CAASA Alternative Perspectives 2025: Private Market Focus

Overview

Now in its second year, this one-day forum brings together institutional investors, family offices, GPs, asset managers, and service providers active in real assets, private equity, venture capital, infrastructure, and private lending. Building on an expanded 2024 program, the 2025 edition will deliver even richer content, sharper analysis, and broader networking opportunities—designed to elevate real-world investing strategies across the private markets.

MSC Cruises Get-away Give-away 2025

We are happy to partner with MSC Cruises for a super prize to be awarded to one of our event attendees (must attend and complete a ballot to be eligible).

Draw will occur at our Networking Night on October 7, 2025.

*Subject to travel restrictions, all details provided to the lucky winner upon receipt.

Where

Borden Ladner Gervais LLP

Bay Adelaide Centre, East Tower, 22 Adelaide St W #3400, Toronto, ON M5H 4E3Keynote Speakers

Maria Clara Rendon

Senior Director, Responsible Investing

University Pension Plan Ontario (UPP)

Miles Bloom

Investment Leader, Private Infrastructure Americas

Partners Group

Maria Clara Rendon

Senior Director, Responsible Investing

University Pension Plan Ontario (UPP)

Maria Clara Rendon is a noted responsible investing specialist, with more than 12 years of experience in the assessment and management of environmental, social and governance (ESG) factors in a wide variety of industries. Her work focuses on the implementation of responsible investing practices by asset owners and managers in both North America and Latin America.

As Senior Director, Responsible Investing at University Pension Plan Ontario (UPP), Maria Clara supports the development and execution of UPP’s Responsible Investing (RI) strategy. She works closely with internal and external partners to ensure a seamless integration of ESG factors into UPP’s investment process and implementation of stewardship practices on behalf of over 37,000 UPP members.

Maria Clara holds a Bachelor of Science in Biological Engineering from the National University of Colombia and earned a Master of Science, Sustainability Management from Columbia University in New York, NY.

Miles Bloom

Investment Leader, Private Infrastructure Americas

Partners Group

Miles Bloom is part of the Private Infrastructure Americas business unit, based in Denver. He has 11 years of industry experience and is a Board Observer on Partners Group portfolio companies, EnfraGen, Milestone, Resilient, and Budderfly. He covers thematic areas in Low Carbon Fuels, Clean Power, and Transportation. Prior to joining Partners Group he worked at ExxonMobil across roles in corporate development, strategy, and engineering. He holds an MBA from Columbia Business School and B.S. in Chemical Engineering and B.A. in Economics from Johns Hopkins University.

Distinguished Speakers

Nimar Bangash

Co-Founder & CEO

Obsiido

Aled ab Iorwerth

Deputy Chief Economist

CMHC – SCHL

Mack Crawford

Co-Founder & CEO

Longridge Partners

Jeff Szeto

CFO & Lead Investor

Avana Capital (Single Family Office) Alder Capital Sustainable Ventures (VC and PE firm)

