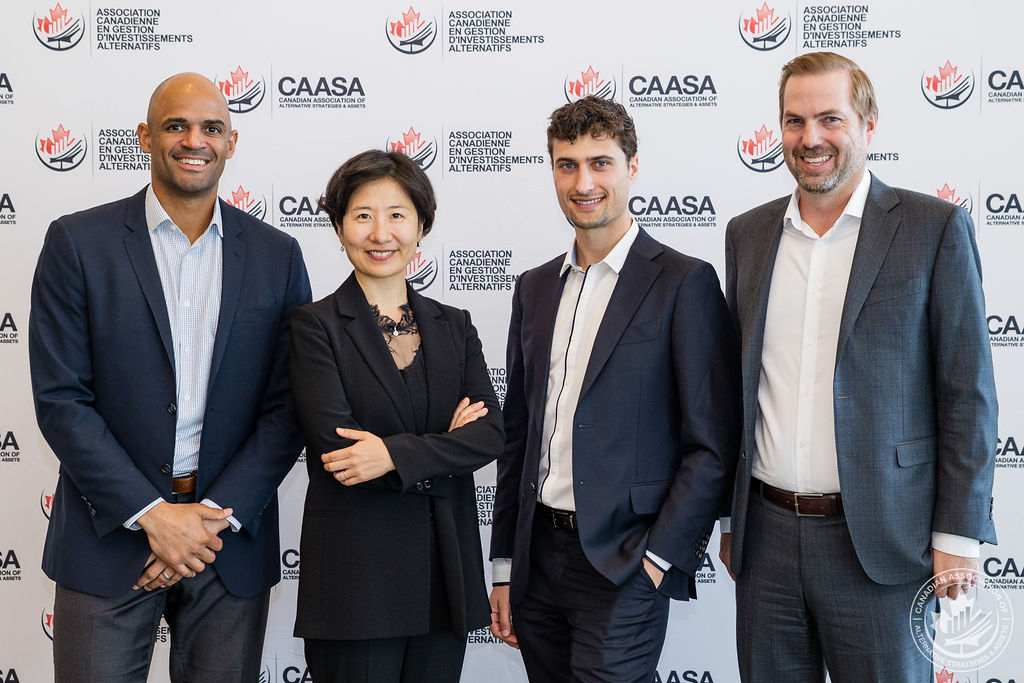

CAASA Alternative Perspectives 2023

Overview

Positioned opposite our CAASA Annual Conference, this program is built for institutional investors and all others as we showcase the talent of alternative managers in our usual, carefully-thought & curated fashion. This will be replete with firesides, NowTalks, panels, and special sessions for all.

Please take a moment to reserve your delegate pass.

Limited Time Only – Delegates are encouraged to use this code for discounted Air Canada flights from May 29 – June 14: J8KEKHQ1

Registration

End Investor means single family offices, and Investment Advisors in the HNW space. Intermediary investors means Multi-family offices and investment consulting companies and +1 means the first delegate is gratis but each additional delegate attracts a small charge. Manager and service provider delegates must be CAASA members in good standing and pay the requisite per person fee for their appropriate sub-category. Core service providers include prime brokers, fund administrators, and accounting and legal firms.

When

- June 5, 2023

- 4:00 pm – 11:00 pm PST

- June 6, 2023

- 8:00 am – 6:00 pm PST

Where

Pan Pacific Vancouver Hotel

Room block available – Contact Alexis at alexis@caasa.ca to make arrangements

Keynote

Scott Wong

Investment Principal

InBC

Wei Liu

Partner

Clocktower Group

Natalia Sokolova

Managing Partner

SGG World

Scott Wong

Investment Principal

InBC

Scott is an Investment Principal at InBC, a $500 million strategic investment fund focused on generating financial returns and achieve social, economic and environmental impact for British Columbia. As an Investment Principal, Scott is responsible for the development of and execution of the investment strategy, while driving InBC’s triple bottom line approach of investing for people, planet and profit.

