CAASA Annual Conference 2023

Our Flagship Conference

Overview

This year’s CAASA Annual Conference, also known as CAC23 is our flagship, premier, and most coveted conference.

In partnership with Bodhi Research Group, founding educational partner, in the CAC series, CAASA is delighted to welcome you back to Montréal from November 7-8, 2023 at Hôtel William Gray.

Air Canada Booking Code for CAC 2023: – Delegates are encouraged to use this code for discounted Air Canada flights (10%-15% – Domestic; 12-15% International) which permits a travel window of 7 days before and 7 days after the event.: NTMRVM61

Who Attends?

The CAASA Annual Conference brings together speakers and participants from private and public pension plans, sovereign wealth funds, single and multi-family offices, consulting firms, investment dealers, Canadian and global investment management houses, and affiliated service providers. Panels and break-out sessions will focus on key issues facing investors and managers in Canada and elsewhere including structuring, legal & tax issues, IT and operational areas, and investments – including: hedge funds, CTAs, private equity, private lending, real estate, infrastructure, and crypto-assets/blockchain-related investments.

All content is subject to Chatham House Rule.

When

Please note that sessions from 11am to 5:50pmNovember 7, 2023 are exclusive to Speakers, Sponsors, and Investors. The Welcome Reception from 5:30pm – 6:30pm is open to all registered delegates of the conference. Due to capacity constraints, we are NOT providing a networking-only option – one must have a full-conference pass to attend any of the sessions.

- November 7, 2023

- 11:00 am – 6:00 pm EST

- November 8, 2023

- 8:00 am – 7:00 pm EST

Where

Hôtel William Gray

Hotel William Gray, 421 Rue Saint Vincent, Vieux-Montréal, QC H2Y 3A62023 Keynotes

Jean-François Pépin

CFA, FRM

Chief Investment Officer – Bimcor

Jim Keohane

Former President and CEO of HOOPP

Pierre Bélanger

Director of Investments – Régime de retraite du personnel des CPE et garderies conventionnées du Québec (RRCPEGQ)

Diana Fu

PhD

Associate Professor – Munk School of Global Affairs & Public Policy and Dept of Political Science, University of Toronto

Jean Turmel

Chair of the board – Nymbus Capital Inc

Jean-François Pépin

CFA, FRM

Chief Investment Officer – Bimcor

Mr. Pépin joined Bimcor in August of 2021 as chief investment officer. In his role, Mr. Pépin oversees the investment activities of the various pension plans for the Bell Canada group of companies. Prior to joining Bimcor, Mr. Pépin was treasurer of Hydro-Québec and in charge of overseeing Hydro-Québec’s pension plan.

Jean-François began his career at Addenda Capital, where he held a number of positions including Trader, senior trader, Vice-President – trading and strategy as well as team leader. From 2012 to 2017, Mr. Pépin was senior vice-president and co-chief investment officer.

Jean-François was an inaugural member of the Bank of Canada’s Canadian Fixed Income Forum (CFIF).

Jean-François has been actively involved in various charities supporting the community such as the Club des Petits déjeuners and La Maison Marguerite.

Jean-François holds a bachelor’s and master’s degree in Business Administration – Finance from the University of Sherbrooke University.

Jim Keohane

Former President and CEO of HOOPP

Jim Keohane is currently a member of the Board of Directors for the Alberta Investment Management Corporation (AIMCo) and was President and CEO of the Healthcare of Ontario Pension plan from 2011 until his recent retirement in March 2020. He joined HOOPP in 1999, bringing more than 25 years of institutional investing experience with several national firms. Mr. Keohane is a frequent speaker on retirement income security and liability driven investing. Jim was the architect of HOOPP’s Liability Driven Investment strategy and is considered a global expert in this area. He is a strong advocate for collective pension schemes and has championed several studies on the topic.

Pierre Bélanger

Director of Investments – Régime de retraite du personnel des CPE et garderies conventionnées du Québec (RRCPEGQ)

Pierre Bélanger is Director of Investments for Régime de retraite du personnel des CPE et garderies conventionnées du Québec (RRCPEGQ), he is responsible for the management of plan assets ($4.0 B).

He has over 30 years of experience in the financial markets.

He has acquired solid expertise in portfolio management, global asset allocation, derivatives trading, financing, structured notes, asset / liability matching and risk management.

During his career, he has recently held the positions of:

– Vice President, Investment Portfolio Management – Fonds de solidarité FTQ

– Vice President – Global Asset Allocation and Special Products – Natcan Portfolio Management

– Senior Manager – Bond Portfolio – Hydro-Québec Pension Plan

Mr. Bélanger holds a Master’s degree in Economics (M.Sc.) and a Bachelor’s degree in Business Administration (B.A.A.) from the École des Hautes Études Commerciales in Montreal.

Mr. Bélanger is a Chartered Director (ASC/C.Dir), having completed the university certification program in corporate governance of the College of Corporate Directors of Université Laval.

Diana Fu

PhD

Associate Professor – Munk School of Global Affairs & Public Policy and Dept of Political Science, University of Toronto

Diana Fu is a nonresident fellow in the John L. Thornton China Center at Brookings and an associate professor of political science at the University of Toronto and director of the East Asia Seminar Series at the Munk School of Global Affairs and Public Policy. She is a Public Intellectuals Fellow at the National Committee on U.S.-China Relations and has been elected to the Royal Society of Canada’s College of New Scholars, Artists, and Scientists.

Her research examines domestic politics in contemporary China, with a focus on civil society, popular protest, state repression, labor, and authoritarian citizenship. She is leading several projects on changes in state and society under the Xi administration, as well as on authoritarian citizenship: what it means to be a “good” versus “bad” citizen in China today. She is author of the award-winning book “Mobilizing Without the Masses: Control and Contention in China.” Based on political ethnography inside labor organizations, it reveals how China’s migrant workers organized for rights without protesting en masse. It received best book awards from the American Political Science Association, the American Sociological Association, and the International Studies Association. Her award-winning articles have appeared in top political science and area studies journals.

