Family Office Summit 2024

Overview

CAASA is pleased to invite you to the 2024 edition of our annual Family Office Summit, where we bring together traditional and multi-family offices, investment dealers, Canadian and global investment management houses and affiliated service providers.

This unique 1-day program (plus special reception on the pre-day + SFO-only sessions on the pre-day) hosted in Toronto at new Toronto Board of Trade offices on Queen’s Quay will highlight investment and intergenerational wealth management topics and issues on the minds of SFOs and their advisors (OCIOs, MFOs, investment consultants, investment bankers, and IAs) and investment managers (PE, VC, hedge, crypto, real estate, alt lending…).

All content is subject to Chatham House Rule.

Registration is now closed.

MSC Cruises Get-away Give-away

We are happy to partner with MSC Cruises for a super prize to be awarded to one of our event attendees (must attend and complete a ballot to be eligible).

The prize is a spectacular MSC Cruises 7-night Caribbean sailing for two in a prestigious Yacht Club cabin*. Prepare to be pampered onboard in the elite MSC Yacht Club with a 24-hour Butler Service, Premium Drink Service, Spa inclusions plus much more! An MSC Cruises Representative will be joining at each event to share all things MSC and the details of the fabulous prize offering. Draw will occur at our Summer Social event on July 17, 2024.

*Subject to travel restrictions, all details provided to the lucky winner upon receipt.

When

- April 9, 2024

- 5:00 pm – 7:00 pm EST

- April 10, 2024

- 8:00 am – 6:00 pm EST

2024 Single Family Office Speakers

Drew Colaiezzi

Private Investments

McPike Global Family Office

Ryan Perillo

Head of Investments

KF Matheson Investment Holdings

Enzo Gabrielli

EVP & CFO

Horizon Capital Holdings

Vincent Zhou

Portfolio Manager – External Manager Selection

RedJay Asset Management

Scott Morrison

Chief Investment Officer

Wealhouse Capital Management

Robert Montgomery

Chief Executive Officer

First Maximilian Associates Inc.

Craig D’Cruze

Chief Operating Officer

Inverted Ventures

Richard Heller

Attorney

Cooper Family Office

Vishnu Amble

Founding Director, Investment Committee Member, and Trustee

GreenBear Group LLC

Josh Roach

Managing Director

Meritage Group LLP

Rahim Kassim-Lakha

Founder & Principal

Blue Sail Capital, Inc.

Shael Soberano

Chief Investment Officer

Sharno Group

Prathna Ramesh

VP Operations

FutureSight

Tec Han

Chief Investment Officer

Vibrato Capital LLC

Drew Colaiezzi

Private Investments

McPike Global Family Office

Drew Colaiezzi is a private equity/venture capital specialist & investment manager with a background in capital markets focused on securitizations, specialty credit products, fixed income asset-back warehouses, financing consultancy, investment strategies & management, investment relationship structures, and early-stage venture.

After working in NYC and Miami for various private equity firms, he moved internationally and currently sits on the investment committee for MGFO, a single-family office based out of the Bahamas with a large venture portfolio containing exposure to various industries with a strong focus on early stage opportunities in financials, tech, fintech, life sciences, the carbon economy, venture funds, co investment opportunities, and web3/crypto based assets.

Ryan Perillo

Head of Investments

KF Matheson Investment Holdings

Ryan Perillo is the Head of Investments for KF Matheson (KFM), a private family office for two successful Canadian entrepreneurs and business partners. KFM takes a long-term approach to investing and managing the accumulated wealth and philanthropic assets of the principals.

Prior to his current role, Ryan held progressive finance roles within the principal’s operating company Baylis Medical, culminating in playing a lead role in its successful 2021 cardiology division sale to Boston Scientific (BSX).

Before joining Baylis Medical, Ryan started his career in the financial services group at PwC, and went on to join a newly launched value investment fund as their second employee in a CCO/finance/operations role, which grew to ~$60m of AUM over his time with the firm.

Ryan holds a BBA from Lazaridis School of Business and Economics at Wilfrid Laurier University, where he graduated With Distinction. He also holds CPA, CA, and CFA designations.

Enzo Gabrielli

EVP & CFO

Horizon Capital Holdings

Enzo leads the family office of the Right Honourable Paul Martin. Enzo is a corporate executive of the holding company, Bromart Holdings Inc. Its main operating company is CSL Group (Canada Steamship Lines) which is the world’s largest commercial manager of self-unloading vessels. Bromart also holds Horizon Capital Holdings, a broad-based investment vehicle and management organization. Horizon’s primarily makes direct investments in private companies, with an intent to buy and hold for expansion and growth. Enzo is President of Horizon Real Estate Ltd, which holds various real estate investments in North America.

Vincent Zhou

Portfolio Manager – External Manager Selection

RedJay Asset Management

Vincent is a portfolio manager at Redjay Asset Management, a spin-out asset management firm from a Toronto based single family office. As a PM, he’s responsible for portfolio construction and manager selection for Redjay’s external funds program. Prior to joining Redjay in 2021, Vincent was a director at Alberta Teachers’ Retirement Fund where he was responsible for manager selection for the $2B absolute return program.

Vincent has a Mathematics degree from University of Waterloo. He’s also a CFA Charter holder.