Scott has over a decade and a half of experience in various finance roles including corporate and investment banking, private equity, investment consulting and real estate. Prior to InBC, Scott spent 10 years at J.P. Morgan, where he led debt capital markets, equity capital markets and M&A transactions for global clients.

Wei Liu

Partner

Clocktower Group

Natalia Sokolova

Managing Partner

SGG World

Natalia Sokolova is widely recognized as a prominent figure in the domains of global entrepreneurship, strategic growth, and innovation. She is a member of a Family Office (SFO) and has served as an industry thought leader and speaker. With an impressive track record spanning over 20 years, she has been instrumental in driving critical initiatives across diverse industries. Natalia’s expertise and passion lie in investing in and advising early-stage technology ventures, with a keen focus on cutting-edge fields such as fintech, defi, video streaming, security tech and AI.

Before her involvement in technology ventures, Natalia spent a decade in capital markets operations including leading Investor Relations for publicly traded companies.

Natalia Sokolova graduated with honors with a dual major in Finance and International Business and graduated Magna Cum Laude from the University of Maryland, College Park. Notably, she achieved this despite facing a life-threatening accident that left her paralyzed at the age of 17. Her determination and passion for life enabled her to overcome the challenges and regain her mobility, even pursuing a successful modeling career. In fact, she was nominated as one of the most beautiful women in the year 2000.

Natalia’s background includes working with renowned organizations such as Elite Models Management, Playboy, John Paul DeJoria’s Group of Companies, Bidz.com, Best Buddies Foundation, and Kick4Life. She has also been involved in the development and implementation of Playboy Licensing strategy, showcasing her expertise in brand management and strategic partnerships.

With a family legacy of inventors and engineers, Natalia’s passion for innovation and entrepreneurship is deeply ingrained. Her grandfather, an esteemed academic and mechanical metallurgical engineering legend, achieved significant recognition for his patents, including winning the Lenin Prize. Following in her family’s footsteps, her mother has also become a professor and a leading expert in the field, with numerous inventions and patents to her name.

Distinguished Speakers 2023

Bondi Kwa

Director, Private Markets Risk Management

BCI

Jessica Wang

Chief Marketing Officer

INP Capital Inc.

Michael Danov

President & Chief Investment Officer

SBP Management

Alex Vallejo Luce

General Partner

Creative Ventures

Tec Han

Chief Investment Officer

Vibrato Capital LLC

Yasir Mallick

Senior Portfolio Manager, Head of Equities and Absolute Return

UBC Investment Management

Guy Pinkman

Two time Presidential Appointee

PBGC Advisory Committee at Pension Benefit Guaranty Corporation (PBGC)

Brad Wise

Senior Vice President & Managing Director, Western Canada

Cameron Stephens Mortgage Capital Ltd.

Daniel Child

Founder, Portfolio Manager

YTM Capital Asset Management

Aly Damji

Managing Partner, Real Estate

Forum Asset Management

Travis Forman

Portfolio manager

Harbourfront Wealth Management

Joshua Leonardi

Managing Director

TD Prime Services LLC

Prateek Alsi

General Partner, Co-Head Venture

Tribe Capital

Heather Hart

Director, Wells Fargo Corporate & Investment Banking

Wells Fargo

John Courtliff

CEO – Partner & Portfolio Manager

ICM Asset Management

Kenndal McArdle

Principal

Pender Ventures

Devon Cranson

President & CEO

Cranson Capital

Vadim Margulis

Managing Partner

Alignment Credit

Bondi Kwa

Director, Private Markets Risk Management

BCI

Jessica Wang

Chief Marketing Officer

INP Capital Inc.

Michael Danov

President & Chief Investment Officer

SBP Management

Michael Danov is president and CIO of SBP Management, a family office specializing in direct and alternative investments. With more than a decade of investment and financial analysis experience, Michael specializes in executing investments focused on public equity opportunities in the alternative, healthcare, metals & mining, cryptocurrency, oil & gas, luxury consumer goods, and technology. He is responsible for advising the operational business on financial matters, growth strategy, and M&A opportunities.

