Officer with responsibility for private market strategies.

Theresa began her career working as an economist for the Conference Board of Canada. She has held a variety of roles at large Canadian financial institutions marketing public fixed income to asset managers as well as structuring bond and equity derivative backed products for retail investors.

Theresa is a Chartered Financial Analyst charterholder and also holds a Bachelor of Arts (BA) in Economics (Honours) from the University of Alberta, a Master of Arts (MA) in Economics from McMaster University, and a Master of Business Administration (MBA) from the Rotman School of Management of the University of Toronto.

Ida Khajadourian

Senior Portfolio Manager, Senior Investment Advisor

Richardson Wealth

For over 20 years, Ida has worked closely with Institutions, Family Offices, wealthy entrepreneurs, and high net worth families building trusted relationships and delivering a high level of holistic Wealth Management services.

Ida’s beliefs include the importance of estate planning, tax minimization, capital preservation and evolutionary portfolio construction using alternative strategies to achieve consistent absolute returns with a risk reward-oriented approach.

Ida obtained a Bachelor of Commerce Degree from the University of Toronto with specialization in Finance and major in Economics. Ida is a multi award winning Portfolio Manager and obtained her Chartered Alternative Investment Advisor (CAIA®) designation in 2005.

Martin Pelletier

Senior Portfolio Manager

Wellington-Altus Private Counsel

Martin has over 20 years of investment industry experience including senior-level positions in both institutional equity research and portfolio management.

Martin is currently a senior portfolio manager at Wellington-Altus Private Counsel (previously TriVest Wealth), an award-winning portfolio management firm (Wealth Professional 5-Star Asset Manager 2022), where he is the co-manager of the firm’s risk-managed balanced fund and helps oversee custom built, HNW and UHNW private client portfolios.

Prior to co-founding TriVest and its sale to Wellington-Altus in early 2020, Martin’s career was focused on institutional energy equity research and capital markets primarily at two top-ranked boutique investment banks. He provided investment recommendations on energy markets, commodities, and individual security selections to institutional fund managers located in Canada, the U.S. and Europe.

Martin is regularly featured in the media as a market strategist including his weekly column to the Financial Post’s Investment Pro section for the past decade. He was won numerous awards for his passion for financial education and quality of service provided for his clients.

Martin holds a Bachelor of Commerce degree with a specialization in finance from the University of Alberta, studied international economics and finance at Örebro University in Sweden, and is a Chartered Financial Analyst (CFA) Charterholder.

Martin grew up in a small farming community in Northern Alberta and believes in the power of positive innovative change having lived in Canada’s first Eco-community. He and his family is also passionate about mental-health awareness initiatives focused on youth impacted by ADHD, OCD and Autism. On weekends, his family can be found on a mountain either freestyle/big mountain skiing or downhill mountain biking.

Rafa Silveira

Portfolio Manager

LGT Capital Partners

Rafa Silveira (American/Brazilian) is a Principal at LGT Capital Partners in New York, where he serves as a portfolio manager for the LGT Multi-Alternative Fund and is a member of the U.S. leadership team. Before joining LGT in 2019, he was a portfolio manager at AQR Capital Management. He has also held roles as a solutions strategist at J.P. Morgan Asset Management and a senior quantitative analyst at Bank of America. Mr. Silveira earned a Ph.D. and M.A. in Economics from the University of Pennsylvania and a B.A. in Economics from the University of Brasília.

Ash Lawrence

Head of AGF Capital Partners

AGF Capital Partners

Ash Lawrence is Head of AGF Capital Partners, AGF Management Limited’s diversified alternatives business with extensive capabilities across both private assets and alternative strategies. Ash is also a member of AGF’s Executive Management Team where he assists in the development and execution of AGF’s overall business strategy providing insight and vision that promotes AGF’s long-term growth.

Ash is a seasoned leader with over 20 years of experience and a wide breadth of expertise in alternative investments and portfolio management across sectors. As Head of AGF Capital Partners, Ash and his team identify tenured managers with demonstrated investment expertise in their fields, structuring partnerships to offer long-term strategic support, resources and capital to sustain and enhance the partners’ growth. Ash and his team are continually looking to diversify and expand the business’ capabilities and alternatives offerings to meet clients’ evolving needs.

Prior to joining AGF Investments, Ash spent 16 years with Brookfield Asset Management working in real estate investments and portfolio management in North America and Brazil, ultimately leading the Canadian real estate business. Ash also has experience in financing municipal infrastructure projects and developing infrastructure and transportation solutions for private and public sector clients.