Scott Morrison

Chief Investment Officer

Wealhouse Capital Management

Scott Morrison is the Chief Investment Officer of Wealhouse Capital Management, a privately-owned investment firm and family office. As the firm’s founder, Scott is responsible for overseeing Wealhouse’s various strategies across asset classes, as well as the firm’s private equity portfolio and real estate holdings.

Outside of Wealhouse, Scott serves on the investment committee of the Centre for International Governance Innovation (CIGI), where he advises on investment decisions for CIGI’s endowment fund. Scott has over 25 years of asset management experience. Prior to Wealhouse, Scott spearheaded the portfolio management for notable firms such as Mackenzie Investments, CI Funds, and Investors Group. Scott holds a Bachelor of Finance from Concordia University and is a CFA Charterholder.

Robert Montgomery

Chief Executive Officer

First Maximilian Associates Inc.

Robert Montgomery is an investor and entrepreneur focused on the digital media, entertainment, gaming and technology industries. For many years, Mr. Montgomery has been an executive and advisor for media, communications and technology companies and the investment community. He currently serves as the CEO of First Maximilian Associates Inc., his own family investment and advisory firm. He also serves as Chairman of GameCo Inc., an innovative company serving and gaming industry. Mr. Montgomery was previously owner and CEO of Achilles Media, an events and transaction facilitation company focused on the entertainment, technology and investment industries.

Mr. Montgomery’s prior positions include: Co-Founder and Partner in Achilles Partners, an investment and advisory firm; President, Americas at the Fantastic Corporation, a broadband software company; Co-Founder and Chairman of Media Content plc in London, a media rights company; Managing Director for Europe and Asia Pacific at communications research and consulting firm Kagan World Media; co-founder of Digital Media International; Managing Director at Euromoney plc, and Managing Director at IBC plc. Mr. Montgomery has served as a Director of several public and private companies and is an active investor in emerging companies. Mr. Montgomery is a graduate of the University of Manitoba, Canada. Active in the community, Mr. Montgomery is Past Chair of the Board of Governors of the OCAD University.

Craig D’Cruze

Chief Operating Officer

Inverted Ventures

Craig D’Cruze is a multi-faceted entrepreneur with an outstanding track record analyzing and operating large businesses.

As the Executive Chef of the University of Calgary, Craig oversaw their conferences and multiple restaurant operations. Before the University of Calgary, Craig was the Executive Sous Chef for Marriott Hotels; Craig was flown around North America to lead positive changes in F&B operations in other Marriott properties underperforming in food cost, labour controls, food quality, staff engagement and retention. Craig successfully built, coached, counseled, and maintained teams of over 100 people.

Craig’s exceptional natural skills in mathematics, research, and pattern analysis make him perfect to lead Inverted Group as the Chief Operating Officer. In 2020, Craig joined Inverted Ventures to lead Inverted’s Due Diligence of both public and private market investments.

Craig’s outstanding performance and proven track record of success led to his establishment of Inverted Group’s Venture Capital Business, which he continues to lead with great success to this day.

Richard Heller

Attorney

Cooper Family Office

Richard Heller, Esq, joined the Cooper Family Office following a lengthy career as an eminent attorney specializing in securities and investment alternatives. With his extensive background in investment law, he is a well-known speaker at family office events nationally and knows numerous family office principals and executives personally. Prior to taking his role as advisor to the Cooper Family Office, he was a partner in the New York office of Thompson Hine, a prestigious national law firm, for 17 years. During that time he served in the Investment Management and Family Office Services groups. As the head of the private funds and broker-dealer practices, he advised numerous hedge funds, private equity funds, funds of funds, broker-dealers, investment advisers and their sponsors and principals. Additionally, he represented family offices in diverse issues including their structure, management, and regulatory matters.

In private practice, Mr. Heller drafted hedge fund offering materials including exhibits relating to the transaction. He rendered advice on activist solicitations. He defended clients in SEC and FINRA enforcement matters. He also served as counsel of special committees for public companies as well as providing state securities “Blue Sky” advice.

Richard Heller has served on three consecutive terms on the Securities and Exchange Commission’s (“SEC”) Business Forum on Small Company Capital Formation which published recommendations to the White House. In addition, he served for 10 years as a Director of the Hedge Fund Association. He served as a director for several private companies. For the past 20 years Mr. Heller has been honored to serve as an Officer and Director of the NY Council of the Navy League of the United States.

Recognized as a legal authority in his area, Mr. Heller is frequently called upon to participate in prominent Family Office and Investment Management Conferences and has often been called upon by the media to give quotes, opinions and interviews. The author of numerous papers, including “Emerging Developments in Hedge Fund Law,” Richard Heller received his BA with distinction in American Studies from Rutgers University and his law degree from Wake Forest University School of Law. He Is a member of the New York Bar and has Court Admissions to the U.S. District Court for the Southern District of New York and the US Supreme Court.

Vishnu Amble

Founding Director, Investment Committee Member, and Trustee

GreenBear Group LLC

Vishnu also serves as a Director of the family office’s foundation focused on funding access to energy, education, healthcare, and climate change solutions in South and SE Asia. Vishnu has built his 20+ year career in investments and capital markets at the intersection of Technology, Infrastructure, Energy, and Sustainability with such companies as Saudi Aramco, E.ON, The Carlyle Group and Lehman Brothers. Vishnu earned his Bachelor’s Degrees in Economics and Computer and Electrical Engineering from the University of Michigan – Ann Arbor.