Michael received his BSc in Finance from the College of Staten Island CUNY. Before his presidency at SBP Management, Michael was a senior vice president at the New York City-based Kingston Advisors. He was responsible for increasing several public companies’ visibility with the investor community, strategic consulting, and M&A.

He utilizes his experience as president, CIO, and senior advisor to bring strategic and growth-oriented value to his current portfolio companies. Michael is also a Venture Partner for CerraCapVentures and a Board Member of Bidease. Previously Senior Advisor at Premium Choice, Halcyon Global Opportunities, Asset Management. He has strong relationships with hedge funds, mutual funds, operators, pension funds, family offices, analysts, and bankers, giving him unique access to high-quality deal flow.

Michael provides mentorship to people with career advice, enjoys traveling and visiting new cities, likes to run, and was previously part of the NY marathon in 2017. Currently a member at Edmond J. Safra Synagogue in NY.

Alex Vallejo Luce

General Partner

Creative Ventures

Dr. Luce is an investor, materials scientist, and company builder. He brings over 15 years of operating and investing experience in the areas of climate change, energy transition, and critical technology areas.

Dr. Luce is currently a General Partner at Creative Ventures, a venture capital firm focused on early-stage deep technology investing. He leads the firm’s climate technology focus area and is active across all aspects of Creative Ventures’ business, including deal sourcing, portfolio support, recruiting, personnel management, fundraising, culture, and strategy. He has been involved in over 30 private company financing transactions.

In addition to his work at Creative Ventures, Dr. Luce is passionate about increasing representation of Latino/a investors in the venture capital industry. He is a founding member of VCFamilia, a nonprofit organization dedicated to creating an inclusive environment for current and future Latinx investors. Dr. Luce has also been an active mentor to emerging venture capitalists for both the National Venture Capital Association and LatinxVC.

Dr. Luce holds a M.S. and Ph.D. in Materials Science and Engineering from UC Berkeley where he was a National Science Foundation Graduate Research Fellow and a Berkeley Chancellor’s Fellow. He also holds a bachelor’s degree in engineering physics from the University of Arizona where he was a National Hispanic Scholar.

Tec Han

Chief Investment Officer

Vibrato Capital LLC

Tec is the Chief Investment Officer of Vibrato Capital LLC, a single family private investment office that oversees both tax-exempt and taxable portfolios. Prior to Vibrato Capital, Tec was a senior analyst for Clark Enterprises, the National Railroad Retirement Investment Trust, and Cambridge Associates. Mr. Han graduated from Vassar College with a B.A. in Economics and earned his M.B.A from the Johnson School of Management at Cornell University and the Smith School of Business at Queen’s University through the combined EMBA Americas Program.

Yasir Mallick

Senior Portfolio Manager, Head of Equities and Absolute Return

UBC Investment Management

Yasir Mallick joined UBC Investment Management in 2020 and plays a lead role in sourcing, monitoring, and evaluating external managers across both public and private markets. His investment management responsibilities include direct oversight of the equity program and absolute return program within UBC Investment Management. In addition to manager selection, monitoring, and portfolio construction, Yasir leads and supports various strategic projects including governance, corporate strategy, investment framework, risk and design and implementation of investment related processes and procedures.

Yasir brings over 15 years of investment and risk related experience having worked at PwC, KPMG, Ontario Power Generation and University of Toronto Asset Management. Yasir holds both a Bachelor of Commerce and a Masters of Finance from the University of Toronto. He is a member of the Chartered Professional Accountants of Ontario (CA, CPA) and holds the Chartered Financial Analyst (CFA) and Chartered Alternative Investment Analyst designations (CAIA).