Fu’s research and commentary on Chinese politics have been featured in BBC World Service, Bloomberg TV, CBC, Foreign Affairs, Foreign Policy, Reuters, US News & World Report, The Economist, The Financial Times, The Globe & Mail, and The New York Times, among others. She was a television host and script writer for the TVO documentary series, “China Here and Now.”

She holds a Doctor of Philosophy in politics and a Master of Philosophy in development studies with distinction from Oxford University, where she studied as a Rhodes Scholar. She is currently serving as national co-secretary of the Rhodes Scholarship for China. She previously held fellowships at Stanford University and the Massachusetts Institute of Technology.

Jean Turmel

Chair of the board – Nymbus Capital Inc

Jean Turmel, born in Ste-Justine, Quebec, stands as a distinguished figure in the financial and philanthropic realms. With an illustrious career spanning several decades, he has made an indelible mark on the Canadian financial landscape.

Mr. Turmel enjoyed a 25-year career at the National Bank of Canada, where he retired as president of Financial Markets, Treasury and Investment Bank. He also held positions at Merrill Lynch, Royal Securities and Dominion Securities prior to joining National Bank as vice-president, Treasury and Foreign Exchange in 1981.

Jean currently holds the position of Chair of the Board at Nymbus Capital Inc, where his visionary leadership continues to shape the company’s trajectory.

Prior to his current role, Jean played a pivotal role in stewarding the Ontario Teachers’ Pension Plan as its Chairman of the Board from 2015 to 2019, and as a Director and Chair of the Investment Committee from 2007 to 2015. His leadership during this period was instrumental in ensuring the financial security and well-being of countless beneficiaries.

Throughout his career, Jean has garnered numerous accolades, including a Doctorat Honoris Causa from Université Laval and the Queen Elizabeth II Diamond Jubilee Medal.

Beyond his professional achievements, Jean Turmel’s interests span a wide spectrum, from a deep love of music, travel, and the arts to a passion for golf, fishing, hunting, and wine collecting.

What truly sets Jean apart is his unwavering commitment to philanthropy. He has contributed significantly to charitable causes and has served on numerous boards and committees, exemplifying his dedication to making a positive impact on society.

Jean Turmel continues to be a prominent and respected figure, admired not only for his financial expertise but also for his enduring commitment to enhancing the lives of others through his philanthropic endeavors.

2023 Faculty

Ranjan Bhaduri

PhD, CFA, CAIA

Founder and CEO – Bodhi Research Group

Barbara Boucher

MBA

Senior Director, Legal – Derivatives and Financial Markets – CDPQ

Tarik Serri

CFA, CAIA

Senior Director, Hedge Funds & Alternative Investments – Trans-Canada Capital Inc.

Raj Kohli

CFA

Associate Director, Absolute Return Strategies – University Pension Plan

Razvan Tonea

CFA

Director, Public Markets – CAAT Pension Plan

Ju Hui Lee

CFA, CAIA, FSA, FCIA, CERA, FRM

Head of Market Risk – United Nations Joint Staff Pension Fund

Cordell W. Thomas II

Enterprise Risk Management – General Motors Asset Management (GMAM)

Constance Everson

CFA

Managing Director – Capital Markets Outlook Group, Inc.

Christoph Dietrich

Director and Portfolio Manager – OTPP

James Burron

CAIA

Co-Founder & Partner – CAASA

Pierre-Philippe Ste-Marie

Visiting Researcher – Bodhi Research Group

Skip Cooper

Managing Director – Cooper Family Office

Niall Whelan

PhD

Risk Executive – Bodhi Research Group

Stacy Joe

Manager, Operational Due Diligence – University Pension Plan Ontario (UPP)

Erkan Yonder

PhD

Associate Professor of Real Estate and Finance | Chair, Finance Department – John Molson School of Business – Concordia University

Oleg Mogilny

CFA

Managing Director, Public Market Alternatives – IMCO

Matthew J. Freedman

CFA, CAIA

Chief Investment Officer – Louisiana School Employees’ Retirement System

Mingjie Liu

CFA

Portfolio Manager, Pension Investment Department – World Bank Group

Éric Lemieux

Senior Manager, Investment structure management – CDPQ

Annie Sorich

Managing Director, Strategic Planning – PSP Investments

Mohamed Farid

Principal Portfolio Manager / Head of Absolute Return – World Bank Pension Fund

Tolga Cenesizoglu

PhD

Finance Professor – HEC Montréal

Harry Pagel

Senior Vice President – HedgeFacts

Mohamed Khalfallah

Senior Director, Data Science & AI – PSP Investments

Ranjan Bhaduri

PhD, CFA, CAIA

Founder and CEO – Bodhi Research Group

Dr. Ranjan Bhaduri is the Founder & CEO of Bodhi Research Group. Bodhi Research Group is focused on research and education in the alternative investments industry.

Dr. Bhaduri has extensive experience in manager research, portfolio management, and due diligence (investment, operational, and structural). Dr. Bhaduri has designed and implemented an institutional due diligence and research program. Dr. Bhaduri’s experience includes being on an Investment Committee at Morgan Stanley Private Wealth Management where he conducted due diligence and helped design customized portfolios of Alternatives. Earlier, he was at a Canadian Fund of Funds, and at a multi-billion dollar capital management firm where he was involved in all aspects of its fund of hedge funds and structured finance business. He has also worked with two major Canadian investment banks in the Financial Strategy Consulting Group and in Global Risk Management &Control, respectively. He has collaborated closely with many pensions and sovereign wealth funds on a variety of portfolio matters.

Dr. Bhaduri has a winning track record of leadership and training. Several of his former analysts and interns have gone on to have successful careers and have held positions at prestigious organizations, including the following firms: Ontario Teachers’ Pension Plan, Goldman Sachs, J.P Morgan, Exelon Corporate Pension, US Securities and Exchange Commission (SEC), and Crabel Capital Management.

