CAASA Annual Conference 2025

Our Flagship Conference

Overview

This year’s CAASA Annual Conference, also known as CAC25 is our flagship, premier, and most coveted conference.

In partnership with Bodhi Research Group, founding educational partner, in the CAC series, CAASA is delighted to welcome you back to Montréal from November 4-5, 2025.

Who Attends?

The CAASA Annual Conference brings together speakers and participants from private and public pension plans, sovereign wealth funds, single and multi-family offices, consulting firms, investment dealers, Canadian and global investment management houses, and affiliated service providers. Panels and break-out sessions will focus on key issues facing investors and managers in Canada and elsewhere including structuring, legal & tax issues, IT and operational areas, and investments – including: hedge funds, CTAs, private equity, private lending, real estate, infrastructure, and crypto-assets/blockchain-related investments.

All content is subject to Chatham House Rule.

When

TBA

Please note that sessions from 11am to 5:50pm November 4, 2025 are exclusive to Speakers, Sponsors, and Investors. The Welcome Reception from 5:30pm – 6:30pm is open to all registered delegates of the conference. Due to capacity constraints, we are NOT providing a networking-only option – one must have a full-conference pass to attend any of the sessions.

- November 4, 2025

- 11:00 am – 6:00 pm EST

- November 5, 2025

- 8:00 am – 7:00 pm EST

2025 Keynotes

GS

Retired

Canadian Armed Forces

Wayne Kozun

CFA, MBA

Co-Chief Investment Officer – Forthlane Partners

Nicolas Vincent

PhD

External Deputy Governor – Bank of Canada

Jingyan Elaine Yuan

Ph.D.

Professor & Director of Graduate Studies – University of Illinois at Chicago

Wayne Kozun

CFA, MBA

Co-Chief Investment Officer – Forthlane Partners

Wayne Kozun is Co-Chief Investment Officer and one of the founding partners of Forthlane Partners, a globally focused, independent asset management firm with offices in Toronto and the Cayman Islands. Forthlane provides sophisticated Outsourced Chief Investment Officer (OCIO) services to individuals, families, family offices, and foundations, applying the same diversification, rigour and due diligence of leading institutional investors.

In his role, Wayne curates highly sophisticated global portfolios, diversified across a wide range of asset classes and invested with top managers around the world. Forthlane’s investment approach is focused on dramatically reducing risk, wealth preservation, and generating steady, compelling returns—in all market environments.

Previously, Wayne spent 22 years at the Ontario Teachers’ Pension Plan where he held senior leadership roles including Senior Vice President of Public Equities, Senior Vice President of Fixed Income & Alternative Investments and Vice President of Tactical Asset Allocation. Wayne has served on several boards including Camelot UK Lottery, Maple Leaf Foods, the Canadian Coalition for Good Governance, the Pacific Pension and Investing Institute, the Michael Garron Hospital Foundation, the Institute for Quantum Computing in Waterloo, Ontario and the Advisory Board for Campbell Lutyens. He holds a Bachelor of Engineering Science from Western University and an MBA from the Ivey School of Business, and he is a CFA® charterholder.

Nicolas Vincent

PhD

External Deputy Governor – Bank of Canada

Nicolas Vincent was appointed external Deputy Governor of the Bank of Canada for a two-year term, effective March 2023, with the term extended by one year in 2024. In this role, Mr. Vincent is a member of the Bank’s Governing Council, which is the Bank’s policy-making body responsible for decisions with respect to monetary policy and financial system stability.

Mr. Vincent is a professor of economics in the Department of Applied Economics at HEC Montréal and co-chair of the Business Cycles and Financial Markets research theme at CIRANO (Centre interuniversitaire de recherche en analyse des organisations). Mr. Vincent began his career as an economist at the Department of Finance Canada in 2000. From 2007 to 2012, he was an assistant professor at HEC Montréal, then an associate professor from 2013 to 2021. He was appointed as a full professor in 2021. He has been a visiting and adjunct faculty member and researcher at numerous institutions, including Columbia Business School, INSEAD, the Banque de France and the Kellogg School of Management.

Mr. Vincent was the 2021 recipient of Marcel Dagenais Award for Outstanding Contribution to Economic Research in Quebec and Canada as well as the recipient of a 2022–26 Social Sciences and Humanities Research Council Insight Grant. He was the winner of the Young Researcher of the Year Award at HEC Montréal in 2012 and has won multiple Teacher of the Year awards from HEC Montréal and INSEAD over the course of his career.

Born in Trois-Rivières, Quebec, Mr. Vincent holds a Bachelor of Commerce degree in applied economics from HEC Montréal, a master’s degree in economics from Queen’s University and a PhD in economics from Northwestern University.

Jingyan Elaine Yuan

Ph.D.

Professor & Director of Graduate Studies – University of Illinois at Chicago

2025 Faculty

Ranjan Bhaduri

PhD, CFA, CAIA

Founder & CEO – Bodhi Research Group

David Ross

CFA

Senior Managing Director, Total Portfolio Management – OPTrust

Shankar Kamath

Director, Partnership Portfolio – BCI

Pierre‐Philippe Ste‐Marie

Managing Director Investment Research – Bodhi Research Group

James Burron

CAIA

Founding Partner – CAASA

Cordell W. Thomas II

Director of Operations – New York State Nurses Association Pension Plan and Benefits Fund

Armeen Bhesania

Senior Manager, Due Diligence & Advisory – Ontario Teachers’ Pension Plan

Andrea Kilibarda

Co-Founder, Head of Client Delivery and Impact – Climate Finance Advisors

Mohamed Farid

Head of Absolute Return Strategies – World Bank Pension Fund

Nirupa Muthurajah

Director, Equity Strategies Lead, Active Public Markets – University Pension Plan

Kristaps Līcis

Director of Exams – CAIA Association

Yan Kvitko

CFA

Managing Director, External Portfolio Management – CPP Investments

Kevin Blank

Senior Analyst – State of Wisconsin Investment Board

Wassim Sakka

CAIA

Senior Vice President – Wilshire

Greg Frank

PhD

Director, Model Validation – Ontario Teachers’ Pension Plan

Marjorie Skolnik

CFA

Managing Director – CI Coriel Capital Inc.