Guy Pinkman

Two time Presidential Appointee

PBGC Advisory Committee at Pension Benefit Guaranty Corporation (PBGC)

Guy Pinkman is Chairman of the City of Lincoln Police and Fire Pension Plan Investment Board in Lincoln, Nebraska. In addition, he was a Captain/paramedic with the Lincoln Fire and Rescue Department for over 30 years. He is a two-time Presidential appointee to the Pension Benefit Guaranty Corporation (PBGC) Advisory board. The PBGC board advises The Secretary of Commerce, Labor, and Treasury on policy, procedure, and investments covering over 34 million Americans with appx 210 billion under management. A graduate of the University of Nebraska-Lincoln. He has completed studies in finance and economics worldwide, including China’s monetary system. Pension systems, institutions, family offices, and consultants worldwide recognize Guy as a subject matter expert and a worldwide speaker on these issues.

Brad Wise

Senior Vice President & Managing Director, Western Canada

Cameron Stephens Mortgage Capital Ltd.

Brad Wise is Senior Vice President & Managing Director, Western Canada for Cameron Stephens and joined the company in 2021. Brad has over 25 years of real estate debt & equity finance, asset management and transaction experience. Prior to joining Cameron Stephens, Brad served 14 years with a Vancouver, BC based real estate private equity investment and asset management firm, serving in the role of President for the past 9 years. Brad has been directly involved in the acquisition, financing and monetization of over $1.2 billion of real estate assets since 2002 across an array of asset classes and geographic markets. Brad holds a Master of Business Administration degree and a Bachelor of Business Administration degree, both from Simon Fraser University, is a registered sub-mortgage broker and a qualified Dealing Representative.

Daniel Child

Founder, Portfolio Manager

YTM Capital Asset Management

After graduating from Ivey Business School, Daniel embarked on a public accounting career. He earned his Chartered Accountancy designation and then changed gears, securing a job as a bond trader at CIBC in 1994. Three years later he moved to Scotiabank Global Banking & Markets where he rose to Head Corporate Bond Trader. He actively traded and made markets for 11 years with responsibility for Scotia’s Canadian corporate bond portfolio and MBS/ABS book. Daniel priced hundreds of new issues and traded billions of dollars of the Bank’s capital in bonds, while employing risk management that allowed him to successfully report to the Bank’s Liability Committee. In 2010 Daniel combined his risk and credit expertise with his entrepreneurial spirit and founded YTM Capital. His vision is to provide investors with income solutions that protect on the downside and optimize the potential for strong risk-adjusted returns.

Aly Damji

Managing Partner, Real Estate

Forum Asset Management

Aly leads Forum’s real estate businesses and has deep expertise in acquisitions, development and asset management across multiple asset classes including hotels, various forms of housing, retail, office and industrial. He has acquired, financed, managed and developed real estate across Canada. He is focused on originations and overseeing real estate investments. He leverages his exposure to a broad range of asset classes as an urban developer, institutional asset manager and operator of value add/opportunistic investments, to drive growth for Forum and its partners.

Aly has transacted and managed on behalf of several institutional, UHNW investors, and believes transparency leads to the sustainability of partnerships. Over the course of his career, Aly has been involved in $4B+ of transactions across North America and has experience managing relationships with pension funds, insurance funds, REITs, and high net worth partners.

Aly holds an MBA specialized in real estate and a bachelors degree specialized in accounting/finance, both from York University. Aly is also a board member of NAIOP Greater Toronto Chapter, one of the commercial real estate industry’s largest advocacy groups, and served as President in 2022.

Travis Forman

Portfolio manager

Harbourfront Wealth Management

Travis Forman is a Portfolio Manager at Strategic Private Wealth Counsel – Harbourfront Wealth Management which has been named one of the fastest-growing wealth management practices in terms of AUM % growth for two years running. Travis holds 25 years of wealth management experience and holds in-depth expertise in the area of alternative investments. He has been instrumental in the development of a collection of private investment pools that span private debt, private real estate, and private equity.

In less than five years and over the course of the pandemic, Travis led the growth of Willoughby Asset Management’s private pools to over $1 billion in AUM.

His mission is to make a difference in the lives of Canadians. He is dedicated to the growth of portfolios owned by retirees, entrepreneurs, and working professionals.