Josh Roach

Managing Director

Meritage Group LLP

Josh Roach is a trusted peer and long-time member of the SFO (single-family-office) community where, over the last fifteen years, he has created significant social capital through his efforts to build like-minded networks and collaborative models to: (a) merge common interests and objectives, (b) pool and leverage specialized industry knowledge and skill sets, and (c) optimize alignment between asset owners in co-investment vehicles.

Rahim Kassim-Lakha

Founder & Principal

Blue Sail Capital, Inc.

Founder & Principal, Blue Sail Capital, Inc. | Principal, Pyfera Growth Capital Corp. | Strategic Advisor, Max Resource Corporation, Storm Exploration Inc., Workforce Wellness.

Rahim Kassim-Lakha is a respected figure in the realm of financial strategy and investment management, with a distinguished career spanning multiple sectors over +25 years. He is acknowledged for his prudent investment approach, award winning fund manager, insightful advisory roles, and strategic foresight.

Shael Soberano

Chief Investment Officer

Sharno Group

Shael Soberano, CFA, Chief Investment Officer of Sharno Group Inc., brings the most current analytical tools and rigorous discipline to the financial analyses he utilizes in capital allocation decisions. Shael developed and refined his financial expertise as a securities analyst and principal investor across a wide array of alternative investments.

Most recently, Shael Soberano was Vice President, Senior Analyst at Vision Capital Corporation, a leading Toronto-based Hedge Fund manager focused on publicly-traded real estate related securities. Shael first joined Vision Capital as an Analyst in 2009, shortly after its inception. He was promoted to Vice President, Senior Analyst in 2014, and was registered as an Advising Representative with the Ontario Securities Commission in 2017. With a wide range of roles spanning both business development and investment management initiatives, Shael’s contributions and leadership were integral in Vision Capital’s substantial AUM growth and contributed to its award-winning risk-adjusted performance over that period.

Shael is a CFA Charterholder and completed the Bachelor of Management and Organizational Studies Honours Degree with a Specialization in Finance at the University of Western Ontario. Shael completed the Partners, Directors, and Senior Officers (PDO) Course in 2019 and the Canadian Securities Course (CSC) in 2010, provided by the Canadian Securities Institute (CSI), and attended the SNL Real Estate REIT School in Chicago, Illinois.

Prathna Ramesh

VP Operations

FutureSight

Prathna is an early-stage investor and operator in B2B SaaS companies. She is currently a VP of Operations at FutureSight, a venture builder fund that backs entrepreneurs as an institutional cofounder with capital. She is the former Managing Director of Maple Leaf Angels in Toronto, one of Canada’s most active angel networks. She served as GP (General Partner) of the MLA48 pre-seed funds and is currently the Chief Compliance Officer. She is active in the founder community as a business advisor and is an advocate for women in venture.

Tec Han

Chief Investment Officer

Vibrato Capital LLC

Tec is the Chief Investment Officer of Vibrato Capital LLC, a single family private investment office that oversees both tax-exempt and taxable portfolios. Prior to Vibrato Capital, Tec was a senior analyst for Clark Enterprises, the National Railroad Retirement Investment Trust, and Cambridge Associates. Mr. Han graduated from Vassar College with a B.A. in Economics and earned his M.B.A from the Johnson School of Management at Cornell University and the Smith School of Business at Queen’s University through the combined EMBA Americas Program.

2024 Distinguished Speakers

Eric Nuttall

Partner, Senior Portfolio Manager

Ninepoint Partners

Matt Zabloski

Fund Manager & Chief Investment Officer

Delbrook Capital Advisors

Greg Moore

Partner & Portfolio Manager

Richter Family Office

Neil Nisker

Co-Founder, CIO & Executive Chairman

Our Family Office

Stephen Harvey

Chief Investment Officer

Grayhawk Wealth

Steve Shepherd

Head of Canada

Capital Fund Management

Priyanka Hindocha

Director – Family Office

Stonehage Fleming

Harry Moore

Senior Client Portfolio Manager

Man AHL

Alison Maschmeyer

Managing Director, Americas

Pinnacle Investment Management Group Limited

Nancy Bertrand

Managing Director and Head of Citi Private Bank, Canada

Citi Private Bank

Philippe Carpentier

Senior Fund Manager

Metori Capital Management

Aaron Stern

Managing Partner & Chief Investment Officer

Converium Capital

Stephanie Hickmott

Principal, Portfolio Manager

Leith Wheeler Investment Counsel Ltd.

Eric Nuttall

Partner, Senior Portfolio Manager

Ninepoint Partners

Eric Nuttall is a Partner and Senior Portfolio Manager with Ninepoint Partners LP. He joined the firm in August 2017 and was previously a Portfolio Manager at Sprott Asset Management LP since February 2003.

Eric’s views on energy are frequently sought after by BNN Bloomberg, CNBC, The Globe and Mail, The National Post, and other media organizations.

Eric graduated with High Honours from Carleton University with an Honours Bachelor of International Business.

Matt Zabloski

Fund Manager & Chief Investment Officer

Delbrook Capital Advisors

Mr. Zabloski is the Founder and Portfolio Manager at Delbrook Capital Advisors, a firm dedicated to alternative strategies in the global materials sector. Mr. Zabloski has capital markets, investment research and portfolio management experience, beginning with Boston-based Fidelity Management and Research Company where he acted as a Portfolio Manager and Research Analyst. In early 2008, he joined CI Investments to launch the CI Cambridge Advisors series of investment funds. While with CI, Mr. Zabloski managed a growth-oriented portfolio and acted as a Senior Research Analyst for various investment funds. Mr. Zabloski received an Honors BA and an MBA, both from the Richard Ivey School of Business at the University of Western Ontario.