Wagner Dada

CFA, PhD

Managing Director, Systematic Strategies Group, Capital Markets & Factor Investing – CPP Investments

Adam Smalley

MBA

Managing Director – FCC Capital

Bill Bobey

Ph.D.

Managing Director, Portfolio Construction and Risk, Capital Markets and Factor Investing – CPP Investments

Marie Gruttadauria

Senior Advisor, Geopolitical Analysis – La Caisse | Conseillère principale, Analyse géopolitique – La Caisse

Angela Lin-Reeve

CFA

Senior Portfolio Manager, External Managers Program – Healthcare of Ontario Pension Plan

Safiya Bannister

CFA

formerly Mastercard Foundation and HOOPP

Tishawna Clyburn

Investment Vice President, Head of Operational Due Diligence – Prudential Select Strategies

Louis L’Ahelec

Junior Analyst – Bodhi Research Group

Pierre Gilbert

CFA

Vice President, Head of Public Markets – Bimcor

Vincent Jacob-Goudreau

Managing Director, Strategic Asset Allocation – PSP Investments

Fangyi Liu

CFA, CAIA, FRM

Director, Manager Selection – UBC Investment Management

Justin Young

CAIA

Director of Investments – MEMCO: Multilateral Endowment Management Company

Richard Iwuc

CFA

Portfolio Manager – University of Alberta

Scott Radke

MBA

Chief Executive Officer and Co-Chief Investment Officer – New Holland Capital (NHC)

Patrice Boucher

CFA

Vice President and Chief Investment Officer – Lucie and André Chagnon Foundation

Richard Macklem

CFA

Portfolio Manager – CPP Investments

Ranjan Bhaduri

PhD, CFA, CAIA

Founder & CEO – Bodhi Research Group

Dr. Ranjan Bhaduri (he/him) is the Founder & CEO of Bodhi Research Group, an advisory and consulting firm dedicated to research and education in the investments industry. Under Dr. Bhaduri’s leadership, Bodhi Research Group has served clients on five continents and worked with over a dozen pension funds.

Dr. Bhaduri is a leading voice and recognized authority in shaping best practices of the alternative investments industry. Dr. Bhaduri has 25 years of experience in manager research, portfolio construction, due diligence, structuring, and implementing managed account solutions. At Morgan Stanley, Dr. Bhaduri performed due diligence and played a crucial role in developing customized portfolios of alternative investments. He also served in an advisory capacity at the East-West Center, an American think tank focused on U.S.-Asia-Pacific relations.

Dr. Bhaduri has been a featured speaker at both industry conferences and prestigious educational institutions, educating both entrants and seasoned professionals in the field. He has addressed diverse topics ranging from entrepreneurship strategies to advanced portfolio and risk management techniques. Dr. Bhaduri’s academic contributions extend to publishing papers on a variety of topics including liquidity, portfolio construction, managed account platforms, hedge fund strategies, and risk management in esteemed publications.

Dr. Bhaduri holds both the CFA and CAIA charters. Previously, he served on the All About Alpha Editorial Board and held roles such as Executive of the CAIA Chicago Chapter and currently serves as Executive of the CAIA Toronto Chapter. He has also contributed to AIMA Canada as a Board Member, co-chair of the Managed Futures Committee, and member of the Global Research Committee.

Dr. Bhaduri has demonstrated a strong track record of leadership and mentorship. Several of his former analysts and interns have achieved notable success, securing positions at renowned organizations.

David Ross

CFA

Senior Managing Director, Total Portfolio Management – OPTrust

David Ross, Senior Managing Director of the Total Portfolio Management (TPM) group at OPTrust, is responsible for overseeing OPTrust’s public market investments, executed both internally and externally. TPM pursues a total portfolio approach, deploying across strategies in equities, credit, rates, commodities, FX, and hedge funds. David’s responsibilities also include oversight of the Plan’s trading, funding and liquidity management, internal systematic strategy development, public markets data science analytics and incubation investments in novel and transformative technologies.

Before joining OPTrust in October 2016, David spent 10 years at the Ontario Teachers’ Pension Plan in Toronto. He served 8 of those years as a Portfolio Manager, pursuing discretionary global macro value-added strategies on the Global Opportunities desk before serving as co-head of the Emerging Markets Fixed Income & FX desk within the FICC group. Prior to OTPP, David focused on developing emerging markets investment strategies in roles based in London, New York and Toronto. David has a B.A., Economics from the University of Western Ontario and an M.A., Economics from the University of Toronto. David has been a CFA charterholder since 2006.

With net assets of $27 billion, OPTrust invests and manages one of Canada’s largest defined benefit plans with over 114,000 members and retirees

Shankar Kamath

Director, Partnership Portfolio – BCI

Shankar Kamath joined BCI in 2016. He is a member of the Partnership Portfolio, an investment team that bridges other BCI asset classes and invests in instruments that are expected to generate positive returns through market environments.

With $250.4 billion in gross assets under management as of March 31, 2024, BCI is one of the largest institutional investors in Canada.

Prior to joining BCI, Shankar was a litigator for 7 years in public and private practice in Canada. Prior to law, Shankar was an electrical engineer in the tech industry for 3 years.

Pierre‐Philippe Ste‐Marie

Managing Director Investment Research – Bodhi Research Group

Pierre‐Philippe Ste‐Marie has 25 years of experience in the financial industry working with fixed income and cross asset absolute returns teams. He has initiated and unwound absolute returns and indexed portfolios and managed Canadian, US and European cross asset exposure levered and unlevered as a team leader (CEO, CIO) as well as a portfolio manager. Pierre-Philippe joined the Bodhi Research Group in 2022.

James Burron

CAIA

Founding Partner – CAASA

James co-founded CAASA in response to industry support for a Canadian alternatives association to serve all aspects including: hedge / alternative strategies; private lending; private real estate; private equity; plus emerging areas where Canada is a leader such as digital assets / blockchain and robo-advisors.

Prior to CAASA, James was the Chief Operating Officer of AIMA Canada where his team of three worked with 12 committees to produce 50-60 events per annum across Canada, organize 100+ committee meetings, and increase member numbers over his 7-year tenure from 66 to 164 corporate entities.