Ash earned an MBA from the Rotman School of Management and a Bachelor of Applied Science in Civil Engineering from the University of Waterloo.

Ash sits on numerous Boards and is a member of the America’s Executive Committee and a Global Governing Trustee for the Urban Land Institute.

Brianne Gardner

Senior Wealth Manager

Velocity Investment Partners – Raymond James

As an Investment Advisor and co-founder of Velocity Investment Partners, Brianne uses her expertise to provide solutions to high-net-worth families who have complex financial needs, anddeliver first-class service to clients who expect the best. Her dedication to understanding and managing the unique financial challenges many families face gives our clients the peace of mind they need.

With the tools provided by the leading independent firm in Canada, Raymond James Ltd., she is continually raising the bar for customized and strategic investment solutions with a focus on risk management. Brianne works closely with successful individuals, medical professionals, corporate executives, business owners and wealthy families across Canada, who have built significant wealth through years of hard work. She takes pride in the opportunity to help them grow, protect, and diversify their wealth, and when the time comes, transfer it to future generations in the most efficient manner.

Brianne and her partner John manage money for families, developing customized wealth management plans and solutions to meet their personal circumstances and goals. Brianne oversees a highly qualified team who help ensure all the clients receive ‘Amazon-like’ efficiency and ‘Four Seasons-like’ service. A disciplined and active risk management strategy allows clients to sleep soundly knowing their money is under prudent stewardship.

Her unwavering passion for being a trusted financial partner and family advisor providing valuable guidance in overseeing their financial affairs is why she has built strong, long-term relationships. Brianne has authored many industry articles over the years and is an expert contributor for Neighbours of Edgemont magazine where she educates clients and investors on financial planning and investments to help them make informed decisions and understand how their money is working for them.

Brianne acts as a mentor to young women in business and has always been an active member of her community. She is a philanthropist through her membership in professional associations and charitable organizations such as Women in Capital Markets, Young Women in Business, SFU Beedie School of Business Mentorship program and ReThink Breast Cancer.

In her free time, Brianne leads an active lifestyle, and you’ll often find her playing golf, tennis, volleyball, skiing or hiking. She and her husband enjoy travelling and they love to spend time with family.

Ted Karon

Portfolio Manager

RBC Dominion Securities

Ted draws on his expert knowledge and more than 30 years of experience in the financial services industry to provide access to a comprehensive range of services. For the past two decades, Ted has been working with high net worth individuals and families to help them meet their complex financial goals.

His depth of experience includes investment banking, commercial lending, mergers and acquisitions, equity research and portfolio management. Over the years, Ted has also developed extensive expertise in the alternative investment sector. Ted brings a holistic perspective on investing to his work, ensuring sound advice, expert execution and peace of mind for clients who need solutions for broad and multi-dimensional wealth management needs.

A graduate of Queen’s University, he earned a Bachelor of Commerce degree with a major in finance. A firm believer in ongoing education, he has acquired the Chartered Financial Analyst (CFA) designation, and licenses for insurance, derivatives fundamentals and options.

Aled ab Iorwerth

Deputy Chief Economist

CMHC – SCHL

Groundbreaking research by CMHC has revealed that inadequate supply is a key driver behind escalating house prices in cities like Vancouver and Toronto. The lead researcher for that project – Deputy Chief Economist Aled ab Iorwerth – now coordinates a diverse national team of researchers and analysts who are investigating impediments to housing supply and potential solutions.

“Housing markets are local. Broader challenges such as supply are often common, but the drivers and magnitude of these challenges may differ significantly across the country. My goal is to help understand and inform on market dynamics, how they support or hinder housing affordability goals and to provide thought leadership on housing economics across housing industry participants.”

Aled joined CMHC in 2016, bringing his strong analytical and research capabilities to bear on complex housing issues. He previously had a 15-year career at Finance Canada, in various research and analysis roles that included secondments to Environment Canada and the Council of Canadian Academies.

Aled holds a PhD in Economics from Western University and master’s degrees in European and International Relations (University of Amsterdam) and Economics (Carleton University). He speaks three languages: English, French and Welsh.

Colleen Redmond

Vice President, Investment Product Research

Morgan Stanley Wealth Management Canada Inc.

As part of the product team at Morgan Stanley Wealth Management Canada (MSWC), Colleen is responsible for conducting initial and ongoing due diligence on various investment products including mutual funds, ETFs, SMAs and alternatives. She works closely with internal and external partners to build out the MSWC product shelf. Prior to joining Morgan Stanley in 2022, Colleen spent over seven years at CI Global Asset Management including four years as the product manager for CI’s suite of liquid alternative products. She also held roles in operations, client services and sales. Colleen holds a BBA from Wilfrid Laurier University and is a Chartered Financial Analyst. Colleen is an avid runner. In her spare time, she enjoys training for her next marathon.