Dr. Bhaduri has held an advisory role at the East-West Center, a leading think tank on the Asia-Pacific region. He has taught finance and mathematics at several universities and lectured on Derivatives for the Montreal Exchange. Dr. Bhaduri has taught parts of the CFA Curriculum for Allen Resources. Dr. Bhaduri has published papers on, and been invited to speak worldwide regarding hedge fund issues, and advanced portfolio and risk management techniques. Dr. Bhaduri was invited by the CME to be part of a special delegation that met with regulators in Beijing and Taipei to discuss hedge fund issues.

Dr. Bhaduri holds both the CFA and CAIA charters. He is a member of the American Mathematical Society, the Mathematical Association of America, and the Toronto CFA Society. Dr. Bhaduri previously served as a member of the All About Alpha Editorial Board, the CAIA Chicago Chapter Executive, on the Board of Directors of AIMA Canada, co-chair of AIMA Canada Managed Futures Committee, and on the AIMA Global Research Committee. Dr. Bhaduri is an avid ice hockey fan and ACBL Silver Life Master in Bridge.

Barbara Boucher

MBA

Senior Director, Legal – Derivatives and Financial Markets – CDPQ

As Senior Director, Barbara Boucher plays a pivotal role in shaping the strategic positioning of Caisse de dépôt et placement du Québec in the financial markets sector, with a particular emphasis on derivatives products. She provides guidance to the organization on issues within this sector and oversees negotiations with market participants, including regulatory authorities.

Ms. Boucher brings over 20 years of experience in the finance industry to her role. Prior to joining the Caisse, she held the position of Head of Derivatives Operations at National Bank of Canada and its subsidiaries. Previously, she worked as a risk management advisor and practiced as a lawyer specializing in labor relations.

In addition to her role as a member of the strategic committee for the $250 million investment fund, Equity 253, which aims to promote diversity and inclusion within SMEs and private technology companies in Quebec and across Canada, she actively participates in investment decisions and contributes to the fund’s strategy.

Ms. Boucher is a member of the Advisory Committee on Derivatives Regulation at the Autorité des marchés financiers (AMF) and represents the Caisse de dépôt on the Canadian Market Infrastructure Committee (CMIC). She also serves on the board of directors of the Montreal North-Central Employment Research Club.

She holds an MBA in Finance and Information Technology from HEC, a Bachelor of Laws degree from the University of Montreal, the title of Chartered Administrators (Adm. A) from the Chartered Administrators Order of Quebec, and accreditation in Civil, Commercial, and Labor Mediation from the Quebec Bar Association. She is also a member of the Quebec Bar Association.

Tarik Serri

CFA, CAIA

Senior Director, Hedge Funds & Alternative Investments – Trans-Canada Capital Inc.

Tarik Serri is Senior Director, Hedge Funds & Alternative Investments at Trans-Canada Capital Inc. (TCC) since 2011. He has cumulated over 18 years of investment experience having previously worked as an analyst and investment advisor at prior institutions. He is responsible for the ongoing management, selection, monitoring and research of TCC’s Hedge Fund and Alternative Investment portfolios including Private Debt, Real Estate, Infrastructure, Co-Investments, etc. Tarik is a voting member of the External Management Investment Committee (EMIC) responsible for the selection & management of the firm’s external managers and asset allocation decisions as well as the assessment of illiquid/liquid co-investment investment opportunities. He serves as an Advisory Board member of multiple external funds across alternative asset classes.

Tarik holds a Bachelor of Commerce degree from Concordia University and a Masters of Business Administration (MBA) from HEC University. He has also completed the Canadian Securities Course offered by the Canadian Securities Institute and is a CFA and CAIA charter holder. He is also a recipient of the NextGen CIO 2019 nomination by CIO Magazine and Hedge Fund Rising Star 2023 by Institutional Investor.

Raj Kohli

CFA

Associate Director, Absolute Return Strategies – University Pension Plan

Raj Kohli, CFA, is Associate Director, Absolute Return Strategies, in the Public Markets division at University Pension Plan (UPP) in Toronto. He is a trusted advisor who provides strategic counsel and leadership on UPP’s absolute return investment strategy, with a focus on fixed income, credit, and discretionary global macro strategies.

Raj has more than 15 years of experience as a portfolio manager, and asset allocator at large financial institutions across North America. He has deep expertise in allocation across traditional and alternative asset classes, with a specialization in hedge funds.

Prior to joining UPP, Raj was Vice President of Multi Asset Class Mandates at Cidel Asset Management in Toronto, with responsibility for the management of discretionary and advisory portfolios for institutional and high net-worth clients.

Raj earned his Professional Master of Science in Financial Mathematics from Worcester Polytechnic Institute in Massachusetts, and his Bachelor of Science (Honors) in computer science and applied mathematics from the New Jersey Institute of Technology.

Razvan Tonea

CFA

Director, Public Markets – CAAT Pension Plan

Razvan Tonea is Director, Public Markets at CAAT Pension Plan. He plays a key role in the management of the public markets program at CAAT, including investment in hedge funds, fixed-income, credit, commodities, currencies, equities and overlay mandates.

Razvan joined CAAT in 2020 and has over 20 years of relevant experience in the financial industry, including senior investment roles at another Canadian pension plan, PSP Investments. Razvan is a CFA charterholder and has an MBA from McGill University.

Ju Hui Lee

CFA, CAIA, FSA, FCIA, CERA, FRM

Head of Market Risk – United Nations Joint Staff Pension Fund

Ju Hui Lee is the Head of Market Risk of UNJSPF (United Nations Joint Staff Pension Fund), responsible for investment risk oversight, asset-lability management, and performance. The fund manages assets of US$84 billion as of 30 June 2023.