Joshua Leonardi

Managing Director

TD Prime Services LLC

Josh Leonardi is a Managing Director and the U.S. Head of Prime Services Sales and Capital Introduction at TD Securities, which provides customized financing solutions to global hedge funds and specialized capital introduction services to institutional allocators. He joined TD in May 2018 and prior to joining that Josh was at Goldman, Sachs & Co. for 7 years. While there he first served as a Vice President and Assistant General Counsel for the Prime Services business before moving to Goldman’s Capital Introduction team in 2015. Josh began his career at Fried Frank in 2006 where he was an associate in the firm’s Asset Management practice and focused primarily on the structuring and representation of hedge funds. During his time at Fried Frank, Josh spent 2 years as a secondee to Goldman, Sachs & Co. and Goldman Sachs Asset Management. Josh received a B.B.A. in Finance from The George Washington University and his J.D. from New York Law School.

Prateek Alsi

General Partner, Co-Head Venture

Tribe Capital

Prateek is a Partner at Tribe Capital, where he co-leads the ventures team. He brings twenty years of operating and investing experience in the tech industry, in both Silicon Valley and New York.

Prior to joining Tribe Capital, Prateek served as a Partner at General Catalyst for five years, where he assisted in the opening of their San Francisco office and invested in companies such as Stripe, Livongo, Grammarly, Fundbox, Gusto, Bustle, and Digit. He also established General Catalyst’s Stripe ecosystem fund, which invested in startups that extended the Stripe network.

Before joining General Catalyst, Prateek was Director of Distribution Partnerships at Square, where he also built its first sales team. He also held operating roles at AOL and Time Warner Cable, and was a partner at Village Global.

Heather Hart

Director, Wells Fargo Corporate & Investment Banking

Wells Fargo

Heather Hart is a Director within the Wells Fargo’s Capital Introduction team, a part of the Equity Finance team in Wells Fargo’s Corporate & Investment Banking division. Heather joined Wells Fargo from Mariner Investment Group’s Business Development team in 2022 where she was successful capital raising across a variety of Fixed Income strategies on the Mariner platform, including Fixed Income Rel Val Multi-Strat, Credit L/S, Agency & Non-Agency MBS, Distressed Credit, and ABS. Prior to her coverage of Mariner’s broader platform, she headed Investor Relations and actively fundraised for Mariner’s Structured Products team. She started her career in alternative investments at Cello Capital Management, LP in 2014, where she ultimately led both the Business Development and Investor Relations efforts, totaling 8 years of experience as a mortgage and mortgage derivatives product specialist. Heather graduated magna cum laude from the University at Albany with a dual B.A. in French & Political Science.

John Courtliff

CEO – Partner & Portfolio Manager

ICM Asset Management

John Courtliff is Chief Executive Officer and a Partner of ICM Asset Management and a Portfolio Manager of ICM Investment Management Inc.

Mr. Courtliff joined ICM in 2011 and became CEO in 2022. Mr. Courtliff has over 15 years of investment industry experience, beginning his career in investment banking before transitioning to real estate asset and investment management. His experience includes structuring complex domestic and cross-border transactions and investment vehicles, underwriting and closing investment opportunities in the U.S., Mexico and Canada, and portfolio/fund management.

Mr. Courtliff received a Bachelor of Commerce in Finance from the University of Calgary as an Academic All-Canadian, including studies at the Vienna University of Economics and Business, Wirtschafts Universitat Wien and holds the Chartered Financial Analyst designation. In addition to English, Mr. Courtliff speaks French and conversational Spanish.

Kenndal McArdle

Principal

Pender Ventures

Kenndal joined Pender Ventures in 2018 as a founding member of the team. Previously, he worked as a public market analyst on the award-winning Pender Small Cap Opportunities Fund and Pender Value Fund, where he sourced, evaluated, and made recommendations on information technology and health care companies. Prior to joining the investment world, Kenndal was a professional hockey player, enjoying a successful career in the NHL, most notably on the left wing for the Jets and Panthers.

