Wealth Managers’ Forum 2024 – Toronto

Overview

Join us, dozens of speakers, and scores of fellow IAs and investors for this all-encompassing alts conference specifically designed for retail advisors and the client base they serve.

These forums will be held in person in Montréal, and Toronto featuring award-winning investment advisors, well-known asset managers, and other distinguished speakers. Program starts at 11AM in each city and includes lunch and a 4pm reception for all.

Registration open now.

CAASA CE Centre

The content for this platform comes from CAASA webinars and podcast as well as panel sessions from a selection of our conferences.

In addition, certain members of CAASA have provided their webinars and podcast for inclusion.

Topics and investment opportunities featured in these courses focus on alternative investments such as hedge funds, liquid alternatives, private equity, private lending, real estate, infrastructure, cryptocurrency, venture capital, and other Alternative assets and strategies.

MSC Cruises Get-away Give-away

We are happy to partner with MSC Cruises for a super prize to be awarded to one of our event attendees (must attend and complete a ballot to be eligible).

The prize is a spectacular MSC Cruises 7-night Caribbean sailing for two in a prestigious Yacht Club cabin*. Prepare to be pampered onboard in the elite MSC Yacht Club with a 24-hour Butler Service, Premium Drink Service, Spa inclusions plus much more! An MSC Cruises Representative will be joining at each event to share all things MSC and the details of the fabulous prize offering. Draw will occur at our Summer Social event on July 17, 2024.

*Subject to travel restrictions, all details provided to the lucky winner upon receipt.