Marcus Daniels

Founding Partner & CEO

Highline Beta

Sudharshan Sathiyamoorthy,

Senior Quantitative Specialist

Star Mountain Capital

Mark Perry

Managing Director

Wilshire

Chad Larson

Partner and Senior Portfolio Manager

Canaccord Genuity Wealth Management

Christophe Truong

Senior Director, Co-Investments

Trans-Canada Capital

Tom Gillespie

Partner and Head of the Alliance Fund

Geodesic Capital

Jonathan Planté

Director, Capital Markets

Omnigence Asset Management

Greg Donovan

CEO

Avondale Private Capital

Ben Keen

Partner

Borden Ladner Gervais LLP

Craig Machel

Portfolio Manager, Investment Advisor

Richardson Wealth

Cam Richards

Chief Investment Officer

Guardian Partners

Darren Coleman

Senior Portfolio Manager

Raymond James

Prathna Ramesh

Partner

FutureSight Ventures

Gavin Reiff

Vice-President, Real Estate Advisory

Richter Family Office

Allan Perez

Co-Founder & Chief Executive Officer

CanFirst Capital Management

Tony Deegan

Senior Vice President, Capital Markets

Walton Global

Nimar Bangash

Co-Founder & CEO

Obsiido

Mr. Bangash is the Co-Founder and CEO of Obsiido, a Toronto based technology enabled investment platform partnering with Canadian wealth managers to invest across private equity, private credit, and real assets through pooled and bespoke investment structures. Obsiido specializes in sourcing and managing evergreen, semi-liquid private market investments on behalf of its wealth manager clients. Mr. Bangash has spent 15 years in the Canadian investment management industry. Prior to founding Obsiido, he led the investment products group at a TSX listed, multi-billion dollar asset manager. He holds degrees from Queen’s University and Wilfrid Laurier University and is a CAIA Charterholder.

Aled ab Iorwerth

Deputy Chief Economist

CMHC – SCHL

Groundbreaking research by CMHC has revealed that inadequate supply is a key driver behind escalating house prices in cities like Vancouver and Toronto. The lead researcher for that project – Deputy Chief Economist Aled ab Iorwerth – now coordinates a diverse national team of researchers and analysts who are investigating impediments to housing supply and potential solutions.

“Housing markets are local. Broader challenges such as supply are often common, but the drivers and magnitude of these challenges may differ significantly across the country. My goal is to help understand and inform on market dynamics, how they support or hinder housing affordability goals and to provide thought leadership on housing economics across housing industry participants.”

Aled joined CMHC in 2016, bringing his strong analytical and research capabilities to bear on complex housing issues. He previously had a 15-year career at Finance Canada, in various research and analysis roles that included secondments to Environment Canada and the Council of Canadian Academies.

Aled holds a PhD in Economics from Western University and master’s degrees in European and International Relations (University of Amsterdam) and Economics (Carleton University). He speaks three languages: English, French and Welsh.

Mack Crawford

Co-Founder & CEO

Longridge Partners

Mack Crawford is the Co-Founder and CEO of Longridge Partners, a Toronto-based private investment firm focused on real estate and strategic ventures. Since founding the company in 2018, he has led its growth to more than 2,000 acres under management across the GTA, emphasizing sustainable development and nature-rich spaces.

Previously, Mack held senior leadership roles in the alternative investment industry, including Managing Director at SS&C CommonWealth and Co-CEO of Caledon Trust Company. He began his career as a Corporate Real Estate Advisor at Devencore and holds a Bachelor of Commerce degree from Queen’s University.

Guided by his passion for the outdoors, Mack’s philosophy is to “invest in good nature.” Outside of work, he enjoys travelling & spending time outdoors with his family and their dog, Carlton.

Jeff Szeto

CFO & Lead Investor

Avana Capital (Single Family Office) Alder Capital Sustainable Ventures (VC and PE firm)

Jeff is the CFO of Avana Capital, a family office, and leads VC and PE investments for Alder Sustainable Ventures, its private capital arm. He also provides CFO support to many portfolio companies, playing a key role in top grading, scaling, and growing these businesses by leveraging his 15 years of experience in leading finance functions for high-growth entrepreneurial companies. His career spans roles in M&A and corporate finance at top-tier institutions and as CFO for fast-growing private companies, guiding several from scale-up to exit.

Marcus Daniels

Founding Partner & CEO

Highline Beta

Marcus is Founding Partner & CEO of Highline Beta, a pre-seed VC and corporate venture studio that builds and funds new ventures from day one, earning global recognition as a leader in the venture studio model. With 26+ years as a serial tech entrepreneur and VC general partner, he has made 70+ investments and achieved a top-decile pre-seed track record with 12 exits.

Most recently, he co-founded Highline Beta ETH to harness Ethereum’s potential to reshape TradFi and Web3 innovation. He works closely with family offices to unlock new venture models that preserve wealth, capture asymmetric upside, and deliver exceptional blended returns.

Before Highline Beta, Marcus co-founded and led Highline VC as CEO, served as Managing Director of Extreme Startups, and built and scaled multiple successful digital product companies. A recognized ecosystem leader and global speaker, he also co-leads AI Salon Toronto and VNTR Toronto, a global investor network.