Ju Hui’s career spans across various financial institutions, including CPP Investments, Scotiabank, KPMG, Mercer, and Manulife Financial. Her expertise includes asset-liability analysis, factor studies, modelling, pension investment strategy development, risk management activities, and actuarial valuation reporting.

Ju Hui holds a BSc in Mathematics, an MBA from Yonsei University in Korea, and an MSc in Financial Mathematics from the University of Chicago. Ju Hui holds CFA, CAIA, FSA, FCIA, CERA, and FRM designations.

Cordell W. Thomas II

Enterprise Risk Management – General Motors Asset Management (GMAM)

Cordell currently serves within General Motors Asset Management’s (GMAM) Enterprise Risk Management team; and is responsible for leading operational due diligence reviews on both alternative and traditional asset managers within GM’s Defined Benefit and Defined Contribution plans across the US, Canada, Belgium, and the UK. Prior to GMAM, Cordell worked at Mercer Sentinel, Mercer Investments’ operational due diligence consulting group. While at Mercer Sentinel, Cordell performed operational due diligence on alternative and traditional asset managers for both external and internal clients. During his over 20 years experience in the asset management industry, Cordell has served in various roles within reputable firms including Morgan Stanley Fund Services, Citco Fund Services, Société Générale and BNY Mellon Wealth Management. He has worked with both alternative and traditional asset managers of various sizes, strategies and geographic locations including North America, Europe, and Asia.

Constance Everson

CFA

Managing Director – Capital Markets Outlook Group, Inc.

Constance M Everson, CFA, Managing Director Capital Markets Outlook Group, Inc.

Connie Everson is Managing Director of the economic & investment strategy consulting firm, Capital Markets Outlook Group (CMOG) in Boston, which she founded with a colleague in 1992. The firm has managed to identify every major turning point for major asset classes since its founding. Connie is represented on the CFA Institute Speakers Bureau, and is a past- president of the Boston Economic Club. She serves on the investment committee of Mass PRIM, the pension fund for public employees in Massachusetts, and investment and audit committees of the Weredale Foundation in her native Montreal.

Christoph Dietrich

Director and Portfolio Manager – OTPP

Christoph Dietrich is a Director and portfolio manager in OTPP’s External Managers Group, focusing on liquid absolute return investments. His main areas of expertise are quantitative equity and futures, commodities and derivatives relative value. Prior to joining OTPP he spent eight years on the sell-side with a primary focus on structuring commodity quantitative strategies and volatility relative value strategies at Bank of America Merrill Lynch. Christoph earned a master’s degree in Finance from Sciences Po Paris.

James Burron

CAIA

Co-Founder & Partner – CAASA

James co-founded CAASA in response to industry support for a Canadian alternatives association to serve all aspects including: hedge / alternative strategies; private lending; private real estate; private equity; plus emerging areas where Canada is a leader such as digital assets / blockchain and robo-advisors.

Prior to CAASA, James was the Chief Operating Officer of AIMA Canada where his team of three worked with 12 committees to produce 50-60 events per annum across Canada, organize 100+ committee meetings, and increase member numbers over his 7-year tenure from 66 to 164 corporate entities.

James also has experience in research and writing for the CAIA Association as well as serving on CAIA’s Exam Council and as a grader for the Level II portion of the exam. He also had roles in institutional sales and FoHF structuring in Seoul, South Korea, as a Product Manager at ICICI Wealth Management, and an Investment Advisor at RBC Dominion Securities. He graduated from Simon Fraser University with a BBA (Finance).

Pierre-Philippe Ste-Marie

Visiting Researcher – Bodhi Research Group

Pierre-Philippe Ste-Marie, financial executive with 25 years of experience in the financial industry working with fixed income and cross asset absolute returns teams. He has initiated and successfully unwound absolute returns and indexed portfolios and managed Canadian, US and European cross asset exposure levered and unlevered as a team leader (CEO, CIO) as well as a portfolio manager. Prior to joining Bodhi Research as a Visiting Researcher, Pierre-Philippe was Optimum Asset management Co-CIO until March 2022. During his tenure he implemented global management and global execution bringing American, European and Canadian teams under the same investment process with cross trading agreements. Prior to joining Optimum, he founded and was Chief Executive Officer of Razorbill Advisors, a Montreal-based investment management firm focused on fixed income, absolute return, total return and relative-value strategies. From 1997 to 2013, he worked for National Bank of Canada, first as a fixed income option modeller, then as a market maker, eventually rising to become a Managing Director, leading a team specialized in quantitative credit modeling and investments.

Skip Cooper

Managing Director – Cooper Family Office

Skip Cooper is a first-generation member of the Cooper Family Office. Skip oversees risk management, portfolio allocation and back office operations. In addition to the office’s US-based alternative investing, his primary focus for the family office is investment internationally: in private equity, hedge funds, real estate and direct opportunities. Mr. Cooper is an honors graduate of Princeton University.

Skip Cooper is a member of the NYU Stern Family Office Council and the Stanford University Global Projects Center Global Investor’s Forum. Skip speaks regularly at family office and investment conferences around the world, often addressing the topic of global investing for US family offices.

Niall Whelan

PhD

Risk Executive – Bodhi Research Group

Niall Whelan is a risk executive with over twenty years experience implementing new and emerging industry practices and regulations. He is a trusted change agent, experienced at leading complex cross-functional initiatives. Areas of specialisation include climate scenario modelling, enterprise risk, enterprise stress testing, credit modelling for IFRS 9 and CECL, and models for market and counterparty credit risk. Niall is a thought leader who has presented in industry forums, has led training sessions, has published peer-reviewed papers, and teaches the next generation of risk leaders.

He has been a trusted mentor and coach for numerous individuals throughout his career, many of whom are now in senior roles across the industry. Niall coordinates the risk course at the Master’s of Mathematical Finance at the University of Toronto as well as serving on the academic advisory board of the Masters of Quantitative Finance at the University of Waterloo.