Where

KPMG

Bay Adelaide Centre, 333 Bay St. #4600, Toronto, ON M5H 2S5

2024 Keynote Speakers

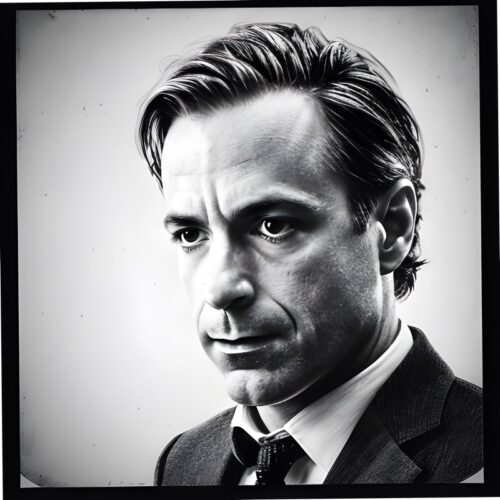

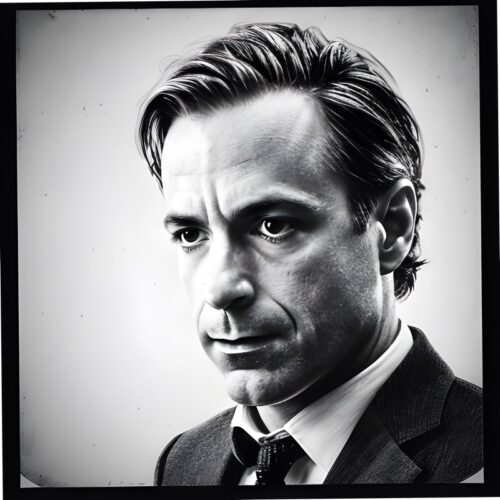

Wilson Tow

Managing Partner

Altrust Investment Solutions

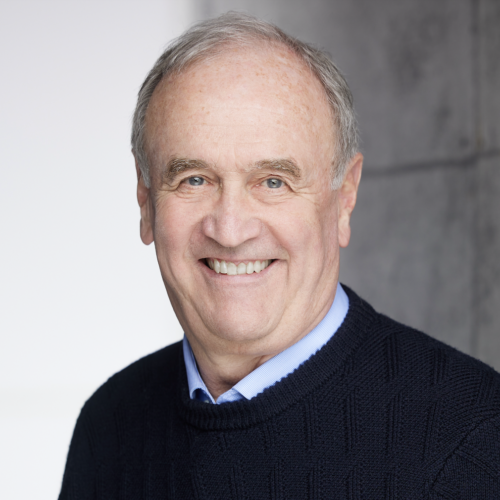

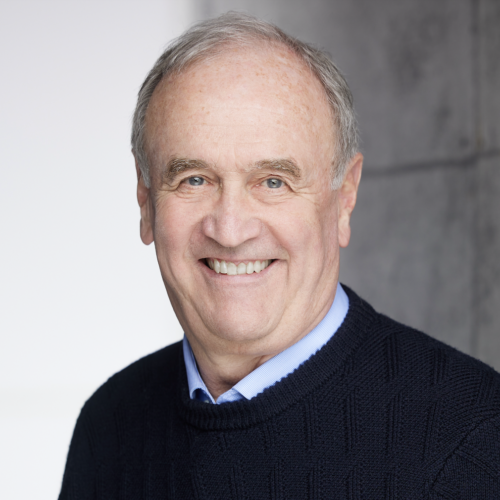

Steve Allen

Head of Distribution, Financial Intermediaries (Canada)

Fiera Capital

Wilson Tow

Managing Partner

Altrust Investment Solutions

Wilson Tow is recognized as one of the most knowledgeable investment product design and product-compliance specialists in Canada. He has spent over 30 years working in wealth and asset management. As a Co-Founder and Managing Partner of Altrust, Mr. Tow advises on product structures, investment design, compliance, distribution requirements, and he works to educate investors on the benefits of alternative investment solutions.

Prior to co-founding Altrust Investment Solutions, Mr. Tow was Co-Founder and Managing Partner at Fern Capital Partners where he created and launched a unique alternative credit fund-of-funds mixing both private and public credit solutions. The novel structure offered retail investors access to assets traditionally available only to institutional investors.

Previously, Mr. Tow was Director of New Products and Complex Investments at Scotia Wealth where he oversaw the due diligence and approval process for all investment products offered on Scotia Wealth’s product shelf. This included a broad range of instruments ranging from GICs to non-brokered private placements and prospectus-exempt securities. Under Mr. Tow’s leadership, Scotia’s alternative offerings grew meaningfully, helping investment advisors and investors structure more robust investment portfolios.

Prior to Scotia Wealth, Mr. Tow was Head of Product Research at Manulife Securities where he was responsible for formulating, designing, and implementing the firm’s due diligence process.

Before moving to wealth management in 2006, Mr. Tow spent the previous twelve years in the asset management business, starting his career at Scudder Canada and its successor companies where he held senior roles in relationship management as well as product management and development. He also spent some time at Maple Financial where he was an analyst and allocator for its fund-of-hedge-funds product.

Mr. Tow is very active in the alternative asset industry in Canada and currently sits on the Member Advisory Panel of the Canadian Association of Alternative Strategies & Assets (“CAASA”). He also sits on the board of the Japanese Canadian Cultural Centre Foundation. Mr. Tow holds a Bachelor of Science degree from the University of Toronto, where he majored in Mathematics and Philosophy.

Steve Allen

Head of Distribution, Financial Intermediaries (Canada)

Fiera Capital

Steve’s role is to lead the distribution function for Fiera Capital’s Canadian Financial intermediary business. More specifically, his focus is to diversify the business by establishing new top-line growth via Canadian banks, independent dealers, and family offices by creating investment vehicles that allow them to access both Fiera’s private and public market strategies. Steve is also tasked with sourcing new sub-advisory relationships with large Canadian asset managers.

Over the past 26 years, Steve has had a number of roles in the industry. Notably:

- Director and Head of Structured Product Distribution, RBC Capital Markets

- Senior Vice President, Head of Canadian Distribution, Macquarie Global Investment

- Managing Director, Onex Credit Partners

- Founder, Executive Vice President, Evolve ETFs

- Partner, Senior Vice President, Brompton Funds

In addition to his work, he is a founding member of the Canadian Association of Urban Financial Professionals and a member of the Black Opportunity Fund, two organizations based in Toronto that focus on building the economic empowerment of the Black community and promoting the advancement of Black professionals. Steve’s community work is very important to his as it allows him to give back so that others can access opportunities that they might otherwise be denied due to their race, socio-economic background, gender, sexual orientation, or disability status. This passion has also led him to join Fiera’s DE&I Council to help promote a culture that is inclusive and welcoming for everyone.

Distinguished Speakers (2024)

Victor Kuntzevitsky

Portfolio Manager

Wellington-Altus Private Counsel

Elina Surkov

Investment Advisor

Wellington-Altus Wealth Management

James Burron

Co-founder & Partner

CAASA

Colleen Redmond

Vice President, Investment Product Research

Morgan Stanley Wealth Management Canada Inc.