James also has experience in research and writing for the CAIA Association as well as serving on CAIA’s Exam Council and as a grader for the Level II portion of the exam. He also had roles in institutional sales and FoHF structuring in Seoul, South Korea, as a Product Manager at ICICI Wealth Management, and an Investment Advisor at RBC Dominion Securities. He graduated from Simon Fraser University with a BBA (Finance).

Cordell W. Thomas II

Director of Operations – New York State Nurses Association Pension Plan and Benefits Fund

Cordell is the Director of Operations at the New York State Nurses Association (NYSNA) Pension Plan and Benefits Fund. He is responsible for leading operational due diligence reviews and broader investment operations functions within NYSNA.

Prior to NYSNA, Cordell served within General Motors Asset Management’s (GMAM) Enterprise Risk Management team; and was responsible for leading operational due diligence reviews on both alternative and traditional asset managers within GM’s Defined Benefit and Defined Contribution plans across the US, Canada, Belgium, and the UK.

Prior to GMAM, Cordell worked at Mercer Sentinel Group, Mercer Investments LLC’s operational due diligence consulting group. While at Mercer Sentinel Group, Cordell performed operational due diligence on alternative and traditional asset managers for both external and internal clients.

During his over 20 years’ experience in the asset management industry, Cordell has served in various roles within reputable firms including Citco Fund Services, Société Générale and BNY Mellon Wealth Management. He has worked with both alternative and traditional asset managers of various sizes and geographic locations including North America, South America, Europe, and Asia.

Armeen Bhesania

Senior Manager, Due Diligence & Advisory – Ontario Teachers’ Pension Plan

Senior Due Diligence Consultant and advisor to institutional investors about systematic macro, real assets, renewable energy infrastructure, real estate, venture capital, and private equity strategies. Specializes in the Americas & Asia Pacific regions, within developed, emerging, and frontier markets. Prior to her current role, she was at CNID and prior to that worked at Albourne Partners (seven years in Toronto and four years in Hong Kong); she has published several articles and led initiatives related to fiduciary oversight, market abuse, and discerning conflicts of interest. Ms. Bhesania is a Chartered Accountant (Ontario, Canada) and CPA (Maine, USA).

Andrea Kilibarda

Co-Founder, Head of Client Delivery and Impact – Climate Finance Advisors

Andrea Kilibarda is the co-founder of Climate Finance Advisors, where she leads the client delivery and impact function, supporting institutional asset owners in managing systemic risks from climate change across their portfolios. Her work focuses on aligning investment decision-making processes with long-term, shared value creation and the broader goal of building prosperous, resilient societies.

In addition to her work with asset owners, Andrea advises governments, banks, and development finance institutions on sustainable finance strategy and implementation, bridging policy and finance to accelerate the deployment of climate-aligned capital at scale.

Prior to co-founding Climate Finance Advisors, Andrea was a core member of the sustainable finance team at one of Canada’s big six banks. There, she helped shape the bank’s sustainable finance capabilities, advising corporate and public sector clients on structuring innovative transactions. Notably, her work includes leading the development of Canada’s first syndicated Social Loan, targeting health equity and access in Northern communities, and the country’s first Blue Loan, designed to address water scarcity. Her approach is designed to tap into growing pools of sustainability-focused capital, while setting new market precedents. Andrea has also participated in IPO and M&A advisory where she played a key role in embedding sustainability into capital-raising narratives and strategic direction. Her advisory experience spans transition finance and carbon and nature-based solutions. She has provided insights into business strategy, governance oversight, commitment setting, and product development.

Andrea is currently pursuing an MSc in Global Environment and Sustainability at the University of London (Birkbeck), further strengthening her interdisciplinary understanding of global environmental risk and opportunity in capital markets.

Andrea holds a Bachelor of Commerce in Finance from Concordia University and is a graduate of the Van Berkom Investment Management Program. She was selected as class valedictorian where her address emphasized the systemic nature of value creation, urging future leaders to redefine success through the lens of shared prosperity and environmental stewardship.

Mohamed Farid

Head of Absolute Return Strategies – World Bank Pension Fund

Mohamed Farid is a Head of Absolute Return Strategies at the World Bank Pension Fund, managing over $4 billion of Absolute Return Strategies portfolio. Mohamed has over 24years of experience investing directly in hedge funds and is an active member ofInvestment Committee at the Pension Plan portfolio. Mohamed has opportunistically co-invested with some hedge fund managers and implemented internal hedging strategies.

Prior to joining the World Bank Pension Plan, Mohamed worked for Deloitte & Touche and KPMG financial consulting groups in Toronto, Canada, Washington D.C, Egypt and Thailand where he led acquisitions and bankruptcy engagements for leading clients in North America and Asia. Mohamed started his career in commercial banking. He holds a master’s degree from the Johns Hopkins University in International Economics and Political Science as well as a Master’s degree in Banking and Finance from Finafrica Foundation in Milan, Italy.

Nirupa Muthurajah

Director, Equity Strategies Lead, Active Public Markets – University Pension Plan

As Director, Equity Strategies Lead at University Pension Plan, Nirupa oversees the design and management of active equity strategies. She is responsible for manager research and due diligence across long-only and hedge fund strategies, as well as the long-term strategic direction of the Active Public Equity portfolio.

Nirupa’s career spans Canada’s top pension plans, Ontario Teachers’ Pension Plan and CPP Investments, as well as a prominent family office. Her experience encompasses diverse roles across private and public markets, building global systematic strategies, structuring hedge fund portfolios, supporting direct lending in Asia-Pacific, and has experience investing in early to late-stage private equity as well as public investment strategies.

Nirupa holds an Honours BA in Financial Mathematics with Business Administration from Wilfrid Laurier University. She is a member of the Investment Committee for the boards of the United Church of Canada and the Ontario Hospital Association. Outside of her professional pursuits, Nirupa enjoys spending time with her young family, and is a proud ambassador for the Princess Margaret Cancer Foundation, an organization dear to her heart.

Kristaps Līcis

Director of Exams – CAIA Association

Kristaps Līcis has served as the Director of Exams at the CAIA Association since 2022 and as the Senior Associate Director of Exams from 2008 until 2022. He works in all areas of the examination process, including, but not limited to, managing CAIA’s exam team, item development, exam design, item analysis, and exam delivery. Prior to joining the CAIA Association, Kristaps worked at Alternative Investment Analytics as a senior analyst.