Prior to joining forces with Bodhi Research Group, Niall spent over 20 years at the Bank of Nova Scotia leading teams involved in various aspects of risk. Previously he was an academic researcher, investigating the boundary between classical and quantum physics. He is the author of dozens of research papers which have garnered thousands of citations. His research took him to leading research institutes in Copenhagen and Paris.

He holds a PhD in theoretical physics from Yale University.

Stacy Joe

Manager, Operational Due Diligence – University Pension Plan Ontario (UPP)

Stacy Joe is UPP’s Manager, Operational Due Diligence, responsible for conducting initial and ongoing operational due diligence on UPP’s current and prospective investment managers across asset classes, including hedge funds, private equity, real estate, and infrastructure.

With expertise across operational risk and controls, Stacy is a trusted partner to UPP’s Investment, Responsible Investing, and Compliance teams, and has contributed to establishing and implementing UPP’s inaugural Operational Due Diligence program.

Prior to joining UPP, Stacy held roles as an investment analyst and consulting analyst at Mercer. She holds a Bachelor of Engineering Science in Civil Engineering from Western University and an Honours Business Administration (HBA) from Ivey Business School.

Erkan Yonder

PhD

Associate Professor of Real Estate and Finance | Chair, Finance Department – John Molson School of Business – Concordia University

Dr. Erkan Yönder is an Associate Professor of Real Estate Finance and serves as the Chair of the Finance Department at John Molson School of Business, Concordia University.

With a primary focus on real estate finance, Erkan’s expertise lies in commercial real estate, commercial mortgages, and sustainable real estate. His recent works mainly focus on the critical intersection of climate issues in the real estate industry. Erkan’s research has found its way into esteemed academic journals, including publications in the Review of Finance and Real Estate Economics.

His projects have secured multiple grants from renowned institutions such as the National Pension Hub (NPH), Real Estate Research Institute (RERI), and the European Public Real Estate Association (EPRA). Notably, his research earned him the Nick Tyrrell Real Estate Research Prize in the UK and the distinguished Best Published Article Award from Principles for Responsible Investment (PRI), a United Nations-supported initiative.

Erkan has had the privilege of presenting his scholarly work at some of the world’s leading universities, including MIT, Yale University, the University of California, Los Angeles (UCLA), and Cornell University.

Erkan received his PhD degree in Finance and Real Estate at Maastricht University in 2013.

Oleg Mogilny

CFA

Managing Director, Public Market Alternatives – IMCO

Oleg Mogilny is Managing Director of Public Market Alternatives. He heads IMCO’s investments in hedge fund strategies, Insurance Linked Securities, royalties and other strategies with an objective to deliver diversification and absolute returns. Oleg has over 20 years of experience in research and portfolio management of multi-asset portfolios. Prior to joining IMCO in 2019, Oleg led the Quantitative Strategies and Research group at Ontario Teachers’ Pension Plan (OTPP). In this role he was responsible for systematic absolute return strategies, quantitative investing in equities and investment-focused data science initiatives. Oleg’s other roles during his 16-year career at OTPP included managing equity portfolio strategy, hedging and thematic investing, research and implementation of macro strategies, portfolio construction and asset allocation research.

Oleg holds an MBA from McGill University and a Master’s degree in Economics from Kyiv School of Economics. He is a CFA charterholder.

Matthew J. Freedman

CFA, CAIA

Chief Investment Officer – Louisiana School Employees’ Retirement System

Matt joined LSERS as CIO in 2017, where he is responsible for managing the System’s $2 billion investment portfolio.

Prior to LSERS, Matt worked at Landseer Advisors, a New York–based OCIO firm primarily serving endowment and foundation clients, where he was a generalist investing across asset classes and strategies globally.

Before Landseer, Matt was a Vice President at investment technology firm Novus. He began his career at State Street advising institutional clients on asset allocation, manager selection, and portfolio risk management. He holds a M.S. in Finance from Boston College, a B.A. in Political Science and Government from Washington University in St. Louis, and both the CFA and CAIA charters.

He is a member of the Investment Committee at The National WWII Museum in New Orleans.

Mingjie Liu

CFA

Portfolio Manager, Pension Investment Department – World Bank Group

Mingjie Liu is a Portfolio Manager at the Pension Investment Department of the World Bank Group. She is responsible for managing the Absolute Return, long-only Developed Equities, and Opportunistic portfolios. Mingjie joined the World Bank in 2020. Prior to joining the World Bank, Mingjie worked at Duke Management Company (DUMAC) for 4 years.

Mingjie holds a Master of Economics degree from Duke University and she is a CFA charterholder.

Éric Lemieux

Senior Manager, Investment structure management – CDPQ

Éric Lemieux is Senior Manager, Investment structure management at Caisse de dépôt et placement du Québec (CDPQ). His role is to ensure that all structure, business and operational risks are assessed and mitigated, both in the pre– and post–investment phases, as well as

to negotiate and support deal implementation.

Éric has held other positions at CDPQ, including Managing Director Funds, Private Markets. Éric joined CDPQ in 2009 and has previously worked at National Bank of Canada and Royal Bank of Canada. Eric holds a BSc and a BAA from Sherbrooke University.

Annie Sorich

Managing Director, Strategic Planning – PSP Investments

Annie Sorich is Managing Director, Strategic Planning, at the Public Sector Pension Investment Board (PSP Investments). She is responsible for facilitating the constant evolution and execution of PSP’s corporate strategy, ensuring strategic decisions enhance PSP’s market positioning and corporate effectiveness. She also oversees PSP’s annual planning process. With over 18 years of experience in the financial services industry, Annie has deep industry knowledge and expertise in public and private markets as well as technology and data.

Prior to joining PSP Investments in 2018, Annie worked at a cybersecurity start-up and spent six years at the Charter School Growth Fund, the largest impact investment fund focused on public education in the United States. She started her career at Morningstar, Inc., where she was a mutual fund and equities analyst and worked on cutting-edge data projects.

