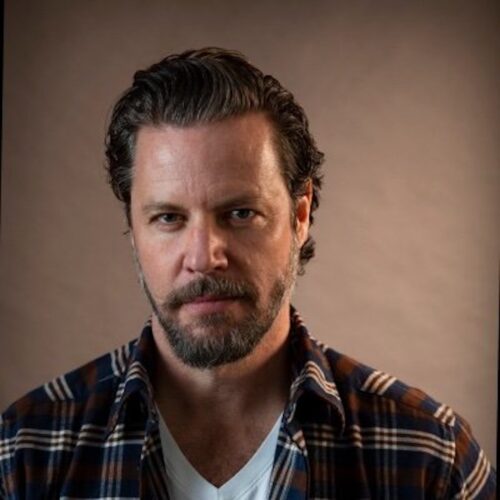

Ian Morley

Chairman

Wentworth Hall Consultancy Ltd

Ian Morley is a successful business Angel and Entrepreneur.

He is the Chairman of Wentworth Hall Family Office and Consultancy, Chairman of Atitlan YRD, an award winning Crypto Multi Manager. Chairman of Salutem Senior Living, Chairman of Regenerative Medical Group, NED at Conister Bank, NED at CF@L, Director of Condor Trade and also holds various Directorships with a range of other companies covering Property, Alterantive Energy, Farmland ,Blockchain and Crypto currencies.

He is the author of Morley’s Laws of Business and Fund Management and one of the leading global figures and pioneers in the development of the Hedge Fund Industry. He ran one of Europe’s first and oldest Fund of Funds and subsequently helped build one of Europe’s largest privately-owned Fund of Funds. He has helped build, manage, own, buy, sell and mentor start-up businesses over the last twenty years. He founded and was elected the first Chairman of what is today known as The Alternative Investment Management Association (AIMA), the world’s only truly global trade association for the Hedge Fund Industry. He has advised Central Banks, International Regulators and other International Organisations such as the EU and OECD on matters related to Economics, Markets and Regulation. He is actively involved in Family Office conferences and networks.

His articles have been published in such papers as The London Times, FT, International Herald Tribune and various trade publications. He has appeared frequently on BBC, radio and TV, Sky, CNN, CNBC, Bloomberg and various international TV and radio stations.

Ian trained as an Economist at LSE where he was Vice President of the Students Union. He is a member of Gray’s Inn and one of the few fund managers to be accredited as a journalist.

Ian served as a battle medic with a MASH unit and has completed sixteen International Marathons, one hundred and fifty Half Marathons and competed in weight lifting and dancing competitions. He was the London Theater Correspondent for the Irish Stage and Screen. He has also written about Running and Building a house in Italy for Italy Magazine. His other interests include boating, football, politics and philanthropy. He lives in London with his dog, cat and sometimes his children.