Yan Kvitko

CFA

Managing Director, External Portfolio Management – CPP Investments

Yan Kvitko is a Managing Director with CPP Investments’ External Portfolio Management (EPM) team. Yan is responsible for the Emerging Manager program globally which pursues investments in early stage hedge fund managers. Prior to joining CPP in 2019, he worked at New Holland Capital where he was a Senior Portfolio Manager responsible for investment research and portfolio management with a focus on quantitative strategies. Yan began his career at Ziff Brothers Investments.

Yan holds a BS in Computer Science from Stanford University and an MA in piano performance from the Conservatorium van Amsterdam. He is a CFA Charterholder.

Kevin Blank

Senior Analyst – State of Wisconsin Investment Board

Kevin is a Senior Analyst for the Private Markets and Funds Alpha Division at the State of Wisconsin Investment Board (SWIB), which oversees approximately $156 billion in assets. Kevin’s responsibilities include manager due diligence, portfolio construction, and oversight of hedge funds and long-only external manager relationships. Kevin received a bachelor’s degree from Marquette University and is currently pursuing his MBA at the Kellogg School of Management at Northwestern University.

Wassim Sakka

CAIA

Senior Vice President – Wilshire

Wassim Sakka is a Senior Vice President focused on hedge fund research on Wilshire’s alternative managed accounts team. He joined the firm in December 2023 as part of the Lyxor U.S. acquisition.

Prior to joining Wilshire, Mr. Sakka was a member of the hedge fund research team at Lyxor U.S. where he was Head of Global Macro, CTAs and Risk Premia Research since 2017. Prior to that, he held a similar role at Lyxor Asset Management in Paris.

Previously, he was a member of Lyxor’s managed account platform serving in a product specialist role focused on quant and macro liquid alternatives. Before joining Lyxor in Paris, he worked within Société Générale’s ETF structuring department and at Sophis as a trading and risk software analyst.

Mr. Sakka earned an engineering degree in computer science and applied mathematics from ENSEEIHT with an exchange program in Polytechnique Montreal. He also holds a master’s in asset management from Dauphine University and the Chartered Alternative Investment Analyst Association (CAIA) designation.

Greg Frank

PhD

Director, Model Validation – Ontario Teachers’ Pension Plan

Greg Frank is a seasoned finance professional with over 25 years of experience specializing in quantitative modeling and executive-level communication. His career spans Canadian and U.S. banks, where he designed and implemented models for valuation, market risk, and credit risk. For the past decade, Greg has led model validation at Ontario Teachers’ Pension Plan (OTPP), evolving the function to encompass broader model risk and governance. He holds a PhD in Applied Mathematics from Western University, with a research focus on modeling and understanding emergent behavior in complex systems.

Marjorie Skolnik

CFA

Managing Director – CI Coriel Capital Inc.

Marjorie Skolnik is a Managing Director at CI Coriel Capital Inc., an Outsourced Chief Investment Officer supporting ultra high-net-worth Canadian families and foundations with their investment programs since 2006.

She previously held various positions in the institutional capital markets, including as Director, Global Equity Derivatives at National Bank of Canada. She began her career at Scotiabank, where she transacted interest rate derivatives with central banks, treasuries and hedge funds.

Marjorie is involved in several philanthropic projects. She currently serves as:

• Member of the Investment Committee of the Fondation Lucie et André Chagnon, and

• Member of the Board of Directors of the Jewish Community Foundation of Montreal.

She holds a Bachelor of Commerce degree, with a Major in Finance, from the John Molson School of Business at Concordia University, and is a CFA charter holder.

Wagner Dada

CFA, PhD

Managing Director, Systematic Strategies Group, Capital Markets & Factor Investing – CPP Investments

Wagner oversees a global portfolio of systematic absolute return strategies in the macro space focusing on interest rates, currencies, and commodities at CPP Investments. Before his current role, he was previously focused on portfolio construction efforts in the global tactical and asset allocation group.

Prior to joining CPP Investments, Wagner was a Quantitative Portfolio Manager responsible for the development, research and management of a global macro multi-asset systematic strategy at Tudor Investment Corporation.

Wagner holds a PhD degree in Economics from the University of Cambridge. He is a CMT and CFA charterholder.

Adam Smalley

MBA

Managing Director – FCC Capital

Adam Smalley is Managing Director at FCC Capital, a division of Farm Credit Canada, andfocuses on innovative investment strategies that support the growth of Canada’s agriculture and food sectors. He joined in 2025 after more than 20 years investing in public and private markets.

Previously, Adam spent eight years at PSP Investments in private markets, holding leadership roles in private debt and an alternatives portfolio focused on venture capital and non-correlated strategies. Earlier in his career, he held progressively senior roles at various asset managers, gaining significant experience in investment analysis, trading, and portfolio management. Hebegan his career in investment banking at Lehman Brothers in New York.

Adam holds an MBA from Columbia Business School and a BS in Accounting from Bucknell University. He has substantial governance experience having served on several boards, including a public company, and other advisory bodies.

Adam lives in Montreal with his wife and son.

Bill Bobey

Ph.D.

Managing Director, Portfolio Construction and Risk, Capital Markets and Factor Investing – CPP Investments

Bill is responsible for CMF’s portfolio strategy, design, and risk management, overseeing an absolute return global public market portfolio that integrates external funds with internal systematic investment programs. Prior to joining CPP Investments in 2011, he was an Assistant Professor of Finance at the Sobey School of Business and a Senior Quant at Capula Investment Management. He holds a PhD in Finance from the University of Toronto and an MSc in Financial Mathematics from the University of Warwick.

Marie Gruttadauria

Senior Advisor, Geopolitical Analysis – La Caisse | Conseillère principale, Analyse géopolitique – La Caisse

–––––––––––

Marie Gruttadauria est conseillère principale, Analyse géopolitique au sein de l’équipe Risques thématiques et émergents des portefeuilles. Auparavant en charge de la région Amérique latine, elle est désormais responsable de l’évaluation des risques politiques et géopolitiques entourant les investissements de La Caisse en Amérique du Nord (Canada, États-Unis, Mexique).Avant de se joindre à La Caisse en 2021, Mme Gruttadauria a travaillé en tant que conseillère en relations gouvernementales au sein du cabinet-conseil Paradigme Stratégies.Elle est titulaire d’une maîtrise en affaires publiques et internationales de l’Université de Montréal et d’un baccalauréat en science politique de l’Université libre de Bruxelles (Belgique).

