Member Initiative Groups

The association’s various Member Initiative Groups (MIGs) are open to all those in membership. These groups meet on a monthly or bi-monthly basis and focus on specific subjects and/or geographical areas within the Canadian alternatives industry. Current groups include those below with more to be added as we continue to collect member input.

If you are a registered CAASA member interested in joining a MIG, please contact us or register below.

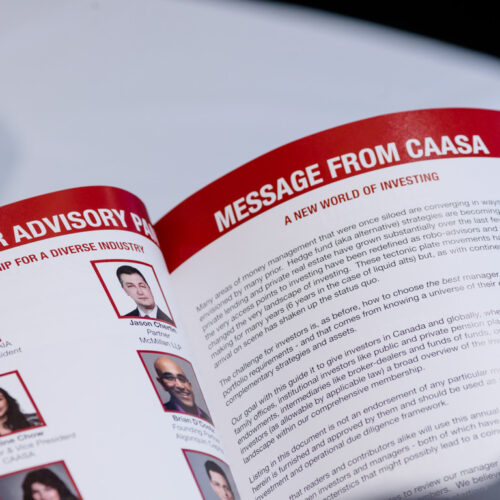

Member Advisory Panel (MAP)

This group serves CAASA membership and the industry at large by planning strategic initiatives, providing input on the direction of the association as well as programming that is carried out by the appropriate Member Interest Groups (MIGs) and CAASA staff. The CAASA 2021 Member Advisory Panel includes:

Jason Chertin, McMillan LLP

Brian D’Costa, Algonquin Capital

Athas Kouvaras, Richter Family Office

Wilson Tow, Altrust Solutions

Kimberly Poster, AUM Law

Dean Shepard, Picton Mahoney Asset Management

Compliance & Operations Group (COG)

The Compliance & Operations Group cover a range of topics that are relevant to compliance groups within the asset management industry (such as client focused reforms) and hope to create interactive sessions with participants, focusing on the practical aspect of compliance matters being dealt with by CAASA members.

Liquid Alternatives Working Group

This group is comprised of industry professionals and is focused on proposing and pursuing regulatory burden reduction measures for liquid alternative funds to the Canadian Securities Administrators. This includes enhancing best practices for all industry participants and, as applicable, fostering the implementation of those methods employed elsewhere (such as the United States, Europe, and Australia) to better position the Canadian industry.

If you’d like to get involved, please reach out to Paul at paul@caasa and we can provide you with further details of the specific proposed initiatives for our working group.

Family Office Group (FOG)

Comprised of single and multi-family office members, this subgroup of the broader Investor Group convenes to discuss topics of due diligence, trading and operations, investment and allocation strategies. Through a combination of in-person and web offerings, members are invited to examine emerging trends and opportunities arising from the ever-evolving alternative assets landscape.

Investor Allocator Group (IAG)

Composed of institutional investors such as pension plans and endowments, members are invited to review and discuss new and existing trends in the alternative investment landscape. Through a combination of in-person and web offerings, members of this group perform a deep dive on investment opportunities, due diligence process, and asset allocation.

Young Professionals Group (YPG)

This group is designed for the Rising Stars and Trailblazers of the industry and is dedicated to bringing together the next generation of industry professionals through a series of events throughout the year.

Open to all professionals at a sub-partner level, this committee’s purpose is to foster a deeper sense of community, camaraderie, and connectivity. Gain more insights through engaging industry focused sessions, hear from select non-sectorial keynotes and speakers, prepare for the next stage in your career path through mentorship opportunities, all while partaking in various social, networking, and sporting events.