Greg Moore

Partner & Portfolio Manager

Richter Family Office

Accomplished, driven, yet known for his kindness, Greg has big ideas that match the scope of his ambition. A great people connector he loves to build durable, effective business relationships. His enthusiastic nature means that he is ready to jump whole heartedly into every project he takes on.

Greg is a seasoned wealth management professional with almost 30 years’ experience in global financial markets, working with individuals, institutions, and family offices. Greg brings a unique, holistic approach to wealth management and works with professionals in a segment of the market that sees value in working alongside an independent, trusted advisor as part of their overarching wealth management solution.

As a Family Enterprise Advisor (FEA), Greg works with families to help them navigate the complexities of wealth and legacy transmission. Bringing together both a technical skill set, as well as a deep understanding of relational family and enterprise strategy issues, he strives to help families address complex problems through open communication and trust.

In addition to his business development and relationship management roles, Greg is actively involved in ongoing investment manager due diligence and manager selection to ensure that RFO clients continue to receive access to unique, best in class investment solutions. Bringing a thoughtful approach to asset allocation and portfolio construction, Greg works closely with families to help them bridge the gap between a complex investment landscape and their own unique investment goals.

Neil Nisker

Co-Founder, CIO & Executive Chairman

Our Family Office

With investment management and wealth advisory experience dating back to 1972, Our Family Office’s Co-Founder, Executive Chairman and CIO enjoys a well-deserved reputation as a trusted and respected figure in the Canadian financial services industry. His keen intellect and deep expertise make him particularly well-qualified to revolutionize the shared family office segment in Canada and grow Our Family Office into the market-leading service provider and partner to the nation’s wealthiest families. Highlights of Neil’s career to date include:

- Fiera Capital Corporation: Neil was active with Fiera Capital Corporation, one of Canada’s largest investment managers, from 2006 to 2014, serving as the President of Fiera Private Wealth and as the company’s Executive Vice Chairman and a member of the company’s board of directors and governance committee.

- YMG Capital Management Inc.: Neil served as President of the YMG Private Wealth Management division from 2000 to 2006. Fiera Capital Corporation purchased YMG Capital Management in 2006.

- Nisker Associates, Strategic Wealth Management: From 1997 to 2000, Neil was the Chairman of Nisker Associates, Strategic Wealth Management, a Canadian registered investment counselling firm. It was acquired by YMG Capital Management in 2000.

- Best Investments International Inc.: In 1990, Sir John Templeton selected Neil to be one of the three managers of Best Investments International Inc., a global equity mutual fund he owned. Neil held this position until the fund was closed in 2000.

- Brown Baldwin Nisker Ltd.: For more than 25 years, Neil was a driving force behind Brown Baldwin Nisker. Through his diligence, the firm grew into one of the premier institutional brokerages in Canada. It was sold to HSBC Securities in 1988.

In addition, Neil has been the President of Privatech Investments Inc., an investment company headquartered in Toronto, Canada since 1994.

Volunteerism and Philanthropy Neil has been extensively involved in philanthropy and a range of activities, including acting as:

- Co-Chair of the UJA Federation of Greater Toronto, Annual Campaign Co-Chair of the Baycrest Centre for Geriatric Care, Campaign

- Vice-Chair of the Mount Sinai Hospital Foundation and Chair of the Investment Committee Chairman of The Jewish Foundation of Greater Toronto and Chair of the Investment Committee

- Co-Chair of the 2011 JFNA Investment Institute in Palm Beach, Florida

- Frequent speaker at Investment Conferences for family offices, and foundations and endowments

Stephen Harvey

Chief Investment Officer

Grayhawk Wealth

Stephen Harvey is the Chief Investment Officer of Grayhawk and manages the investment management functions at the firm. Stephen has over 20 years investing experience with roles in Toronto, London and New York. Most recently Stephen was the Chief Investment Officer of Titan Advisors, where he managed the investment committee and investment team. Prior to that he was a Partner at Saguenay Strathmore Capital, where he focused on risk management and portfolio construction. He started his career at the Ontario Teachers’ Pension Plan within their risk management group.

Steve Shepherd

Head of Canada

Capital Fund Management

Based in Toronto, Steve is responsible for investors in Canada and East Asia. He joined CFM in 2012 and spent nine years as Head of APAC in Tokyo and Sydney and three subsequent years as Head of APAC with Capstone Investment Advisors.

Prior to CFM, Steve was Senior Portfolio Manager in the hedge fund group at the CPPIB in Toronto, responsible for manager selection, active risk allocation, and portfolio analytics, following a stint as Head of Risk Management at a boutique rates fund, and several years in engineering and technology roles in Canada, Eastern Europe and the Middle East.

His academic background includes electrical engineering, finance and generative linguistics, with Masters degrees from McGill University and the University of Toronto. He is also a graduate member of the Australian Institute of Company Directors (AICD).