Martin Pelletier

Senior Portfolio Manager

Wellington-Altus Private Counsel

Bob Simpson

Vice President Portfolio Strategy

Wealth Stewards

Brian D’Costa

Founding Partner & President

Algonquin Capital

Jocelyn Courcelles

VP Client Relations & Business Development

Fundata Canada

Mark Allen

Senior Portfolio Manager

RBC Dominion Securities

Brianne Gardner

Wealth Manager & Financial Advisor

Raymond James Ltd.

Ted Karon

Portfolio Manager

RBC Dominion Securities

Cam Richards

Chief Investment Officer

Guardian Partners

Conner Sura

Portfolio Manager

TURN8 Private Wealth

Victor Kuntzevitsky

Portfolio Manager

Wellington-Altus Private Counsel

Victor is responsible for directing all external manager research focusing on the investment process including selection, due-diligence, benchmarking, and monitoring. He is intimately involved in every step of the investment cycle and an integral part of the team.

Prior to joining Wellington-Altus, Victor spent the first nine years of his career at a Markham-based Multi-Family Office where he worked to help create, monitor and maintain bespoke portfolios across a broad set of public and private investment strategies.

Victor graduated with an Honours Bachelor of Commerce degree from McMaster University. Victor is a CFA charterholder and has also obtained the Chartered Alternative Investment Analyst (CAIA) designation. He is a lifelong learner, intellectually curious, and has interest across many disciplines.

Victor is committed to philanthropy and giving back to the community. He now sits on the board of ‘Second Kicks’ which distributed close to 10,000 of lightly used soccer equipment to communities in Canada and around the world in 2020. He also co-founded the organization ‘Get Swabbed’, which has since expanded to all Canadian universities with a goal of enlisting donors to Canadian Blood Services’ bone marrow registry.

In his free time Victor enjoys reading, watching travel shows, cooking (and eating), and spending time with his wife and young kids.

Elina Surkov

Investment Advisor

Wellington-Altus Wealth Management

Elina Surkov is a highly skilled Investment Advisor at Wellington-Altus, with over a decade of experience in the financial sector. Elina and her team’s focus is on the long-term with an aim to establish lasting relationships with each and every client that range from high-net-worth individuals and families to industry veterans like family office CIO’s, traders, hedge fund managers, private equity and venture capitalists, and angel investors.

Elina has a strong academic foundation with a Master of Science in Financial Markets and an MBA from France. Her career is marked by roles in various prestigious organizations, from private banking and family offices in Monaco to independent investment companies in Canada, demonstrating her expertise in portfolio construction, alternative investments, and a commitment to professional development.

James Burron

Co-founder & Partner

CAASA

James co-founded CAASA in response to industry support for a Canadian alternatives association to serve all aspects including: hedge / alternative strategies; liquid alternatives; private lending; private real estate; private equity; plus emerging areas where Canada is a leader such as digital assets / blockchain and robo-advisors.

Prior to CAASA, James was the Chief Operating Officer of AIMA Canada where his team of three worked with 12 committees to produce 50-60 events per annum across Canada, organized 100+ committee meetings, and increase member numbers over his 7-year tenue from 66 to 164 corporate entities.

James currently sits on the Canadian Investment Funds Standards Committee (CIFSC), which categorizes mutual funds and alternative mutual funds (aka liquid alternatives) for the retail space in Canada. He is also called upon by membership and industry groups to speak to risk ratings and portfolio placement of all types of alternative investments.

James also has experience in research and writing for the CAIA Association (holding the designation since 2006) as well as serving on CAIA’s exam council and as a well as other duties. He had roles in institutional sales and FoHF structuring in Seoul, South Korea, as a Product Manager at ICICI Wealth Management, and as an Investment Advisor at RBC Dominion Securities. James graduated from Simon Fraser University with a BBA (Finance).

Colleen Redmond

Vice President, Investment Product Research

Morgan Stanley Wealth Management Canada Inc.

As part of the product team at Morgan Stanley Wealth Management Canada (MSWC), Colleen is responsible for conducting initial and ongoing due diligence on various investment products including mutual funds, ETFs, SMAs and alternatives. She works closely with internal and external partners to build out the MSWC product shelf. Prior to joining Morgan Stanley in 2022, Colleen spent over seven years at CI Global Asset Management including four years as the product manager for CI’s suite of liquid alternative products. She also held roles in operations, client services and sales. Colleen holds a BBA from Wilfrid Laurier University and is a Chartered Financial Analyst. Colleen is an avid runner. In her spare time, she enjoys training for her next marathon.