Angela Lin-Reeve

CFA

Senior Portfolio Manager, External Managers Program – Healthcare of Ontario Pension Plan

Angela Lin-Reeve joined the Investment Management Team at Healthcare of Ontario Pension Plan (HOOPP) in 2023 as Senior Portfolio Manager, External Manager Program. In this role, Angela oversees a portfolio of absolute return strategies that intends to complement HOOPP’s internal trading capabilities and provides exposure to a wide range of strategies and asset classes.

Prior to joining HOOPP, Angela held the position of Director, Pension Investments at Royal Bank of Canada (RBC) where she managed external manager portfolios in public and private equities, infrastructure, and hedge funds.

Angela began her career at Russell Investments, taking on increasingly senior roles as Portfolio Analyst, Associate PM and Director, Product Development and Strategy.

Angela holds a Bachelor of Commerce from McMaster University and the Chartered Financial Analyst (CFA) designation.

Safiya Bannister

CFA

formerly Mastercard Foundation and HOOPP

Safiya Bannister is a seasoned investment-finance executive with deep expertise in middle office, treasury, and investment operations. Most recently, she served as Director of Middle Office & Treasury at Mastercard Foundation Asset Management (MFAM), where she was responsible for liquidity management, investment performance reporting, and operational due diligence for a globally diversified portfolio.

Prior to MFAM, Safiya spent over two decades with the Healthcare of Ontario Pension Plan (HOOPP), one of Canada’s largest defined benefit plans. At HOOPP, she led progressive investment operations teams and spearheaded major transformation initiatives, including system implementations, valuation automation, and the operationalization of complex alternative and total-fund strategies. Her work enhanced scalability, governance, and efficiency across both public and private markets.

Safiya is recognized for her ability to bridge investment strategy with operational execution, ensuring that institutions can deploy alternative strategies with confidence and rigour. She holds a Bachelor of Commerce and a Master of Finance from the University of Toronto and is a CFA charterholder.

Tishawna Clyburn

Investment Vice President, Head of Operational Due Diligence – Prudential Select Strategies

Tishawna Clyburn joined Prudential Select Strategies (f/k/a Prudential’s Alternative Assets Group) in August 2013 as an Investment Analyst on the Real Assets Investment Team. She has more than 12 years of investment and operational due diligence experience across all alternative asset classes. In 2014, she moved from the Real Assets Investment Team to the Hedge Fund Investment Team, where she assumed increasing amounts of responsibility for manager sourcing and due diligence, and was eventually promoted to Senior Associate. As a Senior Associate, she was responsible for manager research and due diligence of equity and credit-oriented hedge fund investments. In June 2022, she was promoted to Vice President, Head of Operational Due Diligence. In this role, she was tasked with launching and building out an independent operational due diligence function to support all private equity, hedge fund, real assets and manager of managers fund investments and SMA mandates. Prior to joining Prudential, Tishawna was a corporate and investment banking analyst for KeyBanc Capital Markets.

In 2017, Tishawna was recognized among CIO magazine’s 40-under-forty Rising Stars.

Tishawna graduated summa cum laude from the New Jersey Institute of Technology with a Bachelor of Science degree with a concentration in Finance in 2011.

Louis L’Ahelec

Junior Analyst – Bodhi Research Group

Pierre Gilbert

CFA

Vice President, Head of Public Markets – Bimcor

As Vice President – Head of Public Markets at Bimcor, Pierre leads the team overseeing investments across fixed income, public equities, absolute return and credit for the Bell Canada pension plans. He also supports the chief investment officer on a broad range of investment and portfolio management related issues, including liability-driven investing, asset allocation and portfolio construction.

Prior to joining Bimcor in 2005, Pierre worked at the Department of Finance Canada, most recently as senior project leader in the Financial Markets Division where he assumed responsibilities for the development of federal debt management strategy.

Pierre earned his Masters of Arts in Economics from Laval University, holds the Financial Risk Manager (FRM) designation and is a CFA charterholder.

Vincent Jacob-Goudreau

Managing Director, Strategic Asset Allocation – PSP Investments

Vincent is a Managing Director, Strategic Asset Allocation, in the CIO group at the Public Sector Pension Investment Board (PSP Investments). In this capacity, Vincent leads his team’s efforts in advising PSP’s senior management and Board of Directors on strategic asset allocation, including leverage, benchmarks, strategic FX hedging and asset class mandates. He also leads discussions with PSP Investments’ stakeholders regarding pension funding risk and risk appetite based on thorough asset-liability modelling.

Before joining PSP Investments in 2010, Vincent started his career at Aon in 2003, where he successively held positions in actuarial consulting and investment consulting functions before helping kickstart the Financial Risk Consulting group, a group dedicated to investment consulting based on quantitative modelling accounting for risks from both assets and liabilities.

Vincent is a seasoned investment and financial services professional with more than 20 years of institutional investment experience in portfolio construction, strategic asset allocation, and pension management.

Vincent is an Associate of the Society of Actuaries and holds a BSc in Actuarial Sciences from Université Laval. He also holds the Financial Risk Manager designation from the Global Association of Risk Professionals

Fangyi Liu

CFA, CAIA, FRM

Director, Manager Selection – UBC Investment Management

Justin Young

CAIA

Director of Investments – MEMCO: Multilateral Endowment Management Company

Justin Young is the Director of Investments at MEMCO where he is responsible for portfolio construction and manager selection across client portfolios. He has a special focus on uncorrelated strategies to help meet client needs in a wide range of market scenarios. Prior to joining MEMCO, Justin spent 11 years at the $40bn South Carolina Retirement System Investment Commission where he rose from Analyst to Director of Portable Alpha, eventually managing the $5bn hedge fund program which was named 2022 Public Plan of the year by Institutional Investor. In addition to hedge funds, he also spent time covering Fixed Income, GTAA, Equity Options and Commodity allocations at RSIC. Justin began his career as a Research Analyst at Bridgewater associates where he worked with their global equities team. He graduated from the University of South Carolina Honors College where he majored in finance and economics. Justin is also a CAIA Charterholder.