His academic background includes an MBA from Queen’s Smith School of Business, a BA in Psychology and Economics from McGill University, graduate studies in Finance and E-Commerce, and completed the Venture Capital Executive Program at UC Berkeley.

Sudharshan Sathiyamoorthy,

Senior Quantitative Specialist

Star Mountain Capital

Sudharshan Sathiyamoorthy is Senior Quantitative Specialist at Star Mountain Capital. He brings nearly two decades of experience applying quantitative analysis to investment processes and manager research across alternative investments. Previously, he led Manager Diligence and served as Chair of the Investment Committee at Richter Family Office, where he oversaw due diligence on 50+ funds spanning private credit, private equity, and secondaries, and helped institutionalize the firm’s diligence framework. Earlier roles include developing and managing the external manager program at Alignvest Management Corporation and serving as an Associate Portfolio Manager at the Canada Pension Plan Investment Board, contributing to research and investments in insurance-linked securities and macro/multi-strategy managers. He began his alternatives career at DGAM (acquired by Carlyle) after roles at RBC Capital Markets. He holds a PhD in Physics from the University of Toronto and an MBA (Dean’s Honor List) from Ivey Business School.

Mark Perry

Managing Director

Wilshire

Mark Perry serves as Managing Director at Wilshire and oversees sourcing, due diligence, and investment monitoring for private markets sectors in the United States and Canada. As Chair of the Private Markets Manager Research and Investment Committees and portfolio manager for the Wilshire Private Assets Fund, Mr. Perry provides strategic guidance and leadership.

Before joining Wilshire in 2012, he held the position of Vice President at Centinela Capital Partners, where he gained extensive experience in investment strategies. His educational background includes a Bachelor of Science in Electrical Engineering and an MBA in Finance from the University of California, Los Angeles, as well as a Master’s in Electrical Engineering from Stanford University.

Chad Larson

Partner and Senior Portfolio Manager

Canaccord Genuity Wealth Management

Chad Larson is a distinguished leader in Wealth Management, celebrated for his strategic vision, client-focused approach, and innovation in alternative investing. After earning a Bachelor of Arts in Economics, Chad co-founded MLD Wealth Management in 2004 and today, he manages one of the largest multi-family offices in the country, serving high-net-worth (HNW) and ultra-high-net-worth (UHNW) clients across Canada and globally. With countless accolades including being named one of the top 50 most influential individuals in the Canadian investment Industry, and most recently as Advisor of the Year – Alternative Investments by Wealth Professional, Chad’s expertise and dedication has earned him the trust of Canada’s most discerning investors.

Christophe Truong

Senior Director, Co-Investments

Trans-Canada Capital

Christophe is responsible for private market co-investments at TCC, investing in global private opportunities across private equity, private debt, real estate and infrastructure. Christophe joined TCC in 2009 to help with the build-out and management of the private equity and co-investment programs. His past experience includes positions at leading Canadian public and corporate pension plans plans as well as global consulting, banks, asset and wealth management firms in Montreal, Toronto and Paris. Christophe holds a Master of Business Administration from McGill University and a Bachelor of Commerce from Concordia University. He is also a CFA charterholder.

Tom Gillespie

Partner and Head of the Alliance Fund

Geodesic Capital

Tom Gillespie is a Partner and Head of the Alliance Fund at Geodesic Capital, focused on investing in early-stage Deep Tech companies in areas such as space, maritime, power and energy, and autonomous systems. Prior to joining Geodesic, he served for a number of years as a Managing Partner on In-Q-Tel’s Investment Team and Investment Lead for In-Tel’s Deep Tech practice, investing in commercial, venture capital-backed technologies with the potential to address challenges faced by the U.S. national security community.

He has had a particular focus on commercial space technology and has led investments in over twenty space technology ventures, including launch vehicles, remote sensing constellations, space situational awareness, in-space logistics, and satellite componentry investments. In addition to space deals, he has led investments in the areas of robotics, materials, power sources, and autonomous systems, as well as several analytics ventures.

Prior to In-Q-Tel, Tom was a strategy consultant at Booz Allen Hamilton, serving clients in the aerospace, financial services, and government (national security and defense) sectors. Earlier experience includes positions in international privatization and the United States Congress, where he focused on telecommunications, space, financial services, and foreign affairs issue areas.