Kenndal’s current board roles include Checkfront, Swift Medical and Spark RE. He is also an active mentor and advisor to up and coming startups. Kenndal is involved with the CFA Society Vancouver and is a board member with Science World Vancouver (ASTC Science World Society). He earned his CFA Charter in 2018.

Devon Cranson

President & CEO

Cranson Capital

In 2006 Devon Cranson founded Cranson Capital, a boutique private equity real estate investment firm based in Toronto. He has deep expertise in all aspects of real estate development, commercial financing, M&A and Securities. He is a Certified Management Accountant (CMA) and Chartered Public Accountant (CPA).

Cranson Capital Securities is an Exempt Market Dealer focused on raising capital from accredited investors for private equity real estate investments. Under Devon’s leadership, Cranson Capital is a 6-time winner of the PCMA’s Deal of the Year Award and has been ranked 49th on the Profit 500 fastest growing companies in Canada. In 2022, the Cranson Capital Real Estate Development Fund was established as a pool of investments in a variety of Southern Ontario based residential real estate development projects.

In addition to leading Cranson Capital, Devon acts as the General Partner/Trustee for 21 residential development projects in the Greater Toronto Area and as a Trustee of a multifamily residential REIT. Devon also sits on the Board of a TSX-listed real estate lending company and a senior’s housing company based in Western Canada.

Vadim Margulis

Managing Partner

Alignment Credit

Mr. Margulis is the Managing Partner of Alignment Credit (“AC”). He founded AC in 2014 to focus on direct lending to underbanked lower middle-market and growth borrowers in North America and globally. He has more than twenty (25) years of experience in private credit and equity investing, corporate finance and strategic advisory, with the leading firms including Equifin Capital, McKinsey, Bear Stearns, KPMG and Accenture. Mr. Margulis received his M.B.A. in Finance from The Wharton School of the University of Pennsylvania, and his Diploma in Mathematics and Computer Science from the Odessa National University in Ukraine. Mr. Margulis has served as the independent director and observer on the Boards of Directors of numerous private companies.

2023 Agenda (work in progress!)

Day 1

- June 5, 2023

- 5:00 pm – 10:00 pm

Day 2

- June 6, 2023

- 8:00 am – 6:00 pm

- June 5, 2023

- 5:00 pm – 10:00 pm

Sponsor, Speaker, & Investor Boat Cruise

5:00 pm

CAASA’s Hospitality Suite

Join us as we kick off the evening with hors d’oeuvres and CAASA’s signature cocktail

5:45 pm

Depart Pan Pacific Hotel

Transportation will be provided

6:30 pm

Boat Departs from Granville Island

Mingle with fellow sponsors, speakers and investors over dinner and take-in the sunset views

10:00 pm

Boat arrives back to Granville Island

- June 6, 2023

- 8:00 am – 6:00 pm

Main Day

8:00 am

Breakfast & Registration

8:15 am

Fireside Chat – An Update on China

More than two years ago, Clocktower penned a piece entitled “China’s Three Traps & Macro Trilemma” detailing the geographical, demographic, and middle-income traps that plague China, as well as is macro trilemma of a highly leveraged private sector, assertive geopolitical aims, and having a manufacturing-led economy. This talk will re-visit this paper (available here: https://www.clocktowergroup.com/research-insights/chinasthreetrapsmacrotrilemma) and provide as update and possibly new prognosis.

As well as hear from a Single Family Office and how they view the opportunities outside of North America more attractive.

Wei Liu, Clocktower Group

Michael Danov, SBP Management

9:00 am

Investors Allocating to Alts

Alternatives are finally seen as less…alternative – and more a must-have for portfolios that seek high risk-adjusted returns as well as those who simply want to have an opportunity to either (i) have higher overall returns, or (ii) lower volatility and shallower troughs, both due to the benefits of low-correlation assets. But how are real investors looking at their portfolio and finding alternatives to fill the gap? This panel will give the audience an glimpse into how many types of investors source, diligence, and size their allocations to alternative strategies & assets.

