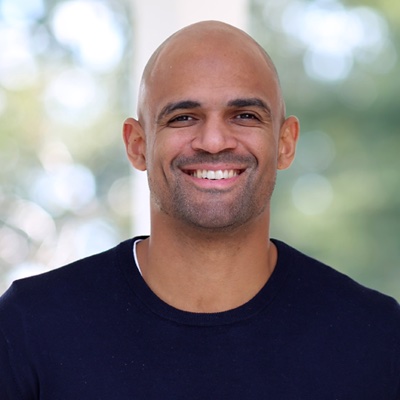

Wendy Diamond

Chief Executive Officer

Women’s Entrepreneurship Day Organization (WEDO)

Wendy Diamond is the CEO / Founder of Women’s Entrepreneurship Day Organization

(WEDO) / #ChooseWOMEN, a non-governmental volunteer organization and global initiative celebrated in 144 countries, and universities/ colleges worldwide with the mission to economically empower WOMEN in business to alleviate poverty.

She is the founder of LDP Ventures (SFO) investing in social impact disruptive technologies and funds making a positive imprint on this world including: Perceptive Capital, Bidversity, OpenGrants, Light Line Medical, Sensorium, EFF Ventures, ASALP, Pocket Network, Producers Market, CoinFund, Basepaws, OP Crypto, Crescent Capital, Valt Fund, Gaingels, Waggit, QuantumRock Technologies, Tooth and Tailz, LOOK Lateral Art, IPWE, Trust Circle, Blocktower Capital, Infinigon Group, SAFE Health, Farma Trust, Breathometer, IGP Energy, Snakt and many more!

Wendy has authored ten widely celebrated books, garnered three Guinness World Records, and has appeared in media outlets including CNBC, Oprah, NBC’s Today Show, Bloomberg, The New York Times and Forbes. She has also been a featured keynote speaker at the United Nations, Davos, and Harvard University.

Wendy sits on the Boards of Ellis Island Honors Society, Global Alliance For a Sustainable Planet (GASP), Girls Club Capital, Global Women in Blockchain, Humane Society of New York, and Grey Muzzle Foundation.

Prior to WEDO, after learning 12 million animals were euthanized annually, Wendy founded Animal Fair Media, Inc the premiere pet lifestyle media platform bridging celebrity and pop culture to support animal rescue/welfare.