Richard Iwuc

CFA

Portfolio Manager – University of Alberta

Richard is a seasoned professional with a diverse background in economics, finance, and investments over his career. His journey began as a Research Analyst for the City of Winnipeg, where he honed his expertise in economics and taxation policy. His career trajectory took a turn towards finance when he assumed the role of an analyst and manager at the Winnipeg Stock Exchange.

Richard’s foray into investments led him to establish and oversee the Manitoba Public Insurance Investment Department. In 2009, he brought his varied experience to the University of Alberta, serving as the Portfolio Manager for the endowment. The focus of his work is presently on external investment managers in private markets and real estate. He is also responsible for risk and strategy research and analysis (including asset allocation). Richard’s academic credentials include a BSc and MBA from the University of Manitoba, and he is a proud holder of the CFA charter. He is also a doctoral candidate at Athabasca University conducting research on Canadian university endowments.

Scott Radke

MBA

Chief Executive Officer and Co-Chief Investment Officer – New Holland Capital (NHC)

Scott Radke is the Chief Executive Officer and Co-Chief Investment Officer at New Holland Capital (NHC). As CEO, Scott is responsible for leading, implementing, and growing NHC’s business activities. As Co-CIO, Scott is responsible for portfolio management, investment research, and portfolio risk alongside Bill Young. Scott is a member of the firm’s Financial Risk Management Committee and a member of the Investment Committee, which opines on investment and portfolio decisions across NHC’s business lines. Prior to the launch of NHC in 2006, Scott was a member of the Hedge Fund Group within a Dutch pension. Before that, Scott was a Vice President at Citigroup Global Markets and previously an Associate within the Insurance-related Structured Transactions Group at Goldman Sachs. Scott graduated magna cum laude from the University of Michigan with a BSE in Mechanical Engineering and received an MBA in Finance with distinction from the Wharton School of the University of Pennsylvania.

Patrice Boucher

CFA

Vice President and Chief Investment Officer – Lucie and André Chagnon Foundation

Patrice Boucher has served as Vice President and Chief Investment Officer at the Lucie and André Chagnon Foundation since 2022. He oversees the management of the Foundation’s investment portfolio as well as that of the family office. He initially joined the organization in 2007 as an analyst.

Throughout his career, he has developed an in-depth understanding of major traditional and alternative asset classes, along with expertise in portfolio management encompassing performance analysis and financial modeling, risk management, manager selection, responsible investing, asset allocation, and the development of investment policies.

In addition, Patrice is actively involved in the financial community as a volunteer member of CFA Montréal’s Sustainable Finance Committee and Programming Committee. He also serves on the Impact Investment Subcommittee of the Foundation of Greater Montréal.

He holds a Bachelor’s degree (B.B.A.) and a Master’s degree (M.Sc.) in Business Administration from HEC Montréal. He is also a CFA charterholder and holds the CFA Institute Certificate in ESG Investing.

______

Patrice Boucher est vice-président et chef des placements à la Fondation Lucie et André Chagnon depuis 2022. Il y supervise la gestion du portefeuille d’investissements de la Fondation, ainsi que celle du bureau familial. Il s’est initialement joint à l’organisation en 2007 à titre d’analyste.

Au fil de sa carrière, il a acquis une connaissance approfondie des principales classes d’actifs traditionnelles et alternatives, ainsi qu’une expertise en gestion de portefeuille couvrant l’analyse de performance et la modélisation financière, la gestion des risques, la sélection de gestionnaires, l’investissement responsable, l’allocation d’actifs et l’élaboration de politiques de placement.

En parallèle, Patrice contribue activement au milieu financier en tant que membre bénévole du comité sur la finance durable et de celui sur la programmation de CFA Montréal. Il siège également au sous-comité d’investissement d’impact de la Fondation du Grand Montréal.

Il est titulaire d’un baccalauréat (B.A.A.) et d’une maîtrise (M.Sc.) en administration des affaires de HEC Montréal. Il détient par ailleurs le titre de CFA, ainsi qu’une certification en investissement ESG (CFA).

Richard Macklem

CFA

Portfolio Manager – CPP Investments

Richard Macklem is a Portfolio Manager with CPP Investments’ External Portfolio Management team, which is responsible for managing a portfolio of investments in commingled hedge funds and separately managed accounts across public market strategies.

He has over 9 years of investment experience spanning portfolio construction and allocation roles across different strategies in the hedge fund space. He invests in hedge fund managers globally, with a current focus on emerging managers. Mr. Macklem joined CPP Investments in 2016.

Mr. Macklem holds a BA in Economics from the Queen’s University and a Master of Financial Economics from the University of Toronto. He is a CFA charterholder.

2025 Agenda

Please note this agenda is subject to change.

Day 1

- November 4, 2025

- 11:00 am – 6:30 pm

Day 2

- November 5, 2025

- 8:00 am – 6:00 pm

- November 4, 2025

- 11:00 am – 6:30 pm

Day 1 – Sponsors, Speakers & Investors Only + General Reception

11:00 am

Registration Opens – Sponsors, Investors, & Speakers ONLY

Sponsors, Investors, & Speakers Only

We welcome all CAASA members who are sponsors of the event as well as all speaker and investors (e.g., those employed by pensions, E&Fs, SWFs, single family offices, and certain wealth managers).

All other registered delegates are welcome to the General Reception in the evening.

11:00 am

1:1 meetings

Sponsors, Investors, & Speakers Only

This is everyone’s opportunity to meet – either as established via our conference meeting & messaging app or ad hoc. We do not require a minimum number of meetings/interactions and encourage everyone to network at their own pace.

11:45 am

Lunch Service Begins

12:15 pm

Welcome Remarks

Sponsors, Investors, & Speakers Only

Welcome to the Eighth CAASA Annual Conference in Montreal!

The growth of CAASA has occurred much because of the success of this event and this is due a great deal to the talent and hard work of Ranjan Bhaduri of Bodhi Research Group who organizes our programming for this (and predecessor events at another organization), our flagship, conference.