Martin Pelletier

Senior Portfolio Manager

Wellington-Altus Private Counsel

Martin has over 20 years of investment industry experience including senior-level positions in both institutional equity research and portfolio management.

Martin is currently a senior portfolio manager at Wellington-Altus Private Counsel (previously TriVest Wealth), an award-winning portfolio management firm (Wealth Professional 5-Star Asset Manager 2022), where he is the co-manager of the firm’s risk-managed balanced fund and helps oversee custom built, HNW and UHNW private client portfolios.

Prior to co-founding TriVest and its sale to Wellington-Altus in early 2020, Martin’s career was focused on institutional energy equity research and capital markets primarily at two top-ranked boutique investment banks. He provided investment recommendations on energy markets, commodities, and individual security selections to institutional fund managers located in Canada, the U.S. and Europe.

Martin is regularly featured in the media as a market strategist including his weekly column to the Financial Post’s Investment Pro section for the past decade. He was won numerous awards for his passion for financial education and quality of service provided for his clients.

Martin holds a Bachelor of Commerce degree with a specialization in finance from the University of Alberta, studied international economics and finance at Örebro University in Sweden, and is a Chartered Financial Analyst (CFA) Charterholder.

Martin grew up in a small farming community in Northern Alberta and believes in the power of positive innovative change having lived in Canada’s first Eco-community. He and his family is also passionate about mental-health awareness initiatives focused on youth impacted by ADHD, OCD and Autism. On weekends, his family can be found on a mountain either freestyle/big mountain skiing or downhill mountain biking.

Bob Simpson

Vice President Portfolio Strategy

Wealth Stewards

Bob Simpson Is Vice President Portfolio Strategy for Wealth Stewards Inc., a Toronto-based Wealth management firm, Co-founder of PrivateDebtandEquity.ca and host of My Private Network Podcast, both designed to educate investors about investing in private markets.

Prior to joining Wealth Stewards, he was President of Synchronicity Performance Consultants, a consulting and coaching firm focused on successful financial advisors across North America.

Prior to that he was SVP National Sales and Fixed Income Strategist at Midland Walwyn, portfolio manager for a publicly-traded insurance company and a successful financial advisor at Nesbitt Thomson.

Brian D’Costa

Founding Partner & President

Algonquin Capital

From Captain in the Airborne Regiment to managing global trading businesses, Brian has achieved tremendous success as a leader, trader, and risk manager. As the former Global Head of Fixed Income and Rates for CIBC, he was responsible for the bank’s entire bond and rate trading business, overseeing 40 traders globally. Before that, Brian spent 11 years with TD Securities, where he was the Global Head of Vanilla Interest Rate Derivatives, managing trading teams in Toronto, London, Tokyo, and Sydney.

As a Captain in the Canadian Armed Forces, he was awarded the Chief of Defense Staff Commendation for exemplary leadership for his peacekeeping services in Iraq. Brian is a member of the Bank of Canada Fixed Income Forum. When not in the office, Brian can usually be found in the gym, at a hockey rink, or undertaking an ambitious gardening project.

Jocelyn Courcelles

VP Client Relations & Business Development

Fundata Canada

Jocelyn joined Fundata Canada in January 2014. Prior to joining, he held roles with the Canadian Armed Forces, Invesco, and TD Commercial Bank.

Mark Allen

Senior Portfolio Manager

RBC Dominion Securities

Mark has more than 20 years of experience serving corporate and private clients. He and his team provide wealth management services to private individuals and family office clients.

Mark has experience co-managing over $1 billion of private client assets, including as a head-office portfolio manager at RBC handling institutional-level asset pools. As a Vice President, Mark was previously a member of RBC’s Global Portfolio Advisory Committee, which establishes investment strategy for the firm.

Prior experience includes Director-level roles in investment banking and mergers & acquisitions at the global bank, UBS AG, and at the Bank of Nova Scotia. From 2000-2008, he advised on transactions totaling $18 billion for corporate clients in Canada, the U.S. and Europe.