Robert Wilson

Senior Vice President, Head of Portfolio Construction Consultation Service

Picton Mahoney Asset Management

Robert Wilson, Senior Vice President, is the Head of Picton Mahoney’s Portfolio Construction Consultation Service (PCCS). He is responsible for leading a multi-disciplinary team of experts in asset allocation, risk management, quantitative research and portfolio management. Robert and his team partner with investment advisors and institutional investors to help them construct more resilient and efficient investment portfolios. Robert is often invited to share his insights on alternative investments, asset allocation and portfolio construction with industry groups and media outlets.

Prior to joining Picton Mahoney in 2019, Robert spent 10 years working in financial services in progressively senior roles. Most recently, Robert was vice president at BlackRock Asset Management Canada Limited where he distributed iShares ETFs to Canadian investment advisors. Prior to that, Robert was an associate at PIMCO where he distributed PIMCO funds to Canadian investment advisors.

Robert holds an MBA from the Rotman School of Management at the University of Toronto. He is a CFA charterholder, and he holds the Chartered Alternative Investment Analyst designation. He is also a member of the Responsible Investment Association of Canada and holds the Responsible Investment Professional Certification designation.

Josh Benchetrit

Principal and Portfolio Manager

Westcourt Capital

As Principal, Asset Management & Client Services, Josh’s responsibilities include the construction and management of diversified investment portfolios and reviewing investment products for Westcourt’s clients. Josh is registered as a Portfolio Manager (Advising Representative) and a Dealing Representative.

Prior to joining Westcourt, Josh was an executive at two of the country’s largest single-family offices, and a member of the Investment Committee. In this role, he was responsible for building the investment framework covering all major asset classes and geographies.

Paul Patterson

National Sales

Spartan Fund Management

Paul has been with Spartan Fund Management since 2015. From 2008 to 2014, Paul was Vice-President, Private Investment at Integrated Asset Management (“IAM”), a $3B Toronto-based multi-strategy alternative asset manager. Prior to that, he was Associate Vice-President, Institutional and Offshore at BluMont Capital, a hedge fund and structured products firm. Before joining BluMont, Paul practiced corporate and securities law with Lang Michener (now McMillan LLP) and served as legal and policy counsel with the Toronto Stock Exchange. Paul has a B.A. from Carleton University, a J.D. from the University of Toronto and an M.B.A. from Northwestern University’s J. L. Kellogg School of Management. He is also CAIA charterholder and is the former Deputy Chair of the Canadian chapter of the Alternative Investment Management Association.

James Burron

Founding Partner

CAASA

James co-founded CAASA in response to industry support for a Canadian alternatives association to serve all aspects including: hedge / alternative strategies; liquid alternatives; private lending; private real estate; private equity; plus emerging areas where Canada is a leader such as digital assets / blockchain and robo-advisors.

Prior to CAASA, James was the Chief Operating Officer of AIMA Canada where his team of three worked with 12 committees to produce 50-60 events per annum across Canada, organized 100+ committee meetings, and increase member numbers over his 7-year tenue from 66 to 164 corporate entities.

James currently sits on the Canadian Investment Funds Standards Committee (CIFSC), which categorizes mutual funds and alternative mutual funds (aka liquid alternatives) for the retail space in Canada. He is also called upon by membership and industry groups to speak to risk ratings and portfolio placement of all types of alternative investments.

James also has experience in research and writing for the CAIA Association (holding the designation since 2006) as well as serving on CAIA’s exam council and as a well as other duties. He had roles in institutional sales and FoHF structuring in Seoul, South Korea, as a Product Manager at ICICI Wealth Management, and as an Investment Advisor at RBC Dominion Securities. James graduated from Simon Fraser University with a BBA (Finance).

2025 Agenda

Please note that 9am – 10:30am is for Advisors (including Investment Advisors, MFOs, and SFOs) ONLY.

Asset managers and service providers are asked to register at 10:30am. None will be admitted before that time.

Day 1

- March 27, 2025

- 9:00 am – 6:00 pm

- March 27, 2025

- 9:00 am – 6:00 pm

Day 1

9:00 am

Advisor registration

Please note that 9am – 10:30am is exclusive to Advisors (including Investment Advisors, MFOs, and SFOs).

Asset managers and service providers are asked to register at 10:30am. None will be admitted before that time.