Tom earned a B.A. in Economics from Stanford University, and an M.B.A. in Finance from the Wharton School of the University of Pennsylvania.

Jonathan Planté

Director, Capital Markets

Omnigence Asset Management

Jonathan Planté is the Head of Capital Formation at Omnigence Asset Management. He is a seasoned alternative investment professional with 18 years of experience and a US$20Bn+ fundraising track record across all alternative asset classes, securing capital from North American and European institutional investors. His expertise spans investment structuring, market expansion, and distribution strategy optimization. Prior to joining Omnigence, he held senior positions in the asset management industry, driving significant AUM growth. Alongside his professional career, Jonathan has been teaching alternative investments at HEC Montréal for 10 years, mentoring students and young professionals entering the asset management industry.

Jonathan holds a Graduate Diploma in Finance from HEC Montréal (Canada), a Master’s degree in International Business Development from ESC St-Étienne (France), and the Chartered Alternative Investment Analyst (CAIA) designation.

Greg Donovan

CEO

Avondale Private Capital

Greg has 17 years of credit-focused structuring, investing, and distribution experience, including 13 years in New York, London, and Toronto with a large Canadian firm. After founding Avondale four years ago to focus on niche underserved areas of middle market private credit and energy transition finance in North America, Avondale has grown to 22 professionals in Canada, the US and UK and has closed $500mm of credit transactions over the last 18 months.

Craig Machel

Portfolio Manager, Investment Advisor

Richardson Wealth

Craig empowers his clients to think differently about investing in order to ensure a positive impact in his clients’ financial circumstances. He works beyond traditional portfolio management in the equity and bond markets alone to include conservative and predictable alternative assets, offering more effective diversification and a benchmark that offers protection and peace of mind regardless of market conditions. Craig is a frequent commentator on alternative asset allocations for various media outlets, and a panelist and speaker at industry events.

Cam Richards

Chief Investment Officer

Guardian Partners

As Chief Investment Officer at Guardian Partners, Cameron’s mission is to combine the investment strategies and disciplined portfolio construction and risk management utilized by pension funds and endowments, with the customization and client responsiveness required by private clients, to increase the robustness of investment solutions and to enhance the experience of Guardian Partners’ clients. Previously, he served as CIO of the Nova Scotia Health Employees’ Pension Plan, and was the Head of Real Assets at Albourne Partners in London, England. He also served as the Co-Chief Investment Officer of University of Toronto Asset Management (UTAM), and Chair of the Investment Committee for the entirety of the university’s investment assets. Before joining Guardian Partners, he founded Isengard Capital Management, which provided capital markets research to Albourne Partners and also designed a research platform which applied global macro, stock selection and quantitative strategies to generate long and short exposures in stocks.

Cameron is a graduate of Osgoode Hall Law School in Toronto, holds a Bachelor’s Degree in Mathematics from Queen’s University, earned an MBA from the Schulich School of Business and is a CFA® Charterholder. He has been called to the Bar in Ontario.

Darren Coleman

Senior Portfolio Manager

Raymond James

Darren Coleman started in the industry in 1992 and with Raymond James in 2012, providing comprehensive wealth services for a variety of clients. During this time, he has been managing brokerage offices, spearheading industry trends and leading his team at Portage Wealth to new territory.

Darren’s many professional accreditations include: Canadian Investment Manager, Financial Management Advisor and Fellow of the Canadian Securities Institute, with a Level II Life Insurance License and an Honours B.Comm from Ryerson University. He was one of the first Canadian professionals to attain the Professional Financial Planner, Certified Financial Planner and Certified Hedge Fund Specialist designations. Due to his success as an advisor in alternative investments, he was the first advisor to sit on committees for the Alternative Investment Management Association (AIMA), and on the Board for the Hedge Fund Association, as a member and an instructor.

An industry veteran before coming to Raymond James, Darren held management and advisor positions at major bank-owned brokerage and financial services firms. Through this experience, together with his involvement with industry boards, he has built a network of professional relationships with the industry’s top managers, firms and executives, through which he is able to offer his clients superior due diligence, access and insight.