Mark graduated with the highest GPA of 496 students in the Faculty of Applied Science (engineering) at Queen’s University and with the highest GPA of ~100 students in his MBA class at the University of Toronto (Rotman School of Management).

Mark is a Board member of the national charitable organization, Mental Health Research Canada.

He and his wife live with their young twins in Toronto.

Brianne Gardner

Wealth Manager & Financial Advisor

Raymond James Ltd.

Brianne is the Senior Wealth Manager and the Managing Partner of Velocity Investment Partners at Raymond James, where she utilizes her extensive knowledge and expertise to serve high net worth families with complex financial needs. Her ability to comprehend the unique financial challenges of multi-generational families distinguishes her in the industry and offers clients the confidence and assurance they need.

She heads a team that caters to an exclusive clientele of individuals and wealthy families across Canada and the US who are seeking a personal trusted partner and CFO to manage their financial affairs with expert guidance. She and her team are now one of the fastest growing teams across Canada and is a regular media contributor on BNN Bloomberg, The Globe & Mail, Financial Post and much more.

Ted Karon

Portfolio Manager

RBC Dominion Securities

Ted draws on his expert knowledge and 30 years of experience in the financial services industry to provide access to a comprehensive range of services to help you build and protect your wealth. For the past two decades, Ted has been working with high net worth individuals and families to help them meet their complex financial goals.

His depth of experience includes investment banking, commercial lending, mergers and acquisitions, equity research and portfolio management. Over the years, Ted has also developed extensive expertise in the alternative investment sector. He is a member and past speaker for the Canadian Association of Alternative Strategies & Assets (CAASA). Ted brings a holistic perspective on investing to his work, ensuring sound advice, expert execution and peace of mind for clients who need solutions for broad and multi-dimensional wealth management needs.

A graduate of Queen’s University, he earned a Bachelor of Commerce degree with a major in finance. A firm believer in ongoing education, he has acquired the Chartered Financial Analyst (CFA) designation, and licenses for insurance, derivatives fundamentals and options.

Away from work, Ted enjoys spending time with his wife, Lesley, and two daughters, Rebecca and Amy. He also enjoys stays active playing competitive badminton, skiing and windsurfing.

Cam Richards

Chief Investment Officer

Guardian Partners

As Chief Investment Officer at Guardian Partners, Cameron’s mission is to combine the investment strategies and disciplined portfolio construction and risk management utilized by pension funds and endowments, with the customization and client responsiveness required by private clients, to increase the robustness of investment solutions and to enhance the experience of Guardian Partners’ clients. Previously, he served as CIO of the Nova Scotia Health Employees’ Pension Plan, and was the Head of Real Assets at Albourne Partners in London, England. He also served as the Co-Chief Investment Officer of University of Toronto Asset Management (UTAM), and Chair of the Investment Committee for the entirety of the university’s investment assets. Before joining Guardian Partners, he founded Isengard Capital Management, which provided capital markets research to Albourne Partners and also designed a research platform which applied global macro, stock selection and quantitative strategies to generate long and short exposures in stocks.

Cameron is a graduate of Osgoode Hall Law School in Toronto, holds a Bachelor’s Degree in Mathematics from Queen’s University, earned an MBA from the Schulich School of Business and is a CFA® Charterholder. He has been called to the Bar in Ontario.

Conner Sura

Portfolio Manager

TURN8 Private Wealth

Conner is an accomplished investment professional with a diverse background in portfolio and wealth management, investment research and product strategy. He currently serves as a portfolio manager at TURN8 Private Wealth, a boutique wealth management firm known for its commitment to innovation and tailored portfolio solutions. Within TURN8, Conner oversees the management of fixed income and alternative investments across three pooled vehicles. Before joining TURN8, Conner spent time working at a prominent Toronto-based multi-family office, a long/short credit hedge fund, and one of Canada’s largest mutual fund manufacturers. He holds a bachelor’s degree in mechanical engineering from Queen’s University and has earned the CFA designation. Additionally, Conner is registered as a portfolio manager with the securities regulator.

2024 Agenda

Day 1

- March 5, 2024

- 10:30 am – 6:00 pm

- March 5, 2024

- 10:30 am – 6:00 pm

Day 1

10:30 am

Registration & Coffee

10:45 am

Adding Alternatives to Your Book & Portfolio Allocation

How do alternatives work in client portfolios? How have successful IAs added alts to their books and how did they manage the portfolio allocations? Forward-thinking advisors know that taking the time to understand alternatives can propel their business to new highs – as well as provide a moat of knowledge that differentiates them from their competitors. This talk will explain how this can be achieved from those who have seen it work in real life.