Priyanka Hindocha

Director – Family Office

Stonehage Fleming

Priyanka is a Director in the London based Family Office department of the multi-family office Stonehage Fleming. She supports high net worth families and entrepreneurs around the world with the strategic coordination of their affairs, with a particular focus on the development of governance and succession plans that give families the best chance of sustainable, intergenerational success. Working closely with Matthew Fleming (a fifth generation Fleming family member), she supports families with a process of articulating a purpose for their wealth as well as identifying risks to the successful preservation of the family and its wealth, ahead of implementing strategies to mitigate against those risks. Her responsibilities also include supporting the next generation of family members manage the responsibilities associated the privilege of significant wealth via mentoring, coaching and bespoke educational sessions

Prior to joining the Group, Priyanka was part of the Private Client Tax practice at Deloitte, focussed on international tax planning for high net worth individuals, families and their offshore structures. She holds a first class BA (Hons) degree in Modern Languages (French & Italian) from University College London and is a qualified Chartered Accountant (ACA) and Tax Adviser (CTA). In 2023 she was the winner of the Future Leader in Private Client Services category at the Spear’s Magazine Awards and was included in Citywealth’s NextGen Leaders Top 40 Under 40 List.

Harry Moore

Senior Client Portfolio Manager

Man AHL

Harry Moore is a Senior Client Portfolio Manager at Man AHL with principal responsibility for investor engagement, new product development, and communication of Man AHL’s strategies to clients.

Prior to joining Man AHL in 2019, Harry worked as a hedge fund analyst at Mercer, constructing fund of hedge fund portfolios across a broad mix of systematic and discretionary investment styles. Prior to that, he was an actuarial analyst focused on liability-driven investments and de-risking strategies for institutional clients. Before moving to focus on investments, Harry worked at Willis Towers Watson as a student actuary, managing liability models for pension schemes.

Harry holds a BSc (hons) in Economics from the University of Birmingham, is a Fellow of the Institute and Faculty of Actuaries (‘FIA’) and holds the Chartered Alternative Investment Analyst (‘CAIA’) qualification.

Nancy Bertrand

Managing Director and Head of Citi Private Bank, Canada

Citi Private Bank

Nancy Hoi Bertrand is Managing Director and Head of Citi Private Bank, Canada. In this role, she is responsible for the growth of the business in Canada, which serves and advises ultra-high net worth families, foundations and single-family offices on wealth preservation and creation, with a particular focus on alternative and international investments.

Citi Private Bank is dedicated to serving the world’s wealthiest individuals and their families. From 52 locations across 20 countries, the Private Bank offers services to more than 14,000 ultra-high net worth clients from nearly 100 nations. Its Canadian offices are in Toronto, Montreal and Vancouver.

Having originally joined Citi Private Bank in 2006, Nancy has over 20 years of capital markets experience. Prior to Citi, she practiced U.S. securities law at the global law firm, Shearman & Sterling LLP, specializing in cross-border corporate finance and mergers and acquisitions.

Nancy sits on the board of the Golf Association of Ontario and is Past-President of the Toronto CFA Society and former Chair of its Governance and Nominations Committee. She was a member of the CFA Institute’s Capital Markets Policy Committee and a member of CFA Institute’s Global Corporate Governance Task Force and received her Chartered Financial Analyst designation in 2002.

Nancy is a graduate in Business Administration (Dean’s List) from the Richard Ivey School of Business at Western University and a Bachelor of Laws (great distinction) from McGill University. She has been called to the bars of the State of New York, the Commonwealth of Massachusetts and the Province of Ontario. She previously sat on the cabinet of the Royal Ontario Museum’s Young Patrons’ Circle, speaks Mandarin, Cantonese and French, is married and raising a teenage daughter.

Philippe Carpentier

Senior Fund Manager

Metori Capital Management

Philippe has been a quantitative fund manager at Lyxor since 2013, specialized in smart beta and quantitative fixed income. Prior to this, Philippe has been a quantitative researcher for the derivatives division of Société Générale from 2004 to 2013, applying his expertise to various asset classes. He started his career in 2003 at HSBC as a quant analyst in the model validation team. Philippe holds engineering degrees from Ecole Polytechnique and ENSAE, and a Master degree in applied mathematics from the University Paris VI (Jussieu).

Aaron Stern

Managing Partner & Chief Investment Officer

Converium Capital

Aaron Stern is a Managing Partner and the Chief Investment Officer of Converium Capital, a multi-strategy opportunistic investment manager headquartered in Montreal. Converium aims to deliver positive and uncorrelated returns regardless of macroeconomic conditions by investing in distressed and event-driven opportunities globally and across the capital structure. Prior to founding the firm, Aaron was a Partner and Managing Director at Fir Tree Partners, a multi-strategy investment firm founded by Jeffrey Tannenbaum. At Fir Tree, Aaron was responsible for distressed, special situations and event-driven investments globally where he successfully employed his contrarian idea selection in new areas for the firm, including sovereign and municipal debt, emerging markets and engagement opportunities in Europe and Asia. He most recently led an innovative restructuring of Puerto Rico’s Government Development Bank and a campaign to improve governance and shareholder returns at a recently privatized Japanese railway operator.

Prior to Fir Tree, Aaron held investment roles at O.S.S. Capital Management and Millennium Management. Before Millennium, he was an investment banking analyst in Credit Suisse’s Leveraged Finance and Restructuring groups.

He earned his bachelor’s degree in Commerce, with a Major in Accounting from McGill University, where he is a Global Expert and guest lecturer.

Stephanie Hickmott

Principal, Portfolio Manager

Leith Wheeler Investment Counsel Ltd.