James Burron, CAASA

Ranjan Bhaduri, Bodhi Research Group

Louis L’Ahelec, Bodhi Research Group (Master of Ceremonies)

12:30 pm

Lunch Keynote – Portfolio Diversification beyond the 60-40 Portfolio

Sponsors, Investors, & Speakers Only

For much of the past 40 years, the 60-40 portfolio has performed well, supported by a declining interest rate environment and stable inflation. Since 2022, however, stocks and bonds have become positively correlated. If this trend continues, investors must consider new ways to diversify their portfolios. Can commodities play a role? What about gold and other real assets? And can absolute return strategies such as hedge funds provide the needed diversification? This Keynote session will answer these questions.

Wayne Kozun, Forthlane Partners

1:00 pm

Total Portfolio Management – From Vision to Execution: Case Study of OPTrust

Sponsors, Investors, & Speakers Only

This session explores OPTrust’s advances in Total Portfolio Management (TPM), an integrated framework that aligns investment strategy, risk management, and funding objectives across the portfolio. This fireside chat, featuring senior executive David Ross of OPTrust, is a case study of a how an innovative pension plan that has applied TPM in practice, providing insights into governance, decision-making, and implementation.

David Ross, OPTrust

Ranjan Bhaduri, Bodhi Research Group

1:30 pm

Table Talk Session 1 (Managers)

Sponsors, Investors, & Speakers Only

2:15 pm

Break

Sponsors, Investors, & Speakers Only

2:30 pm

The Next 25 Years

Sponsors, Investors, & Speakers Only

What will the next 25 years hold for markets and the global economy? Pierre-Philippe Ste-Marie, who has a successful trading history through the crises of 1997–98, 2008, and 2020, uses an implementation of the original 1956 Solow-Swan model to explore scenarios of economic growth and contraction. He offers practical insights on population trends and productivity, highlighting the importance of focusing on key issues over tools, understanding risks, and preparing before crises hit.

Pierre‐Philippe Ste‐Marie, Bodhi Research Group

3:00 pm

Table Talk Session 2 (Managers)

Sponsors, Investors, & Speakers Only

3:45 pm

Break

4:00 pm

First Mover Advantage

Sponsors, Investors, & Speakers Only

This fireside chat explores CPP’s innovative approach to investing in emerging hedge fund managers. Richard Macklem of CPP Investments and Dr. Ranjan Bhaduri discuss what CPP looks for in new managers, how early partnerships can create an edge, and how innovation and alignment drive long-term success.

Ranjan Bhaduri, Bodhi Research Group

Richard Macklem, CPP Investments

4:30 pm

Top of the House: Asset Allocation – Challenges & Opportunities

Sponsors, Investors, & Speakers Only

This panel examines both the challenges and opportunities facing institutional investors today. Drawing on perspectives from three leading pension plans, the discussion will explore asset allocation, the biggest potential risks, and potential opportunities. Attendees will gain insights into how top investors navigate uncertainty, adapt, and position their portfolios for resilience and growth.

Pierre‐Philippe Ste‐Marie, Bodhi Research Group

Vincent Jacob-Goudreau, PSP Investments

Mohamed Farid, World Bank Pension Fund

Pierre Gilbert, Bimcor Inc

5:00 pm

Registration Opens for All Delegates

5:00 pm

Welcome Reception and Networking – All Delegates

All registered delegates are invited to this opportunity to meet and perhaps begin a more fulsome evening.

6:30 pm

End of day

We suggest that delegates use the conference messaging app to reach out to fellow conference goers if they wish to arrange other meetings/dinners.

- November 5, 2025

- 8:00 am – 6:00 pm

Day 2 – All Delegates

8:00 am

Registration & Breakfast

Please arrive during this 30 minutes so we can start on time and keep to our busy schedule.

8:15 am

Opening Remarks & Curriculum Overview (for all delegates)

We’ll give you a brief overview of the day and how we created the curriculum for the day.

The growth of CAASA has occurred much because of the success of this event and this is due a great deal to the talent and hard work of Ranjan Bhaduri of Bodhi Research Group who organizes our programming for this (and predecessor events at another organization), our flagship, conference.

James Burron, CAASA

Ranjan Bhaduri, Bodhi Research Group

Louis L’Ahelec, Bodhi Research Group (Master of Ceremonies)

8:20 am

Next Frontier of Sustainability Integration into the Endowment Model

As sustainability goals evolve beyond traditional ESG integration, Canadian foundations are advancing how capital can drive meaningful impact. This session presents a case study of a foundation progressively incorporating impact investing, social finance, and climate-aligned strategies into its portfolio. Participants will gain insights into aligning investment mandates with purpose and practical approaches to mobilize capital toward climate and social outcomes.

Andrea Kilibarda, Climate Finance Advisors

Patrice Boucher, Lucie and André Chagnon Foundation

8:45 am

New Research by CAIA: From Vision to Execution – Total Portfolio Approach

This NowTalk shares how leading institutions move from Strategic Asset Allocation to the Total Portfolio Approach, revealing the cultural shifts, governance challenges, and practical steps needed to turn TPA from concept into practice.

Kristaps Līcis, CAIA Association

9:00 am

Keynote: How the Bank of Canada makes a Monetary Policy Decision

In this Keynote Presentation, External Deputy Governor Nicolas Vincent gives a behind-the-scenes look at how the Bank of Canada’s Governing Council arrives at its monetary policy decisions.

Deputy Governor Nicolas Vincent, Bank of Canada

9:30 am

Finding Alpha – best ideas for 2026

A panel of top PMs from pensions and endowments share their most compelling ideas and strategies for generating alpha in 2026, offering a front-row look at where they see opportunity.

Angela Lin-Reeve, Healthcare of Ontario Pension Plan

Nirupa Muthurajah, University Pension Plan

Fangyi Liu, UBC Investment Management

Richard Iwuc, University of Alberta

10:00 am

Coffee Break

10:30 am

Balancing Purity and Pragmatism: Practical Approaches to Model Risk Governance

As models drive both daily portfolio decisions and long-term strategy, robust governance is essential. This session explores practical approaches to managing model risk, tackling complexity, transparency, and AI innovation, while providing actionable insights to strengthen decision-making and resilience.

Greg Frank, Ontario Teachers’ Pension Plan

11:00 am

Operational Excellence: The Hidden Driver of Investment Success

Explore operational due diligence through the eyes of allocators in this candid, practical panel. Panelists will share real-world lessons on scaling operations, managing risk, and meeting allocator expectations, with actionable takeaways for emerging and established managers alike. Gain insights into what separates operationally ready firms from those that raise red flags.