Elina Surkov, Wellington-Altus Wealth Management

Martin Pelletier, Wellington-Altus Private Counsel

Cam Richards, Guardian Partners

11:30 am

NowTalk – Looking Over the Liquidity Valley

Illiquid investments pose many challenges: their pricing can be ‘stale-dated’, investment terms are typically long (i.e., not daily or weekly liquidity, but more likely monthly or even 5+ years), and there is not typically a secondary market if an investor needs to sell (although that is changing). Over the last few years various sub-sets of illiquid investments have faced challenges that can cause investors and their advisors to wring their hands – but that need not be the case if expectations are well-defined at the outset. This talk will illustrate how investors and advisors can start with the right perspective to allow them to see through trying times and extract the benefits of these securities.

Bob Simpson, Wealth Stewards

Victor Kuntzevitsky, Wellington-Altus

12:00 pm

Lunch

12:15 pm

Lunch Keynote – The State of Alternatives in Canada

Alternative investments have been available to Canadian retail/Accredited Investors for decades: from the first few hedge funds offered in the early 1990s, to the addition of various private investment vehicles as TMX-listed closed-end funds or as mutual funds on Fundserv, to the formal adoption of the Liquid Alts rules in January 2019. The industry has struggled with head office approvals, IA inertia, and the odd bad actor that has not made it any easier. This session will discuss the state of alternatives in Canada and where we are headed.

Wilson Tow, Altrust Investment Solutions

Steve Allen, Fiera Capital

1:15 pm

Table Talks

Round table discussions hosted by our Sponsors.

This session is aimed at providing all event attendees with the ability to join in genuine knowledge exchange and discussion in a small group setting.

Choose from 2 x 25-minute round table discussions

2:15 pm

Liquid Alts – Portfolio Panacea?

It took six long years for the CSA, working with industry players, to create the Liquid Alts legislation and since its introduction the reception by the market has been not what some expected, but also better than previous alts regulations that did not work at all. With about 1% of investment/mutual fund AUM in liquid alts, it has a long way to go but performance (especially in crashing markets) has been as expected. Higher risk-adjusted returns and crisis alpha have been on display over the last 5+ years. This panel will discuss how IAs are making the most of this new arrow in their quiver and what the future of the industry might be.

Colleen Redmond, Morgan Stanley Wealth Management

Brian D’Costa, Algonquin Capital

Jocelyn Courcelles, Fundata

Conner Sura, TURN8 Private Wealth

3:00 pm

What’s in Your Book? Trends in Canadian IA Portfolios

Each IA is unique and focuses on a certain type of client – and their offering to these clients, while tailored to each investor’s needs, can be generally similar in many ways. As markets and products of offer by the dealer and asset management companies evolves, client portfolios naturally shift among asset classes, alternative strategies, investment strategies (who remembers borrowing to invest?), and the use of risk mitigators/enhances such as derivatives. This panel will give a briefing of where each person started in the industry, what they have learned along the way, and where they are implementing these lessons in client portfolios

Mark Allen, RBC Dominion Securities

Brianne Gardner, Raymond James

Ted Karon, RBC Dominion Securities

4:00 pm

Reception

Opportunity to network over food and drinks!

6:00 pm

End of Wealth Managers’ Forum Toronto 2024!

See you at another conference soon!

Registration

End Investor means pensions, foundations/endowments, sovereign wealth funds, and single family offices. Intermediary investors means Multi-family offices, investment advsiors/dealers, wealth managers, and investment consulting companies and +1 means the first delegate is gratis but each additional delegate attracts a small charge. Manager and service provider delegates must be CAASA members in good standing and pay the requisite per person fee for their appropriate sub-category. Core service providers include prime brokers, fund administrators, and accounting and legal firms.

CAASA Members

Members of CAASA

Please email Paul at Paul@caasa.ca to get on waitlist.

Event Registration Closed

Non-Members

Investment Advisor & Single Family Office

Please email Paul at Paul@caasa.ca to get on waitlist.

Event Registration Closed

Thank You to Our 2024 Gold Sponsors

Thank You to Our 2024 Silver Sponsors