Stephanie is a Portfolio Manager in Leith Wheeler’s Private Client Group in Toronto. She manages balanced and specialty asset class portfolios for private clients, family offices, and foundations. She began her post-graduate career in banking and finance with RBC, and later switched to wealth management in 2008. She was an Investment Counsellor with BNY Mellon Wealth Management Advisory Services for eight years prior to joining Leith Wheeler in 2016. Stephanie volunteers as an investment committee member for the Humber River Hospital Foundation and works with the Anishnawbe Health Foundation on fundraising initiatives. She has an MBA from the Schulich School of Business (York University) and a BA Economics from McGill University.

2024 Agenda

Day 1

- April 9, 2024

- 5:00 pm – 7:00 pm

Day 2

- April 10, 2023

- 8:00 am – 6:00 pm

- April 9, 2024

- 5:00 pm – 7:00 pm

Pre-day – PLEASE NOTE ATTENDEE TYPES

3:00 pm

Single Family Office Roundtable (Relatives Only)

Life as the principal of a family office can be exciting, inspirational, and busy, while at the same time worrisome, stressful, and draining. We provide this (strictly!) family members only session as an opportunity to meet with your peers and share questions, concerns, solutions, and insights across the table. We have nominated three leaders/instigators to get things going and guarantee that all will find the evening illuminating and fun.

Capacity is limited to 20 SFO Relatives this year.

SFO Relatives Instigators (3 total):

Robert Montgomery, First Maximillian Associates

Craig D’Cruze, Inverted Ventures

Shael Soberano, Sharno Group

3:00 pm

Single Family Office Roundtables (Professionals Only)

Working in a single family office is not your typical investment management job – you gain the benefit of a sometimes extremely flat organizational structure and many find the spectrum of duties and tasks to be (very) intellectually stimulating. On the other hand, it can be isolating and difficult to keep up with the pace of work: each family has its own dynamic and cadence so we created this dinner where (strictly!) full time employees (not relatives) of SFOs can interact with their peers to get the most out of their roles.

This year we have a bumper crop of SFO Pros, so we will have 2 rooms of up to 20.

SFO Professionals Instigators (3 per room):

Drew Colaiezzi, McPike Global Family Office

Scott Morrison, Wealhouse Asset Management

Tec Han, Vibrato Capital LLC

Prathna Ramesh, FutureSight

5:00 pm

General Welcome Reception

Everyone welcome to this time to meet. Generally, sponsors and managers arrange private dinners after this time with select conference delegates – either via the messaging & meeting app or off-line.

7:00 pm

End of Pre-day

- April 10, 2023

- 8:00 am – 6:00 pm

Main Day

8:00 am

Registration & Breakfast

8:30 am

Operating Company vs. Portfolio Investments

Family offices come in two basic flavours: ones that continue to hold the operating company that founded it, and ones that are holding other, portfolio, investments subsequent to the sale. Each one has a distinct dynamic based on the legacy investment, relationships, and relationships to the legacy investment. This panel will discuss the pros and cons of having this ‘founding asset’ on the books throughout successive generations vs. a situation where the investment mix is that of a newer, usually more diversified sort. It features three stages of this situation: a family office with its operating company, one transitioning to portfolio investments, and one that has done so for some time. A truly singular experience for our audience!

Enzo Gabrielli, Horizon Capital Holdings

Scott Morrison, Wealhouse Capital Management

Ryan Perillo, KF Matheson Holdings

9:15 am

Three Shades of Staking GPs

There’s nothing like the focus afforded a new venture – plus the commensurate risk of ruin that might come to pass if the company is not run well or simply doesn’t achieve the scale required to continue as a going concern. As well, hitting one’s stride and capitalizing on hard work is paramount to leaping to the next stage. This panel will impart practical wisdom from three single family offices who invest in more start-up and emerging managers – great information for managers and investors alike.

Richard Heller, Cooper Family Office

Vishnu Amble, GreenBear Group LLC

Alison Maschmeyer, Pinnacle Investment Management

10:00 am

New Thinking About Commodities: Paths to profit

Inflation and the price of everything has been in the news a great deal for the last many month – or even decades! – as investors have taken note of how asset values can exceed even the most wild predictions. As well, price crashes occur from time to time in all assets; an inevitable consequence of over-valuation and a phenomenon not unique to today’s markets: prices have peaked and troughed for time immemorial. This panel will put forth tangible investment ideas that one can use to make the most of both manic and depressed markets as well as a frame of reference for knowing which phase one might be in.

Rahim Kassim-Lakha, Blue Sail Capital, Inc.

Eric Nuttall, Ninepoint Partners

Matt Zabloski, Delbrook Capital Advisors

10:30 am

1:1 meetings & Morning refresher

11:30 am

The Power of Quant: Harnessing data for returns

Hedge funds (aka alternative strategies) have, at their core, mathematical principals such as correlation (shorting reduces a portfolio’s correlation and many strategies have low correlations between each other and among their constituent managers) and optionality (either the trades or instruments employed can produce an advantageous payoff formula). With advances in computational power, many (perhaps all) managers are employing quantitative methods to source trades, model their behaviour in various markets, entering and exiting trades, monitoring risk, and enhancing their understanding of the markets overall. This panel will discuss all this and more!