Annie holds an MBA with Honors from the University of Chicago Booth School of Business, and attended Oberlin College, where she received her Bachelor of Arts degree in biology, Phi Beta Kappa.

Mohamed Farid

Principal Portfolio Manager / Head of Absolute Return – World Bank Pension Fund

Mohamed Farid is a Principal Portfolio Manager / Head of Absolute Return Strategies at the World Bank Pension Fund, managing over $4 billion of Absolute Return Strategies portfolio. Mohamed has over 23 years of experience investing directly in hedge funds and is an active member of Investment Committee at the Pension Plan portfolio. Mohamed has opportunistically co-invested with some hedge fund managers and implemented internal hedging strategies.

Prior to joining the World Bank Pension Plan, Mohamed worked for Deloitte & Touche and KPMG financial consulting groups in Toronto, Canada, Washington D.C, Egypt and Thailand where he led acquisitions and bankruptcy engagements for leading clients in North America and Asia. Mohamed started his career in commercial banking. He holds a master’s degree from the Johns Hopkins University in International Economics and Political Science as well as a Master’s degree in Banking and Finance from Finafrica Foundation in Milan, Italy.

Tolga Cenesizoglu

PhD

Finance Professor – HEC Montréal

Tolga Cenesizoglu is a finance professor at HEC Montreal, where he has been since 2006. He currently serves as the Director of the Canadian Derivatives Institute, an institute specializing in research and training programs in finance, particularly in derivatives. Prof. Cenesizoglu is also involved with the BNI-HEC Montreal Fund, overseeing $5.5 million in student-run assets.

He held positions as an associate professor of finance at Alliance Manchester Business School, adjunct faculty at Warwick Business School, and visiting faculty at London School of Economics and Political Science. He earned his Ph.D. in economics from the University of California, San Diego (UCSD), along with an M.Sc. in statistics, an M.A. in economics from UCSD, and a B.Sc. in industrial engineering from Bogazici University, Turkiye.

Prof. Cenesizoglu currently teaches Portfolio Management in the M.Sc. in Finance and Financial Engineering programs at HEC Montreal. He has also taught courses in empirical methods in finance, investments, and corporate finance at various academic levels. His research interests encompass empirical and theoretical asset pricing, financial econometrics, forecasting, machine learning, and market microstructure. His scholarly work has been published in respected journals such as Management Science, Journal of Financial Econometrics, Journal of Banking and Finance, Journal of Empirical Finance, Journal of Financial Markets, Journal of Financial Research, International Journal of Forecasting, Journal of Forecasting, Energy, and Macroeconomic Dynamics.

Harry Pagel

Senior Vice President – HedgeFacts

Mohamed Khalfallah

Senior Director, Data Science & AI – PSP Investments

Mohamed Khalfallah is Senior Director, Data Science & AI at PSP Investments. He joined PSP in January 2020 and has focused on developing and deploying solutions to both improve productivity and decision-making processes across PSP investment activities. Mohamed and his team are responsible for multiple internal AI/ML products, including ML predictive models used in public and private market investing as well as generative AI tools.

Before stepping into his role at PSP Investments, Mohamed spent 13 years as leading and building ML/AI products in multiple industries, including asset management, P&C insurance, e-commerce, and retail. His work on delivering AI tools has spanned continents, having led projects in Europe, Asia, and North America for small and large companies.

Mohamed holds a master’s in engineering from ISIMA (France) and a master’s in Asset Management from Paris-Dauphine University (France).

2023 Agenda

Please note this agenda is subject to change.

Day 1

- November 7, 2023

- 11:00 am – 6:30 pm

Day 2

- November 8, 2023

- 8:00 am – 6:00 pm

- November 7, 2023

- 11:00 am – 6:30 pm

Day 1 – Sponsors, Speakers & Investors Only + General Reception

11:00 am

Registration Opens – Sponsors, Investors, & Speakers ONLY

We welcome all CAASA members who are sponsors of the event as well as all speaker and investors (e.g., those employed by pensions, E&Fs, SWFs, single family offices, and certain wealth managers).

All other registered delegates are welcome to the General Reception in the evening.

12:00 pm

Welcome Remarks, Lunch & Content

Sponsors, Investors, & Speakers Only

Welcome to the Sixth CAASA Annual Conference in Montreal!

The growth of CAASA has occurred much because of the success of this event and this is due a great deal to the talent and hard work of Ranjan Bhaduri of Bodhi Research Group who organizes our programming for this (and predecessor events at another organization), our flagship, conference.

James Burron, CAASA

Dr. Ranjan Bhaduri, Bodhi Research Group

12:15 pm

Lunch Keynote – CIO Corner: Benchmarking and asset allocation in a volatile market

Sponsors, Investors, & Speakers Only

In a period of cross asset correlation breakdown and high sectoral volatility, both asset allocation needs to be re-examined and benchmarking, which is the foundation on which asset allocation is built, also deserves serious thought. Jean-Francois Pepin and Pierre Belanger, two veteran CIOs, provide their insights on asset allocation and benchmarking.

In a period of cross asset correlation breakdown and high sectoral volatility, both asset allocation and benchmarking, the foundation on which asset allocation is built, deserve to be re-examined evaluated. Jean-Francois Pepin and Pierre Belanger, two veteran CIOs, provide their insights on asset allocation and benchmarking.

