CAASA WEBINAR – HOW TO SELL IN A SOCIAL DISTANCING WORLD

Overview

According to Harvard, we may be in a social distancing world until sometime in 2022 – and for virtually everyone who might be used to in-person meetings, travel, and the occasional conference call – this is uncharted territory. Zoom meetings, screen-sharing, webinars, and podcasts are the tools of the future, now. Learn how our panelists are adapting to this new reality and transitioning to remote work and prospecting; and also to the investors that they might serve on how they prefer to be engaged with and how that may have changed over the last few weeks.

Where

Dial-in details will be sent once registration is complete

CAASA’S Virtual PlatformSPEAKERS

Mark Tower

Director, Business Development

Lyxor Asset Management Inc.

Christopher Rapcewicz

Director of Risk and Operations

Helmsley Charitable Trust

Brian Casselman

Principal

Casselman & Co. Inc

Tim Elliot

President

Connor Clark & Lunn Funds Inc.

Darren Coleman

Senior Vice President & Portfolio Manager

Private Client Group, Coleman Wealth – Raymond James Ltd.

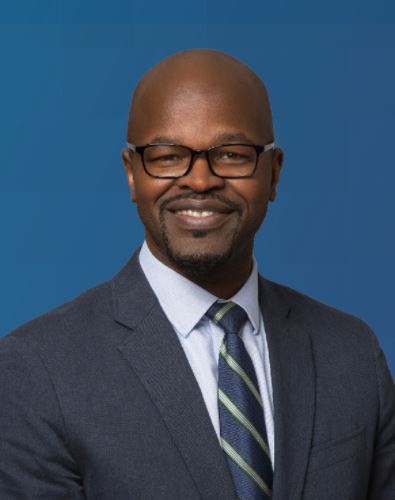

Mark Tower

Director, Business Development

Lyxor Asset Management Inc.

Mark Tower is a Director of North American Business Development at Lyxor Asset Management Inc. (“Lyxor Inc.”), a wholly-owned subsidiary of Société Générale Group. Mr. Tower joined Lyxor Inc. in December 2015. Prior to joining Lyxor Inc. Mr. Tower was an Institutional Sales & Business Development Consultant at UBP Asset Management from December 2013 to December 2014. Prior to that, Mr. Tower was Head of Institutional Marketing at Rock Maple Funds from 2009 through 2013. From 2004 to 2009, he was Vice President, Institutional Marketing at Muirfield Capital Management. Prior to that Mr. Tower handled Institutional Marketing at Refco Alternative Investments Group from 2002 to 2003. From 2000 to 2002 he was a Wholesaler at Ortbitex Financial Services Group. Mr. Tower has more than 15 years of experience with alternative investments, including hedge funds, fund-of-hedge funds, and liquid alternatives.

Mr. Tower serves as a board member for Friends of Firefighters and Badge of Honor Memorial Foundation, both non-profit organizations. Mr. Tower received a B.A. from Boston College.

Christopher Rapcewicz

Director of Risk and Operations

Helmsley Charitable Trust

Christopher Rapcewicz is Director of Risk and Operations at the Helmsley Charitable Trust. He is part of the development and implementation of the overall investment strategy and is principally responsible for the risk management of Helmsley’s investments across all asset classes and for ensuring the integrity and effectiveness of the investment operations. Christopher received the Investor Intelligence Award: Risk Management in 2016.

Brian Casselman

Principal

Casselman & Co. Inc

Brian Casselman operates through his family office Casselman & Company Inc. From 1982 until 1991 he worked in the Canadian Investment Management business, first as a Registered Representative specializing in commodity futures, while also licensed for equities. From McLeod Young Weir, and Merrill Lynch Canada, he ended as a Futures Portfolio Manager at Friedberg Mercantile Group, where he ran SMA’s and a long / short futures LP.

Beginning in 1991 he oversaw the transition of Barbie Casselman Inc. from nutrition counselling, into a multi-faceted nutrition consulting business in Toronto, while managing his own futures and equity portfolio. In 1997, in collaboration with established hedge fund PM’s, he began investing with both international and domestic alternative fund managers, as well as seeding Canadian hedge fund start-ups. From 1998 to 2000 also assisted a US-based CTA and hedge fund manager with the development of their marketing programs.

In 2004 he participated in the organization of several family offices focused on the alternative manger space. In 2007, as lead investor, he assisted with the development of a multi-manager CTA fund, serving as a director until 2010.

Currently, he continues explore and invest in a variety of alt and alt-alt trading and investment strategies, while “dabbling” in private equity and real estate.

Tim Elliot

President

Connor Clark & Lunn Funds Inc.

Tim Elliott is President of Connor, Clark and Lunn Funds Inc., a business he founded within the CC&L Financial Group to deliver unique, institutional quality investments to individual investors through funds, alternative investments and separately managed accounts. The CC&L Financial Group is one of Canada’s largest independently-owned asset managers, responsible for approximately $70 billion in assets, across a broad range of traditional and alternative investments, including public and private market asset classes, for institutional and individual investors. Tim holds a BA in Economics from Dalhousie University and holds the CFA designation

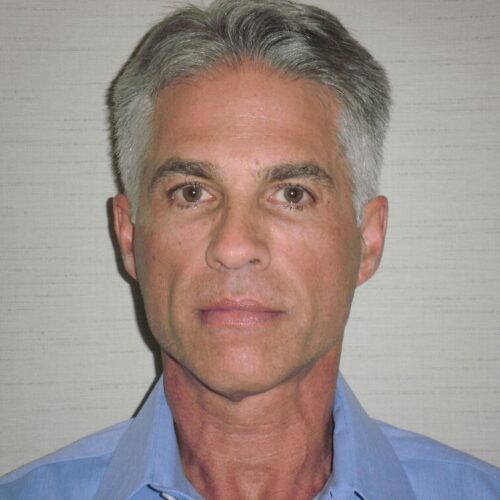

Darren Coleman

Senior Vice President & Portfolio Manager

Private Client Group, Coleman Wealth – Raymond James Ltd.

Darren Coleman started in the industry in 1992 and with Raymond James in 2012, providing comprehensive wealth services for a variety of clients. During this time, he has been managing brokerage offices, spearheading industry trends and leading his team at Coleman Wealth to new territory.

Darren’s many professional accreditations include: Canadian Investment Manager, Financial Management Advisor and Fellow of the Canadian Securities Institute, with a Level II Life Insurance License. He was one of the first Canadian professionals to attain the Professional Financial Planner, Certified Financial Planner and Certified Hedge Fund Specialist designations. Due to his success as an advisor in alternative investments, he was the first advisor to sit on committees for the Alternative Investment Management Association (AIMA), and on the Board for the Hedge Fund Association, as a member and an instructor.

An industry veteran before coming to Raymond James, Darren held management and advisor positions at major bank-owned brokerage and financial services firms. He frequently speaks at conferences and educational events and currently sits on the Editorial Board for Advisor’s Edge Report for Canadian investment professionals, and is frequently interviewed for the Globe and Mail, Investment Executive, BNN Bloomberg and other media.