Vincent Zhou, RedJay Asset Management

Harry Moore, Man AHL

Steve Shepherd, Capital Fund Management

12:00 pm

Emerging Markets as an Investment Destination

Prior to the turn of the century, emerging markets were the darling of investor portfolios – their potential was unmatched, access was becoming easier, and corporate governance seemed to be (finally) getting up to where investors expected. The deluge of cash into these markets pushed them to stratospheric levels and the subsequent crashes in the late 1990s were the stuff of legend. Investors, once (more) burned turned to TMT for their high-octane fix (with perhaps anticipated results).

Over the last couple of decades, the trends which had begun back then have taken hold in many countries – this provides opportunity to invest with the potential to make money for investors thanks to persistent inefficiencies in some markets that can continue to be exploited. Learn about these benefits during this panel!

12:30 pm

Lunch & Keynote: Being Direct (Speaking begins at 1:00)

Family offices have a multitude of investment opportunities via various vehicles and structures: funds, FoFs, direct, SMAs, and joint ventures to name a few. This fireside will focus on direct investments and how one family office is managing their deal sourcing, transaction process, operational oversight and maintenance, and divesture of a number of situations over the years. Joined by a multi-family office with a dedicated Direct Investment Program, they will speak to how families make use of these types of programs and take a holistic look at managing one’s portfolio – along with constraints that may be present based on the family’s composition. (E.g., having less or more of a leaning toward direct investments and/or certain market sectors based on where they made their money or continue to have legacy assets and expertise.)

This is a rare glimpse at how these speakers make the most of directs and a great opportunity to add your question to the mix!

Nancy Bertrand, Citi Private Bank

Josh Roach, Meritage Group LLP

1:45 pm

Table Talks & first afternoon refresher

This session is aimed at providing all event attendees with the ability to join in genuine knowledge exchange and discussion in a small group setting.

Asset Management One – Quantitative Strategies & Dynamic Tilting

Wilshire – An introduction to Wilshire Alternatives Capabilities

iCapital – Bringing World Class Alternative to Wealth Channels

HGC Investment Management – M&A Opportunity Set and Outlook

Hazelview Investments – The Real Estate Asset Class & Family Offices:

Navigating Structure, Access & Scale

MGG Investment Group – MGG Partnering w iCapital to Bring 1st US Non-

Sponsor Focused Private Debt Fund to Canadian Market

Trans-Canada Capital – Come and visit our table for a chat or an intro!

Choose from 2 x 30-minute round table discussions

2:45 pm

NowTalk – SFO Vignettes

The world of Family Offices is unique. Stonehage Fleming – the multi family office with over 150 years’ experience in supporting families all over the world – undertakes regular research with the families that it serves based on the theme ‘wealth strategies for intergenerational success’. They published their latest report in 2023 with the premise that families and wealth creators should focus on the stewardship of not only their financial capital, but also of their social, cultural and intellectual capital – the Four Pillars of Capital. In the firm’s experience, each pillar is equally important to the successful transition of wealth and reputation and the creation of an impactful legacy.

Priyanka Hindocha, Stonehage Fleming

3:15 pm

Afternoon Coffee Break

3:30 pm

MFO 2.0

Just as each SFO is unique, multi-family offices are each run with their own special emphasis on certain planning techniques, investment selections, and suite of overall services. This panel will showcase three prominent Canadian multi-family offices and get their takes on these areas as well as topical trends in the markets and their client base.

Greg Moore, Richter Family Office

Neil Nisker, Our Family Office

Stephen Harvey, Grayhawk Wealth

4:00 pm

Table Talks & second afternoon refresher

This session is aimed at providing all event attendees with the ability to join in genuine knowledge exchange and discussion in a small group setting.

Richter Family Office – Family Office Investment Trends

Waypoint Investment Partners – Asset-Backed Private Credit Solutions for

Canadian Families

BMO Global Asset Management – Balancing Act: Navigating Liquidity and

Risk in the Era of Alternative Investments for Family Offices

AGF Capital Partners – Private Credit – Boom or Bust? Demystifying the

headlines as we discuss the next leg of opportunities and risks in private credit.

Ninepoint Partners LP – Portfolio Diversification Through Alternatives

Amur Capital – Real Estate and Mortgage Market Analysis: Trends and

Emerging Opportunities

Kirkland Capital Group – Private Credit in Micro-Balance Commercial Real Estate

Choose from 2 x 30-minute round table discussions

5:00 pm

Closing reception

Open to all delegates.

7:00 pm

End of Family Office Summit 2024

Thank you!