Pierre-Philippe Ste-Marie, Bodhi Research Group

Pierre Bélanger, Régime de retraite du personnel des CPE et garderies conventionnées du Québec (RRCPEGQ)

Jean-François Pepin, Bimcor

1:30 pm

Table Talks (managers) – Two x 25min session

Sponsors, Investors, & Speakers Only

Table Talks from the following sponsors:

Table 1 – Lyxor Asset Management

The Case for Investing in Diversifying Strategies Through a Managed Account Platform

Table 2 – Group RMC

Understanding Real Estate Royalties – Creating wealth from the ground up

Table 3 – Romspen Investment Corporation

Ask us Anything

Table 4 – HGC Investment Management

Ask us Anything

Table 5 – Cameron Stephens Equity Capital

The State of the Multi-Family Residential Real Estate Market in Canada

Table 6 – Capital Fund Management

Accessing alpha through multi-strategy futures strategies

Table 7 – Clifton Blake

Opportunities in Real Estate Thanks to Higher Rates

Table 8 – Cross Ocean Partners

The growing wave US and European bank sales of illiquid debt

Table 9 – Highbrook Investors

Barbell Opportunities in US & European Real Estate

Table 10 – Metori Capital Management

Using correlation in portfolio construction: does it add or destroy value?

Table 11 – MGG Investment Group

Why U.S. Non-sponsored Lending is Entering a Golden Era as Regional Banks Retrench

Table 12 – Farm Lending Canada

Planting Prosperity: The Canadian Agricultural Debt Market

Table 13 – Patrizia

Infrastructure Debt: A Formidable Friend in Turbulent Times

2:30 pm

Keynote – China’s Rise as Superpower: Deciphering Beijing’s Domestic Politics

Sponsors, Investors, & Speakers Only

The rivalry between China and the United States has come to a head. Western leaders talk of economic de-risking while Beijing speaks of the need to restore stability in trade relations. How did China transform from a poor, developing country to become the world’s second largest economy in the first place? How does the Chinese Communist Party maintain control over society and what are the political risks associated? As Canada navigates one of the thorniest periods in its relationship with China, it is imperative to take a deep dive into Beijing’s domestic politics. This Keynote lecture will take you there.

Dr. Diana Fu, Munk School of Global Affairs & Public Policy and Dept of Political Science, University of Toronto

3:15 pm

Quantum Computing Applied to Portfolio Management

Sponsors, Investors, & Speakers Only

With the rise of GPT and other language models, we have seen an immense interest in the AI space and its potential impacts on finance. We discuss another developing technology with the threat of being equally as disruptive: quantum computing. From breaking encryption to accelerating the speed of portfolio optimization, quantum computing is a challenge, but has the potential for increased advancement.

Dr. Niall Whelan, Bodhi Research Group

3:45 pm

Afternoon Break

Sponsors, Investors, & Speakers Only

Quick refresher before we get back to more great content!

4:00 pm

Absolute Return Portfolios

Sponsors, Investors, & Speakers Only

With increased uncertainty in the long-only markets, absolute return portfolios may play an even more prominent role in total portfolios. This panel of esteemed PMs discuss different strategies, their portfolio priorities, and portfolio construction techniques.

James Burron, CAASA

Raj Kohli, University Pension Plan Ontario (UPP)

Oleg Mogilny, Investment Management Corporation of Ontario (IMCO)

Razvan Tonea, CAAT Pension Plan

Christoph Diedrich, Ontario Teachers’ Pension Plan (OTPP)

4:45 pm

Effective Risk Management

Sponsors, Investors, & Speakers Only

This expert panel will examine risk management in a multidisciplinary and multidimensional manner. Preventive risk management via operational due diligence pre-investment in both public and private markets, legal & regulatory risk, reputation risk, market risk, and geo-political risk will be examined.

Harry Pagel, HedgeFacts

Stacy Joe, University Pension Plan Ontario (UPP)

Barbara Boucher, Caisse de dépôt et placement du Québec (CDPQ)

Ju Hui Lee, United Nations Join Staff Pension Fund

Cordell Thomas II, General Motors Asset Management (GMAM)

5:00 pm

Registration Opens for All Delegates

5:30 pm

General Welcome Reception

All registered delegates are invited to this opportunity to meet and perhaps begin a more fulsome evening.

6:30 pm

End of day

We suggest that delegates use the conference messaging app to reach out to fellow conference goers if they wish to arrange other meetings/dinners.

The conference app will open on October 31st.

CAASA staff NEVER provide individuals’ contact information.

- November 8, 2023

- 8:00 am – 6:00 pm

Day 2 – All Delegates

8:00 am

Registration & Breakfast

Please arrive during this 30 minutes so we can start on time and keep to our busy schedule.

8:30 am

Opening Remarks & Curriculum Overview (for all delegates)

We’ll give you a brief overview of the day and how we created the curriculum for the day.

James Burron, CAASA

Dr. Ranjan Bhaduri, Bodhi Research Group

8:45 am

Economic Outlook – The Holy Grail: A normalized investing environment

We may all have forgotten what a normal investing environment used to look like: Positive real rates, an upward sloping yield curve, inflation that stabilized at relatively low levels, and the key to it all: sustained higher economic growth. Stock market leadership could be geared to current earnings, fueled by sustained economic growth, rather than mega-cap tech relying on sustained earnings growth.

Could equity leadership finally change? This session will be a discussion of factors required, and developments to watch for.

Constance Everson, Capital Markets Outlook Group, Inc.

9:15 am

Keynote – Legends Lounge with Jim Keohane

Jim Keohane, retired President and CEO of HOOPP, and current Board Member of AIMCO and Trans-Canada Capital, was the architect of HOOPP”s Liability Driven Investing. In this exciting CAASA session, Mr. Keohane will share his insights on inflation and provide nuggets of wisdom.

Dr. Ranjan Bhaduri, Bodhi Research Group

Jim Keohane, Former President and CEO of HOOPP

10:00 am

Private Eye

With an eye towards the privates, these industry experts, with different lenses, confer on its current state.

Annie Sorich, PSP Investments

Skip Cooper, Cooper Family Office

Eric Lemieux, Caisse de dépôt et placement du Québec (CDPQ)

Tarik Serri, Trans-Canada Capital

10:45 am

1:1 meetings

This is everyone’s opportunity to meet – either as established via our conference meeting & messaging app or ad hoc. We do not require a minimum number of meetings/interactions and encourage everyone to network at their own pace.