Moderator:

Joshua Leonardi, TD Prime Services LLC

Panelist:

Tec Han, Vibrato LLC

Yasir Mallick, UBC Investment Management

Bondi Kwa, BCI

9:45 am

1:1 Meetings & Morning Refresher

5 x 15-minute 1:1 meeting

11:00 am

Institutional-Grade Venture

If there is one area on investing that is even more steeped in intrigue and assumed insider information (of the legal sort) than private equity, it is venture investing. Many fund managers/venture capitalists claim to have special relationships, insights, or processes that allow them to access ‘the best deals’ and fund ‘the best founders’; still others provide access to ‘the best funds’. Investors in this space are offered a myriad of options, yet determining the efficacy of a manager/VC is not straight-forward. These panelists will share what they see in the horizon and what investors need to know before investing in the space.

Jessica Wang, INP Capital

Alex Luce, Creative Ventures

Prateek Alsi, Tribe Capital

11:45 am

Real Estate at the Crossroads

Long-hailed as a truly long-term investment portfolio component that can help ameliorate the effects of inflation (thanks to its ability to increase in price as well as increase rents during times of higher prices), real estate can get investors into trouble in times of rising interest rates. Cap(italization) rates take time to adjust to higher prices, and this can put real estate yields in an unfavourable light compared to more liquid options such as government and corporate bonds – leading to a lower price sought by buyers. Investor stress might also be heightened as valuations might fall (as just described) and/or monthly debt-servicing payments increase along with rising borrowing rate. Where is the market now? Hear from this learned and experienced panel to find out!

Moderator:

Travis Forman, Harbourfront Wealth Management

Panelist:

Aly Damji, Forum Asset Management

John Courtliff, ICM Asset Management

Devon Cranson, Cranson Captial

12:30 pm

Lunch & Keynote Fireside

Scott Wong, InBC

Kenndal McArdle, Pender Ventures

1:45 pm

Sponsors’ Table Talks

This session is aimed at providing all event attendees with the ability to join in genuine knowledge exchange and discussion in a small group setting.

Sponsors and topics to be determined and displayed here.

Choose from 2 x 25-minute round table discussions

2:45 pm

NowTalk – Digging out from Under-Funding

Under-funding of pensions is a well-worn weakness of many plans that have over-promised in terms of benefits or investment returns. This has reached perhaps nightmarish proportions as some plans are distributing to retirees up to 12% of their assets each year – and the trend is for this to accelerate vs. ameliorate. Our speaker will give a briefing on the PBGC (Pension Benefit Guaranty Corporation) which is tasked with ensuring that these pensions are funded and provide for the millions of beneficiaries that have or will come to rely on their payments to meet their needs.

Guy Pinkman, Presidential Appointee, PBGC Advisory Committee at Pension Benefit Guaranty Corporation and Trustee, City of Lincoln Nebraska Police & Fire Pension

3:15 pm

An Industry in Flux: Credit and Lending Markets & Investments

Investors have witnessed the multi-decade and inexorable descent of interest rates snap back in violent fashion over the last year or so. Many say they saw it coming, since inflation (brought on by money-printing) was undoubtedly going to require central banks to raise rates, but how many positioned their portfolios to account for this eventuality and how did they fare? This panel will discuss how investors and managers fared, why their returns were what they were, and what investors can do now to prepare for the next leg of the credit cycle.

Moderator:

Heather Hart, Wells Fargo

Panelists:

Daniel Child, YTM Capital Asset Management

Vadim Margulis, Alignment Credit

Brad Wise, Cameron Stephens

4:00 pm

Reception

Reception for all delegates

6:00 pm

End of conference – thank you!

Member – Investor

Event Registration Closed

Non-Members – Investor

Event Registration Closed

Member – Manager

Special CAP pricing includes 2 delegates passes for the price of 1.

Limited time only.

Event Registration Closed

Member – Service Provider & Others

Special CAP pricing includes 2 delegates passes for the price of 1.

Limited time only.

Event Registration Closed

2022 Gallery