Darren is considered a champion of Raymond James’ cross-border service offering and is among the Global Top 50 group of advisors within the firm across North America and the U.K.

He frequently speaks at conferences and educational events and currently sits on the Editorial Board for Advisor’s Edge Report for Canadian investment professionals, and is frequently interviewed for the Globe and Mail.

Prathna Ramesh

Partner

FutureSight Ventures

Prathna is an early-stage investor and operator in B2B SaaS companies. She is currently a Partner at SF & Toronto based FutureSight, a Vertical AI/B2B Saas firm that backs repeat entrepreneurs with an all-star team and formation capital. She is the former Managing Director of Maple Leaf Angels in Toronto, one of Canada’s most active angel networks, and served as GP of the MLA48 and Chief Compliance Officer. Prathna holds a Commerce degree from the Rotman School of Management, an Executive MBA from the Smith School of Business at Queens University and is an OSC licensed Exempt market professional.

Gavin Reiff

Vice-President, Real Estate Advisory

Richter Family Office

Gavin leads the Real Estate practice at Richter, managing its Real Estate Business Advisory and Investment Management services.

Gavin has real estate investment experience in both institutional private equity and public market environments. He has extensive investment transaction and management experience as a principal investor and a joint venture partner. Gavin is also a member of advisory boards for real estate investment funds.

Allan Perez

Co-Founder & Chief Executive Officer

CanFirst Capital Management

Allan Perez is a co-founder & Chief Executive Officer of CanFirst Capital Management, a private real estate equity firm. CanFirst invests on behalf of institutional and private high net worth investors and has raised in excess of $1.5 billion of equity capital since its inception. Allan’s real estate career encompasses 40 years of senior executive positions with real estate organizations including The Prudential Insurance Company of America, Canderel Ltd., Dundee Realty Corporation and V&A Properties. His responsibilities included acquisition and disposition, development, marketing, leasing, e-commerce and asset management.

Allan graduated from McGill University in 1980 with a Bachelor of Commerce degree where he majored in Finance and Marketing.

Tony Deegan

Senior Vice President, Capital Markets

Walton Global

As Senior Vice President, Capital Markets at Walton Global, Tony Deegan is responsible for sourcing new debt & equity capital for Walton and its investment vehicles, maintaining and growing client and partner relationships, and assisting in the execution of investment strategies in both Canada and throughout Latin America. Tony has held multiple executive level positions over his 24 years with Walton including COO for Walton for Southeast Asia out of Singapore in 2018 and 2019, President of Walton International Group Canada from 2015 to 2017 and positions in Business Development, Operations, Marketing, and Investor Relations

2025 Agenda

Day 1

- September 17, 2025

- 8:30 am – 6:00 pm

- September 17, 2025

- 8:30 am – 6:00 pm

Conference Day

8:00 am

Breakfast & Registration

9:00 am

P1 – The New Age of Venture: Rethinking Capital, Innovation, and Access

The venture capital landscape is undergoing a profound transformation—shaped by shifting economic conditions, emerging technologies, alternative funding models, and a broader push for inclusivity and impact. This panel brings together next-generation investors, founders, and ecosystem builders to explore what the future of venture looks like. From the rise of solo capitalists and venture DAOs to a growing emphasis on sustainability, AI-driven startups, and global deal flow, we’ll discuss how innovation is being financed and who gets to participate. Join us for an inside look at the evolving dynamics of venture in this new era.

Tom Gillespie, Geodesic Capital

Prathna Ramesh, FutureSight Ventures

Jeff Szeto, Avana Capital & Alder Capital Sustainable Ventures

Marcus Daniels, Highline Beta

9:45 am

Core or Satellite? Are alts a base or an extension for your portfolio?

The ideas of ‘hub & spoke’ or ‘core & explore’ usually denotes traditional investments as a base and then alternatives as a diversifier or ‘extra’ allocation – but what if alts are the portfolio foundation and traditional assets (if any!) are the diversifiers. Correlations of alts to traditional option is typically low and alt strategies and assets to each other is also low – so why not use them as the 80%-90% ‘core’ and then diversify by adding beta via traditional assets?