Safiya Bannister

Armeen Bhesania, Ontario Teachers’ Pension Plan

Cordell W. Thomas II, New York State Nurses Association Pension Plan and Benefits Fund

Tishawna Clyburn, Prudential Select Strategies

11:30 am

Table Talks (Service Providers)

12:15 pm

Lunch Service Begins

12:45 pm

Lunch Keynote: The Shifting Landscapes of AI in China and the US

AI is set to drive the next technological revolution—reshaping economies, societies, and the global balance of power. In this talk, Dr. Yuan explores how China and the United States are pursuing AI along divergent paths. The US bets on breakthrough innovation, powered by private capital and tech giants racing to build ever-larger models and cloud infrastructures. China, by contrast, emphasizes rapid diffusion—leveraging open-source platforms to lower barriers, accelerate adoption, and align AI with national priorities and coordinated infrastructure developments. One strategy prizes frontier discovery, the other scale and integration. Together, they are defining a new technological rivalry that will shape the future.

Jingyan Elaine Yuan, University of Illinois at Chicago

1:30 pm

Keynote: Debrief: Strategic Thinking in High-Stakes Environments

James Burron, CAASA

GS, Canadian Armed Forces (Retired)

2:00 pm

One-on-One Meetings

3:00 pm

Geopolitics and Ramifications for Portfolio Management

Join experts from two of Canada’s leading pension funds for a dynamic fireside chat on how global political shifts are reshaping the investment landscape. Gain first-hand insights on navigating geopolitical risks, adapting portfolio strategies, and seizing opportunities in an increasingly complex world.

Marie Gruttadauria, La Caisse

Bill Bobey, CPP Investments

3:30 pm

Systematic Strategies and the Pursuit of Alpha

This panel of seasoned allocators explores systematic strategies from diverse angles, united by the pursuit of alpha.

Wassim Sakka, Wilshire

Kevin Blank, State of Wisconsin Investment Board

Wagner Dada, CPP Investments

Scott Radke, New Holland Capital (NHC)

4:00 pm

Perspectives on Private Matters

Leading investors share their insights and approaches to unlocking value in private markets and the trends shaping their outlook.

Shankar Kamath, BCI

Adam Smalley, FCC Capital

Marjorie Skolnik, CI Coriel Capital Inc.

Justin Young, MEMCO: Multilateral Endowment Management Company

4:30 pm

Reception

6:00 pm

End of Conference

Until next year!

Registration

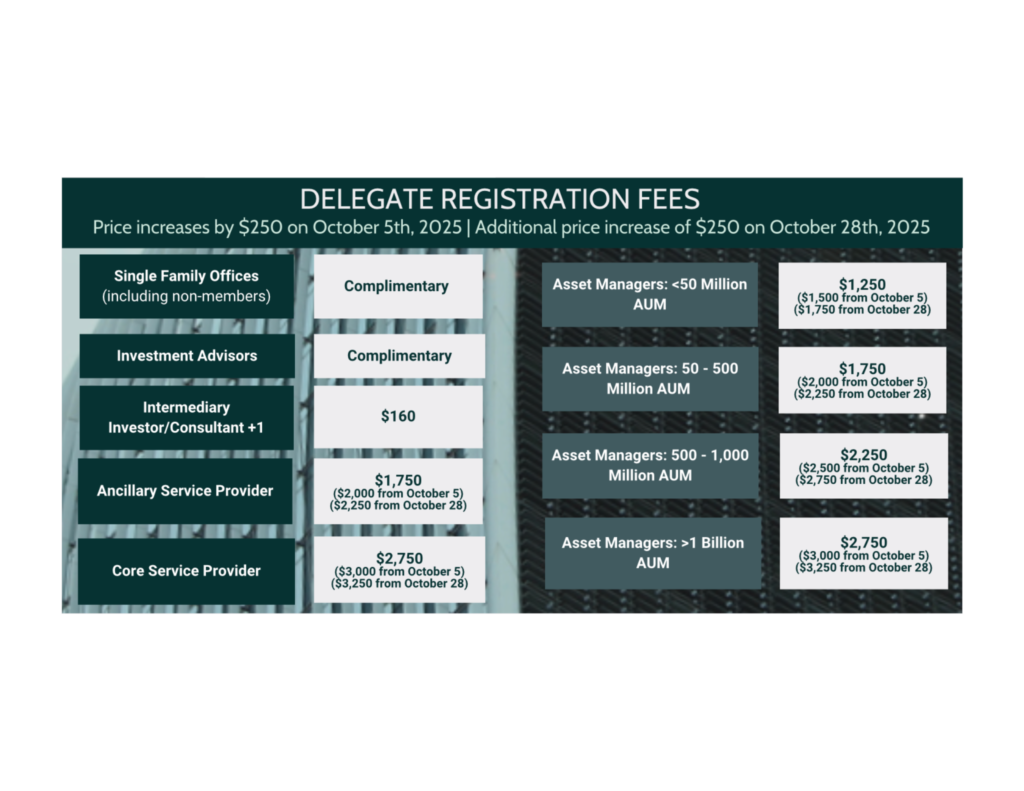

End Investor means pensions, foundations/endowments, sovereign wealth funds, and single family offices. Intermediary investors means Multi-family offices, investment advsiors/dealers, wealth managers, and investment consulting companies and +1 means the first delegate is gratis but each additional delegate attracts a small charge. Manager and service provider delegates must be CAASA members in good standing and pay the requisite per person fee for their appropriate sub-category. Core service providers include prime brokers, fund administrators, and accounting and legal firms.

Member – Investor

Event Registration Closed

Non-Member – Investor

Limited space available, please contact Paul at Paul@caasa.ca to register.

Event Registration Closed

Member – Service Provider

Limited space available, please contact Paul at Paul@caasa.ca to register.

Event Registration Closed

Member – Manager

Limited space available, please contact Paul at Paul@caasa.ca to register.

Event Registration Closed

Thank You to Our 2025 Gold Sponsors

Thank You to Our 2025 Silver Sponsors

Thank You to Our 2025 Bronze Sponsors