Starting an Alternative Fund Series: Choosing Your Service Providers (Part 1)

Overview

One of our most common questions from new and veteran managers is how to choose their initial service providers, determine their efficacy and appropriateness (in terms of product and service offering as well as pricing and ability to coordinate with their team), and do the same for new areas of endeavor such as offshore and liquid alts funds, retail and institutional markets, and forays into new asset classes and strategies as their companies grow. This session will also compare establishing one’s own fund vs. using a platform.

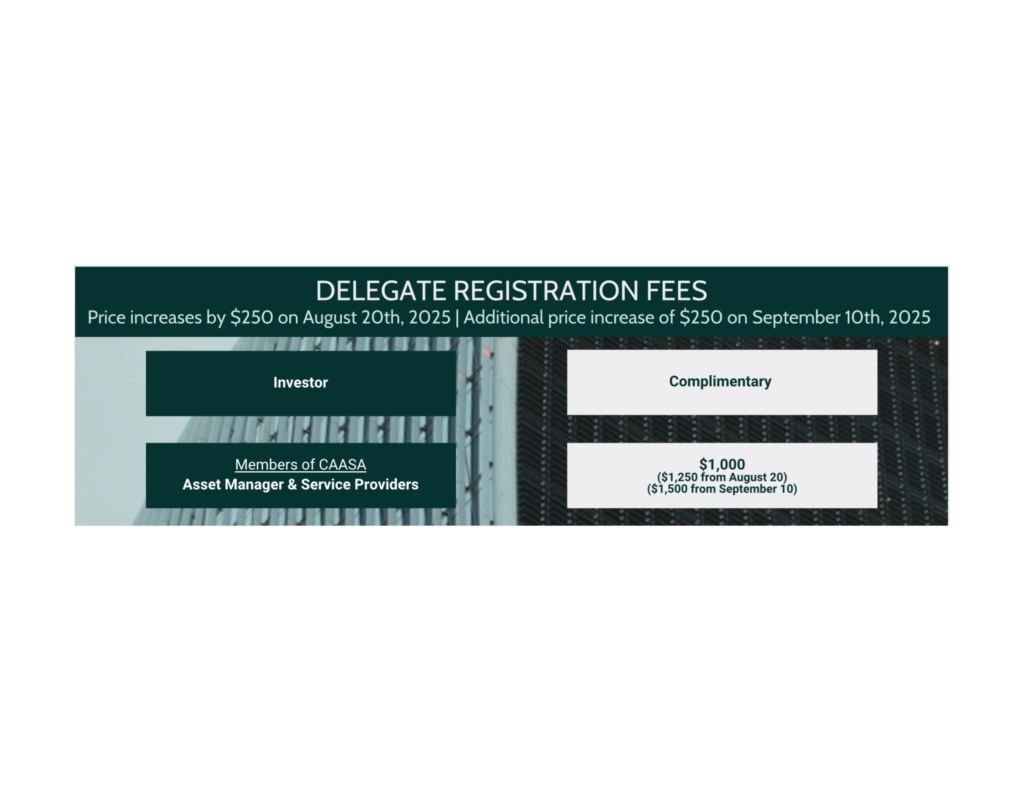

Online registration has closed, please contact Paul at paul@caasa.ca or 647-953-0737 for more information.

This is part 1 of our Starting an Alternative Fund series to be held throughout 2019. The topics this series will cover are the following:

Establishment:

- Structure and registration of the Fund Management Company – including roles, tax planning, proficiencies, capital requirements, creating a business plan, and (important!) managing expectations of investors and those starting the company

- Onshore fund structuring and tax planning – types of funds (including liquid alts) and costs

- Offshore fund structuring and tax planning – jurisdictions, why do so, advantages and disadvantages of structures, cost of going offshore; as well as how to engage service providers in various jurisdictions

Mid/back-office:

- Choosing service providers – primes, legal, auditor, fund administrator

- Compliance and Operations facets of establishing and maintaining a fund management company and various funds

- Finding staff/talent and compensation structures

- Getting ready for operations audits – including prescribed ones by securities commissions and those performed by out-sourced due diligence companies and in-house talent of potential investors

- Specific service providers and niche functions – which might include software, performance reporting (solutions), and trading venders; class action services, Fundserv back-office functions, Managed Account Platforms, due diligence services, and listing funds on an exchange

Sales & Marketing:

- Selling into the Retail channel – true retail/liquid alts as well as Accredited Investors/Offering Memorandum product (will include a primer on liquid alts and the market to date)

- Selling to sophisticated investors – including the Retail Accredited Investor channel, multi and single family offices, and institutional investors such as Canadian and foreign sovereign wealth funds, foundations & endowments, and public & private pension plans (both direct and through investment consultants)

- PR and exposure – honing your message and how to use earned adverting (aka free PR) to deliver it to the right audience (includes use of social media)

- Public opinion and industry surveys – using broad and targeted surveys to deliver actionable data for use in product design, pricing, and messaging

Where

CIBC Mellon, 1 York Street, 5th floor, Toronto ON M5J 0B6