Jonathan Planté, Omnigence Asset Management

Sudharshan Sathiyamoorthy, Star Mountain Capital

Greg Donovan, Avondale Private Capital

Moderator – James Burron, CAASA

10:30 am

1:1 meetings / Morning Refresher

This is everyone’s opportunity to meet – either as established via our conference meeting & messaging app or ad hoc

11:30 am

Private Investments for Everyone?

A great deal of progress has occurred in creating platforms and the regulatory infrastructure to provide private investments (hitherto accessible only by those deemed wealthy enough to take on the ‘risk’ attributed to these investments). As institutional investors have been seen to make great gains in private assets such as PE, private lending, and infrastructure, the idea of restricting access to all other investors (who are not in defined benefit pensions) has been derided as ‘undemocratic’, adding supply and demand pressures to these asset classes. This panel will explain where we are in this evolution of markets and what to expect in the next short while.

Cam Richards, Guardian Partners

Mark Perry, Wilshire

Christophe Truong, Trans-Canada Capital

Nimar Bangash, Obsiido

12:15 pm

Lunch & Keynote: Building Value Through Responsible Investing: Strengthening the LP GP Partnership

Keynote will begin at 12:30PM

In today’s rapidly evolving investment landscape, both asset owners and asset managers play pivotal roles in shaping strategies that address systemic risks such as climate change and shifting regulatory frameworks while driving long-term value creation. Representing the LP perspective, Maria Clara Rendón of the University Pension Plan will be joined by Miles Bloom of Partners Group, offering the GP perspective, to explore how responsible investing can serve as a practical and powerful tool for aligning interests in the LP GP relationship.

This joint keynote will highlight how constructive, ongoing engagement beyond initial due diligence can foster collaboration, improve risk management, and identify new opportunities. From incident response and transparent communication to integrating ESG considerations into core investment processes, Maria Clara and Miles will share actionable insights on how asset managers and investors can work together to create resilient, high-performing portfolios that thrive in a complex global environment.

Maria Clara Rendon, University Pension Plan Ontario

Miles Bloom, Partners Group

1:15 pm

Table Talks

Your opportunity to join a table and discuss the topic on offer, lead by one of our sponsoring CAASA members.

2:00 pm

Evergreen Funds: Hidden Risks and LP Considerations

Ben Keen, BLG

James Burron, CAASA

2:30 pm

Where do we stand on housing?

Aled will give an overview of the housing system across Canada as well as deliver a synopsis of the risks inherent in the system and the market. The audience will be treated to copious amounts of background information as well as the opportunity to pose their questions to him both during the session and one-on-one for the balance of the conference. Attendees can also feel free to connect with him via the meeting app for more insight and connection.

Aled Ab Iorwerth, CMHC – SCHL

3:00 pm

Nap of the Earth: Getting into the nitty-gritty of today’s real estate market

Real estate underpins the net worth of virtually every investor: if they are ‘smaller’ retail investors then one’s principal residence is likely their largest asset and liability but it has the benefit of providing shelter. If mass affluent or wealthier, these assets take on a more investment-like place in one’s mind and balance sheet – they need to perform to create positive wealth creation over many years. This panel will look into how specific real estate markets are positioned to provide this to investors; as well as the risks of certain markets.

Gavin Reiff, Richter Family Office

Tony Deegan, Walton Global

Allan Perez, CanFirst Capital Management

Mack Crawford, Longridge Partners

3:45 pm

Oh the Portfolios You Will See: How Investment Advisors are creating resilient portfolios

The Investment Advisor or financial consultant/relationship manager is where the rubber meets the road – and it’s their product due diligence and integrity in assessing suitability that allows appropriate client portfolios to be created. This panel will discuss each advisor’s modus operandi regarding product sourcing and investigation as well as client communication during all types of market and economic situations.

David Sheng, Aksia

Chad Larson, Canaccord Genuity Wealth Management

Craig Machel, Richardson Wealth

Darren Coleman, Raymond James

4:30 pm

Reception

Time to make a few more connections and chat about the day

6:00 pm

End of conference

See you at our next event!