11:45 am

Machine Learning in Portfolio & Risk Management

This session dives into machine learning and its role in portfolio and risk management.

Dr. Niall Whelan, Bodhi Research Group

Dr. Tolga Cenesizoglu, HEC Montréal

Mohamed Khalfallah, PSP Investments

12:15 pm

Climate Change in Real Estate

Rising carbon levels have led to a surge in climate-related risks, which has injected significant uncertainty into financial markets, particularly physical assets, such as real estate and financial instruments that possess geographical components. This presentation will shed light on the latest evidence regarding these risks and provide valuable insights into managing climate-related financial uncertainties in real estate.

Dr. Erkan Yonder, John Molson School of Business – Concordia University

12:45 pm

Lunch Keynote – Legends Lounge II: The evolution of the Canadian derivatives market

The Canadian derivatives market has grown leaps and bounds since its origins in the 1980’s. Join us as Jean Turmel, a legend of the Canadian investment industry, brings us through its history and provides us with a vision of what could be its future.

Pierre-Philippe Ste-Marie, Bodhi Research Group

Jean Turmel, Nymbus Capital

Lunch served until 1:15pm only. Keynote will be approximately 45 minutes.

2:00 pm

Table Talks (service providers) – Two x 25min session

Come join the discussions with the following CAASA members:

Table 1 – Preqin

The Future of Alternatives

Table 2 – Polymath

Tokenization: Why is Larry Fink so excited?

Table 3 – Sandbox Ltd.

Using interactive, visual technology to uncover unique fund attributes and build better portfolios

3:00 pm

Portfolio Perspectives: Navigating uncertainty in the current environment

This panel examines current opportunities and challenges in managing a portfolio through these turbulent times.

Dr. Ranjan Bhaduri, Bodhi Research Group

Mohamed Farid, World Bank Pension

Matt Freedman, Louisiana School Employees’ Retirement System

3:30 pm

1:1 meetings

This is everyone’s opportunity to meet – either as established via our conference meeting & messaging app or ad hoc. We do not require a minimum number of meetings/interactions and encourage everyone to network at their own pace.

4:30 pm

Closing Reception

Thank you for being a part of this year’s CAASA Annual Conference. We encourage those who are not otherwise engaged (e.g., heading to the airport) to find a friend and enjoy all that Montréal has to offer!

6:00 pm

End of Conference

Until next year!

Registration

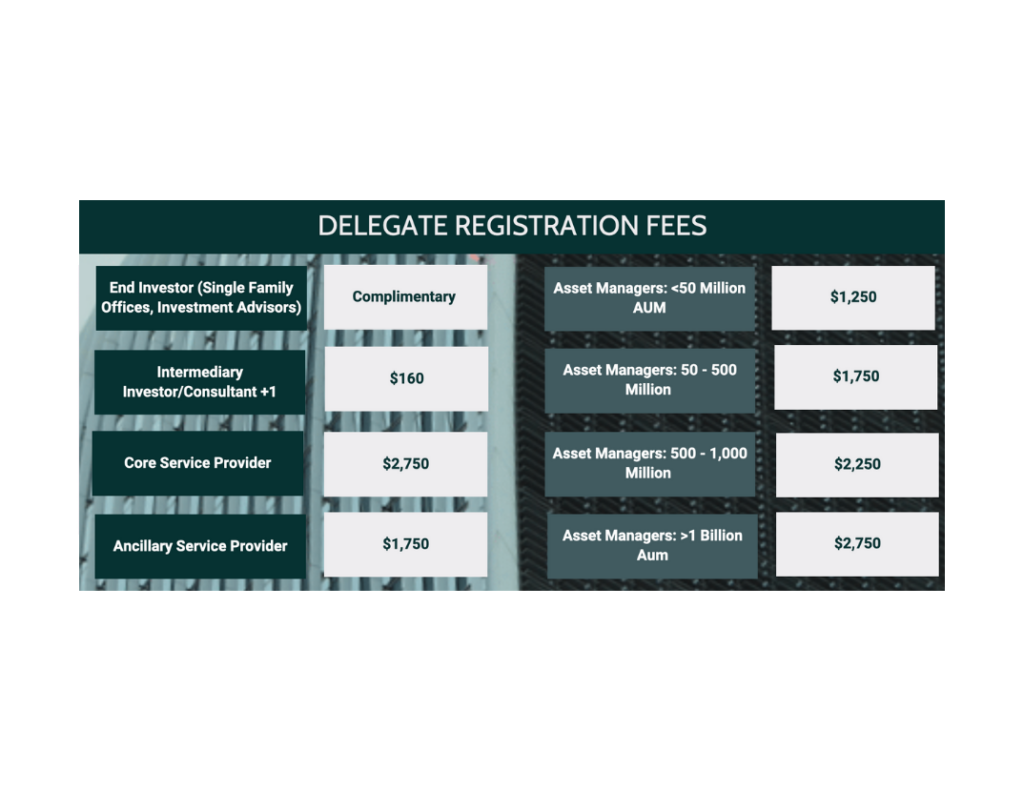

End Investor means pensions, foundations/endowments, sovereign wealth funds, and single family offices. Intermediary investors means Multi-family offices, investment advsiors/dealers, wealth managers, and investment consulting companies and +1 means the first delegate is gratis but each additional delegate attracts a small charge. Manager and service provider delegates must be CAASA members in good standing and pay the requisite per person fee for their appropriate sub-category. Core service providers include prime brokers, fund administrators, and accounting and legal firms.

Member – Investor

Complimentary Registration for End Investors

Event Registration Closed

Non-Member – Investor

Complimentary Registration for End Investors

Event Registration Closed

Member – Service Provider

Event Registration Closed

Member – Manager

Event Registration Closed

Should you wish to register for this event, please contact Paul Koonar at paul@caasa.ca for additional information.

2023 Gallery