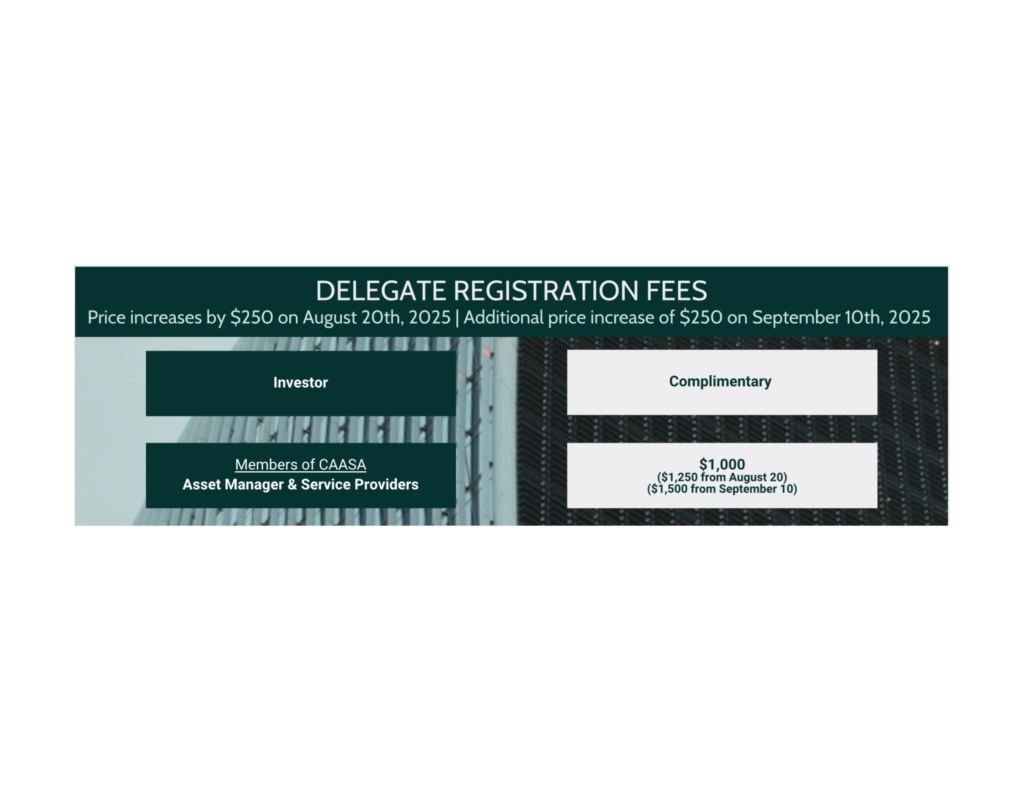

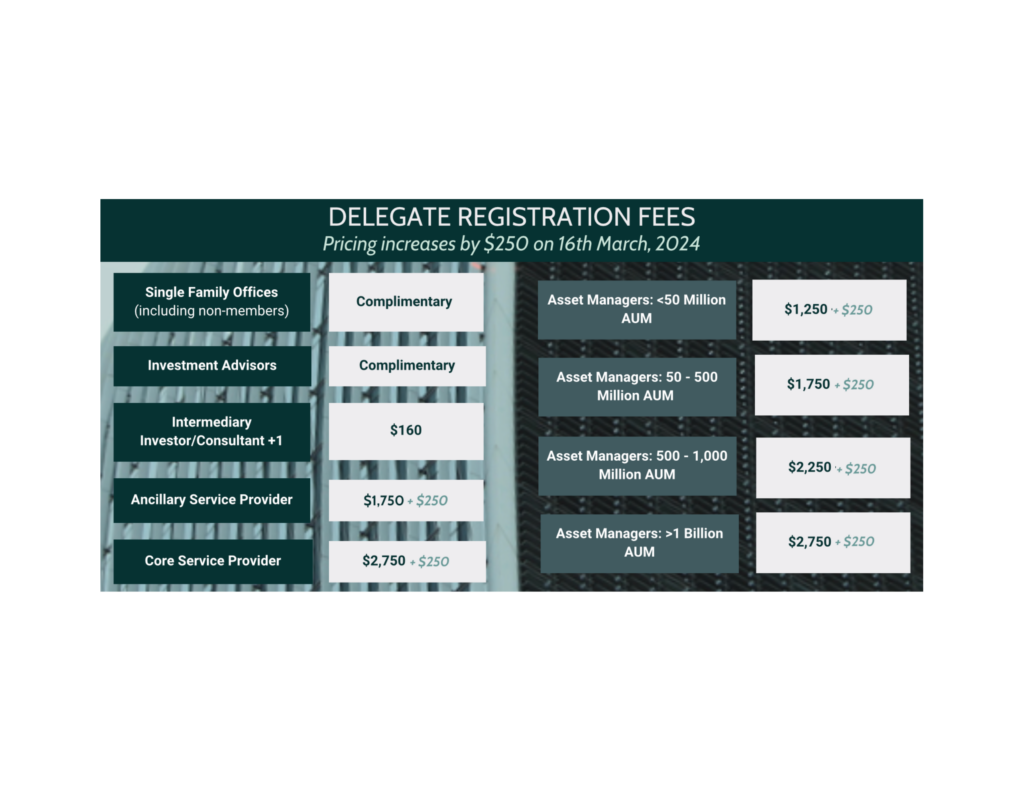

Registration

End Investor means pensions, foundations/endowments, sovereign wealth funds, and single family offices. Intermediary investors means Multi-family offices, investment advsiors/dealers, wealth managers, and investment consulting companies and +1 means the first delegate is gratis but each additional delegate attracts a small charge. Manager and service provider delegates must be CAASA members in good standing and pay the requisite per person fee for their appropriate sub-category. Core service providers include prime brokers, fund administrators, and accounting and legal firms.

Member – Manager

Member of CAASA.

Event Registration Closed

Member – Service Provider & Others

Member of CAASA. Includes core & ancillary service providers.

Event Registration Closed

Member – Investor

Please contact Paul at Paul@caasa.ca to register for the Summit.

Limited space available

Event Registration Closed

Non-Members – Investor

Please contact Paul at Paul@caasa.ca to register for the Summit.

Limited space available

Event Registration Closed

Thank You to Our 2024 Gold Sponsors

Thank You to Our 2024 Silver Sponsors

Thank You to Our 2024 Bronze Sponsor