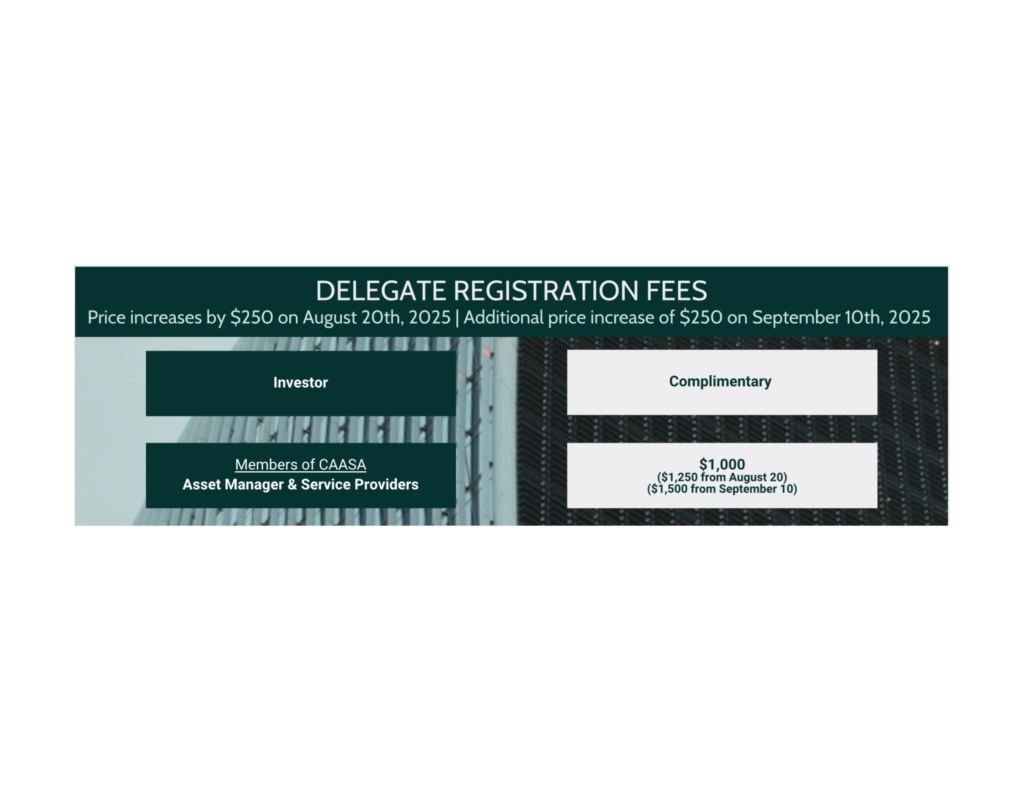

Registration

End Investor means pensions, foundations/endowments, sovereign wealth funds, and single family offices. Intermediary investors means Multi-family offices, investment advsiors/dealers, wealth managers, and investment consulting companies and +1 means the first delegate is gratis but each additional delegate attracts a small charge. Manager and service provider delegates must be CAASA members in good standing and pay the requisite per person fee ($1,000 + tax).

Sponsorship is an additional $3,500 and does NOT include a delegate pass (those are purchased separately in all cases).

Note : Single Family Office means the those related to the family or full-time members of the investment team. All parties must not have outside commercial interests, as determined by CAASA, such as investment funds seeking external money, investment banking operations, or other activities that would also be performed by our members.

Pension and other institutional investor (e.g., E&F) attendees need to be full-time employees of the investor. Acting as a consultant, board member, or advisor (whether compensated or not) is not sufficient. Individuals who have an outside commercial interest are required to be employed by CAASA members and pay the requisite delegate pass fee.

CAASA Members

Members of CAASA including asset managers, service providers, multi-family offices, and investment advisors/consultants.

Event Registration Closed

Non-Members

Investors such as pensions, foundations & endowments, and single family offices.

Event Registration Closed

Thank You to Our 2025 Title Sponsor

Thank You to Our 2025 Venue Sponsor

Thank You to Our 2025 Gold Sponsors

Thank You to Our 2025 Silver Sponsor