9:30 am

Advisor-ONLY sessions

This hour is exclusive to IAs and wealth managers who are interested in (i) adding alts to their books, (ii) growing their allocations into the best-performing sectors/assets/strategies, and/or (iii) looking to connect with other high-performing advisors to share best ideas and advice. Topics will be lead by 2-3 ‘instigators’ who will introduce the subject and get the discussions going and all are encouraged to contribute as much as they like.

Ted Karon, Portfolio Manager, RBC Dominion Securities

Martin Pelletier, Senior Portfolio Manager, TriVest Wealth, Wellington-Altus Private Counsel

Theresa Shutt, Chief Investment Officer, Harbourfront Wealth Management

10:30 am

General Registration & Coffee

Asset managers and service providers are welcome to register at this time.

10:45 am

Update on Liquid Alts (6 years)

We love to gather stats on the industry and had done so for years once the Liquid Alts legislation (81-102) was promulgated in 2019 – thankfully Second engine has a dedicated team that amasses the AUM and performance statistics of the Canadian liquid alts industry and produces much better reports than we ever did.

This session will highlight the growth of these ‘hedge strategies in a mutual fund wrapper’ funds and their efficacy in investor portfolios over the last 6 years. You won’t want to miss this!

Robert Wilson, Senior Vice President, Head of Portfolio Construction Consultation Service, Picton Mahoney Asset Management

Moderated by: Colleen Redmond, Vice President, Investment Product Research, Morgan Stanley Wealth Management Canada Inc.

11:15 am

Table Talks

Round table discussions hosted by our Sponsors.

This session is aimed at providing all event attendees with the ability to join in genuine knowledge exchange and discussion in a small group setting.

Choose from any of the topics for these 45-minute sessions

12:00 pm

Lunch

Lunch is served prior to our Luncheon Fireside.

12:15 pm

Lunch Keynote – 30 Years in the Business IA & Institutional

We are honored to have two big names in the Canadian wealth and alts industsry for our keynote luncheon fireside.

Guy Côté is in Montréal has been an advisor for 30 years and Cameron Richards has been working in the institutional side – and now MFO – of the business for 30 years as well working in Victoria, Halifax, London (UK), and Toronto.

Their perspectives on how the business of investing has evolved and where it is headed will be insightful for all in the room!

Guy Côté, Senior Wealth Advisor & Portfolio Manager Guy Côté, Family Wealth Management Team, National Bank Financial

Cameron Richards, Chief Investment Officer, Guardian Partners

Moderator: James Burron, Founding Partner, CAASA

1:15 pm

1:1 meetings

This is your opportunity to meet with your peers and gather important market intel from all participants.

Meetings can be scheduled via our messaging and meeting app or ad hoc at this time.

2:15 pm

NowTalk

Aled ab Iorwerth, Deputy Chief Economist, CMHC – SCHL

2:45 pm

CIO Outlook: The future of alternatives

This is always fun: we put together experienced pros from a variety of perspectives in alts with an experienced moderator who will guide the conversation around areas such as: what is the most exciting part of their business now; how are their respective strategy/asset specialties performing; and what are the potential hazards in their respective markets over the next 12-18 months? We will have time for audience questions and welcome all to participate.

Rafa Silveira, Portfolio Manager, LGT Capital Partners

Paul Patterson, National Sales, Spartan Fund Management

Ash Lawrence, Head of AGF Capital Partners, AGF Investments

Moderated by: Brianne Gardner, Senior Wealth Manager,Velocity Investment Partners, Raymond James Ltd

3:30 pm

Advisors’ Best Ideas for the 2020s

Ending the day with a bang – this panel brings together three IAs who have seen a plethora of market moves and a number of market sectors as they have grown, plateaued, and subsided. Let’s hear from them where they see opportunities for advisors and their clients for the balance of 2025 and beyond.

Martin Pelletier, Senior Portfolio Manager, TriVest Wealth, Wellington-Altus Private Counsel

Ida Khajadourian, Portfolio Manager, Investment Advisor, Richardson Wealth

Theresa Shutt, Chief Investment Officer, Harbourfront Wealth Management

Moderated by: Josh Benchetrit, Principal and Portfolio Manager, Westcourt Capital

4:15 pm

Reception

Opportunity to network over food and drinks!

6:00 pm

End of Wealth Managers’ Forum Toronto 2024!

See you at another conference soon!

Our Family Office Summit is April 23-24.

CAASA Members

Members of CAASA

Event Registration Closed

Non-Members

Investment Advisor & Single Family Office

Event Registration Closed

Thank You to Our 2025 Gold Sponsors

Thank You to Our 2025 Silver Sponsor

Thank You to Our 2025 Bronze Sponsor